Meta Platforms: The Time to Take Your Profits and Run is Near

2024.05.10 08:27

In our previous article about Meta Platforms (NASDAQ:), we showed readers how back in June 2022, Elliott Wave analysis put us ahead of the stock’s 2023 surge. Despite its recent post-Q1 earnings drop, the share price is up by another 34% in 2024 so far and seems on track for a repeat of last year’s outperformance. However, we think that extrapolating the recent past into the distant future is a dangerous game.

When Meta was trading above $380 a share in September 2021, hardly anyone expected it to lose nearly four-fifths of its market value over the following 14 months. Alas, that’s precisely what happened. In the same way, people now forget that a notable drop is even possible with the stock not far from its records. But possible it is. And according to the chart below, it is fast approaching.

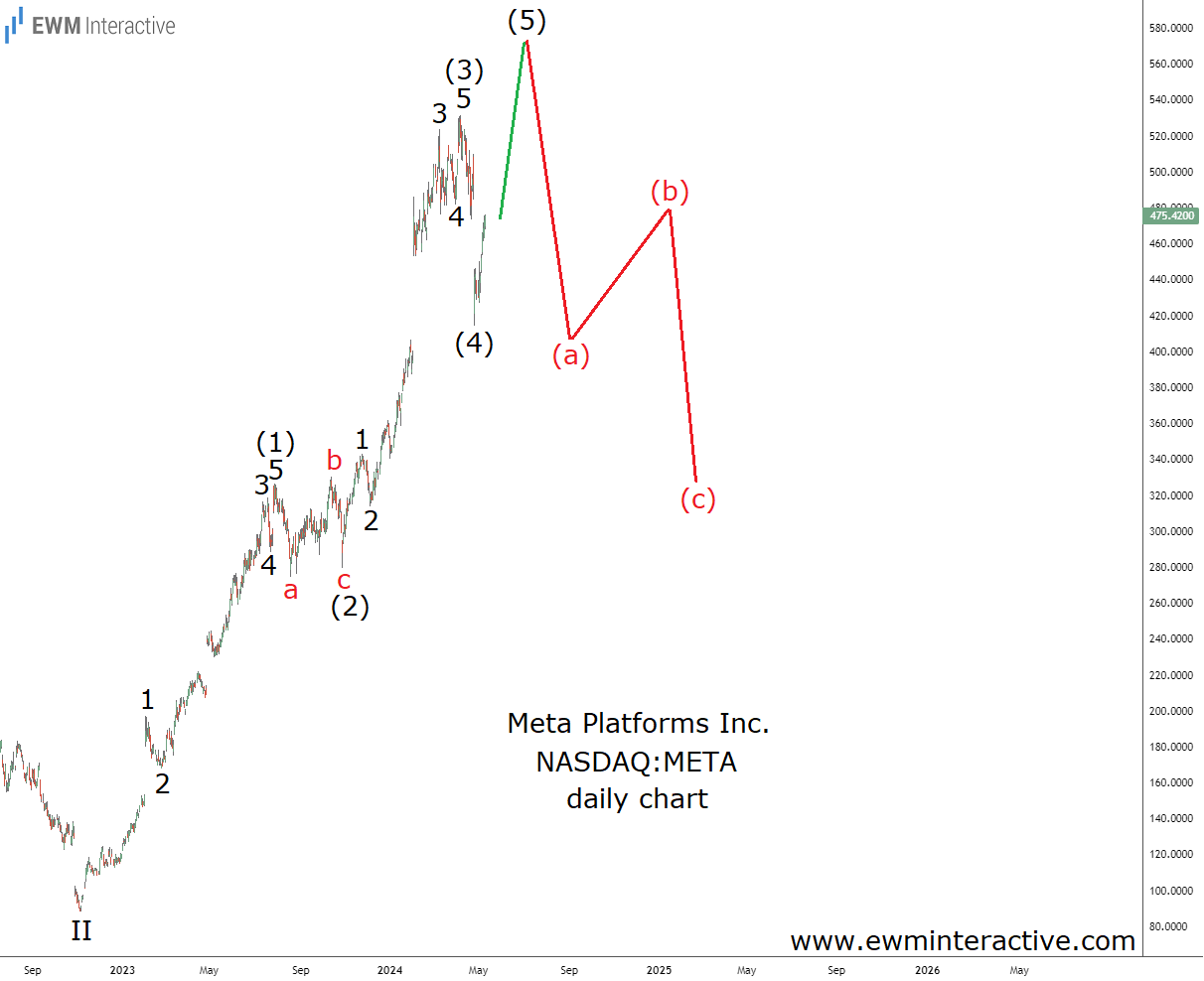

The daily chart of Meta Platforms stock reveals that its phenomenal surge from under $90 has taken the shape of an almost complete impulse pattern. We’ve labeled it (1)-(2)-(3)-(4)-(5), where the five sub-waves of (1) and (3) are also visible. Wave (2) was a running flat sideways correction, while wave (4), observing the guideline of alternation, was a sharp pullback.

If this count is correct, wave (5) should make a new all-time high in the vicinity of $600 a share soon. The crowd is likely to be most bullish then. Unfortunately, at that point the stock would offer the least attractive risk/reward ratio. According to the Elliott Wave theory, a three-wave correction follows every impulse. In Meta‘s case, a decline to the support near $300 a share would make sense.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Original Post