Markets Consolidate Gains Amid Absence of Risk-Off Clues: What Lies Ahead?

2023.11.09 08:41

A in early September suggested that the recent correction didn’t trigger a clear risk-off signal. Two months later, not much has changed, based on several ETF pairs that are proxies for various aspects of market sentiment via prices through yesterday’s close (Nov. 8). Markets are churning as various threats raise questions about the path ahead, but for the moment it’s still not obvious that investors are throwing in the towel on risk assets.

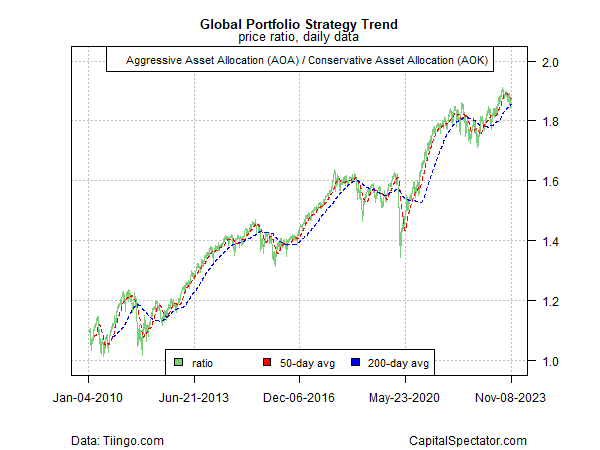

Let’s start with the big picture via a set of global asset allocation funds. The ratio for the aggressive portfolio () vs. its conservative counterpart () has corrected in recent months, but an uptrend is still conspicuous. The upside bias, if it holds, suggests that the appetite for risk, while battered lately, has yet to surrender to an outright risk-off signal.

Global Portfolio Strategy Trend

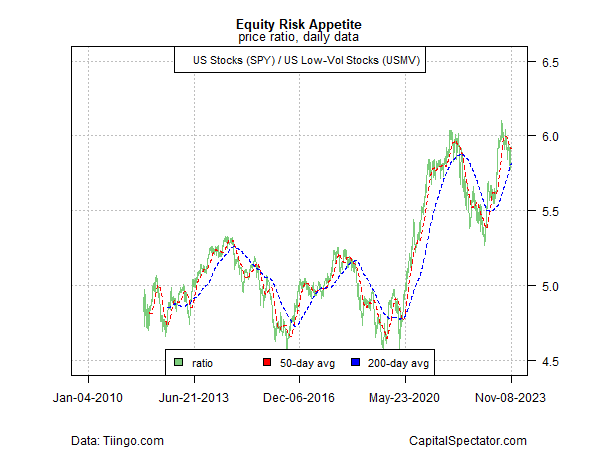

The ratio for US stocks () vs. a low-volatility subset () may be on the threshold of signaling a risk-off environment, but not yet. The next several weeks could be decisive, one way or the other, but for the moment this pair is effectively sitting on the fence and waiting to see how various risk factors unfold.

SPY vs USMV Chart

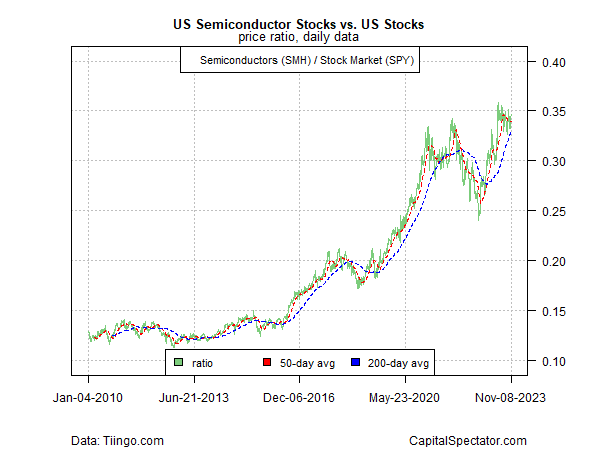

By contrast, the relative strength in semiconductor stocks () vs. US equities overall (SPY) still reflects a bullish trend, albeit one in a holding pattern lately. That’s encouraging because semi-stocks are considered a proxy for the risk appetite generally as well as the business cycle. It’s hardly a silver bullet, but it’s one more item in the bullish column, at least potentially.

SMH vs SPY Chart

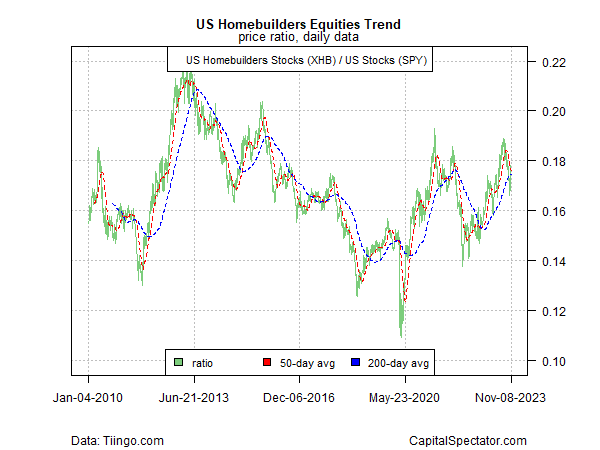

One area that raises more concern is housing stocks (). Comparing these shares to the broad equities market (SPY) offers a more cautious outlook, which isn’t surprising, given the recent rise in mortgage rates.

But if Treasury yields have peaked, , perhaps the worst has passed for housing. If so, that would bode well for risk assets generally. Once again, the next several weeks could be decisive for deciding what’s brewing for 2024.

XHB vs SPY Chart

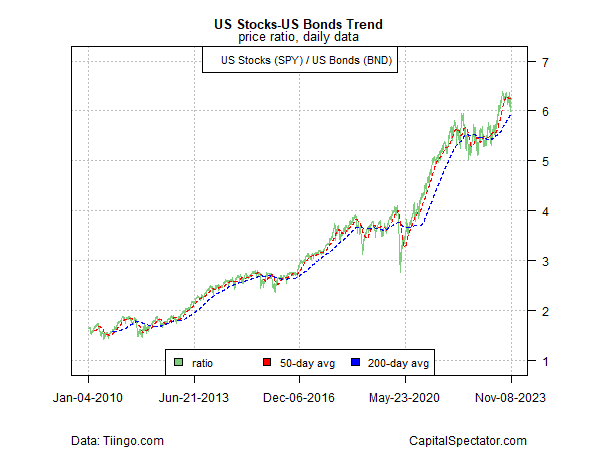

Finally, the stock-bond ratio (via SPY and ) continues to suggest that the appetite for risk has only been dented but the upside trend hasn’t been broken. That’s encouraging in that the recent spike in macro and geopolitical threats have yet to tank this ratio, which implies a resilience that still favors risk allocations.

SPY vs BND Chart