Markets Remain Under Pressure

2022.10.03 12:52

[ad_1]

Stocks fell sharply on Friday, with the down 1.5% and 2.9% for the week. It left the S&P 500 trading at a new 52-week of 3,585.

The RSI is back below 30, but the technicals look pretty bad on the S&P 500, and it seems possible at this point that we may have started a wave five down.

It would seem that the S&P 500 has finished a period of consolidation, which could result in the index dropping to about 3,500. However, if this is the start of a wave five lower, we could see the index decline to around 3,200, which would also be around the September 2020 lows.

QQQ ETF

The is not all that different, with short-term support of around $260. If this is the start of a wave five down, it could result in the QQQ falling back to its pre-pandemic highs of approximately $237.

QQQ Vs TIP Relationship

While there is no perfect way to measure the relationship between the ETF and the QQQ, at least based on a ratio, we can tell that the QQQ hasn’t completely caught up to the TIP yet. The ratio of the QQQ to the TIP is currently 2.55, and it had been at 2.37 at the June lows. This tells us that the QQQ still needs to fall further, and with the TIP trading at $104.90, the QQQ probably needs to fall to around $248 to bring that ratio back to the June lows of 2.37.

QQQ/TIP Ratio Daily Chart

QQQ/TIP Ratio Daily Chart

Shopify

Shopify (NYSE:) still has its RSI trending higher, and as long as the RSI is trending higher, it gives me hope that there is a momentum shift from bearish to bullish occurring. No, the technicals do not look great, with the stock flirting with breaking a downtrend, but again as long as the shares can hold that trend line and the RSI can remain upward sloping, I think the stock is still in a bottoming process.

Tesla

Tesla (NASDAQ:) has surprisingly held up very well throughout most of the carnage, and the company should be announcing third-quarter deliveries today. But upward momentum is broken. The stock has stalled and fallen below an uptrend, leading to the stock falling to around $246 and filling the gap.

Alphabet

Alphabet (NASDAQ:) has struggled and has fallen below support at $95. While the stock doesn’t look great over the short-term, the long-term outlook remains strong, in my opinion, and so even if the shares should fall back to, say, $83 and fill the gap, I do not think the long-term prospects have been damaged.

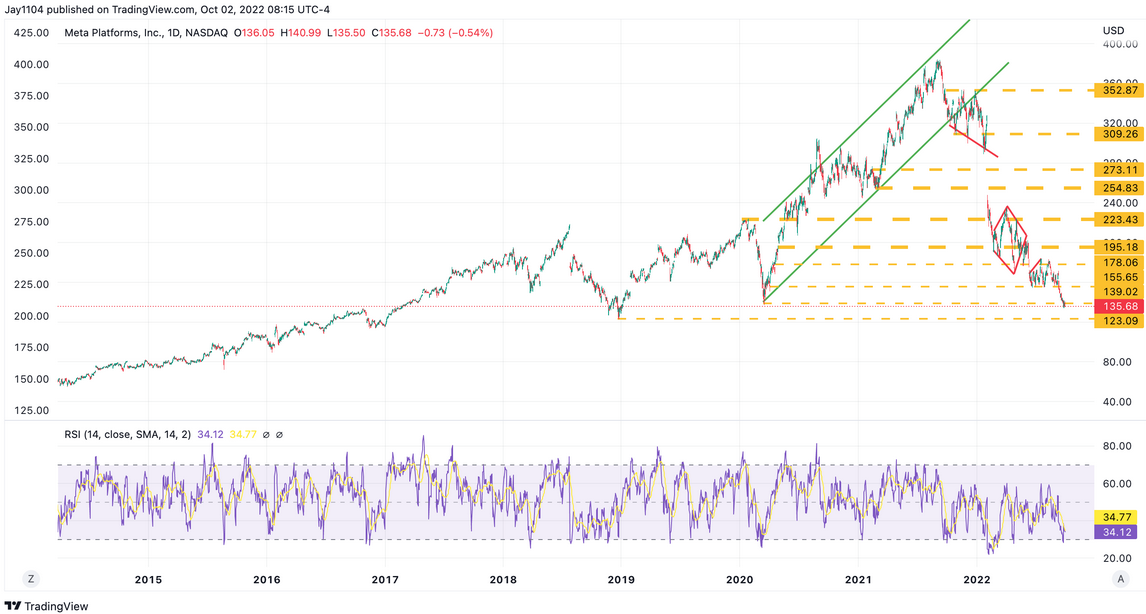

Meta Platforms

Meta Platforms (NASDAQ:), on the other hand, in my opinion, is in a very different position, and while this stock is breaking down and could even be heading back to its 2018 lows of $123. The longer-term outlook is not strong, given the increased competition from Tik Tok and Apple (NASDAQ:) privacy headwinds. I have never liked Meta because these social media platforms tend to be faddish, and while those fades can last for years, they are always just one new competitor away from becoming obsolete; look up MySpace and Friendster.

Meta Platforms Daily Chart

Meta Platforms Daily Chart

Original Post

[ad_2]

Source link