Marketmind: “Substantially more evidence”

2022.12.14 17:50

[ad_1]

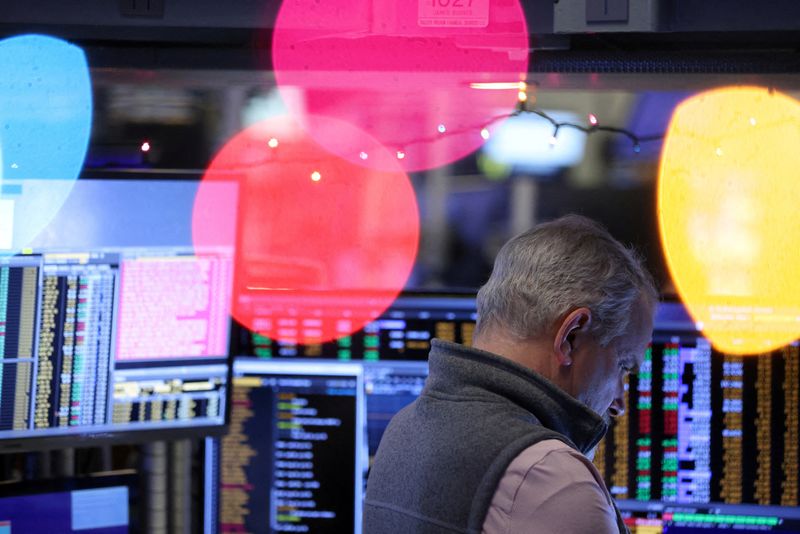

© Reuters. FILE PHOTO: A trader works on the trading floor at the New York Stock Exchange (NYSE) in New York City, U.S., December 14, 2022. REUTERS/Andrew Kelly/File Photo

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

It’s a U.S.-Sino, one-two punch for Asian markets on Thursday, as they react to Federal Reserve Chair Jerome Powell’s press conference following the last interest rate hike of the year, and digest a raft of top-tier economi c data from China.

The Fed raised rates by 50 basis points on Wednesday, as expected, bringing the calendar year total to 425 bps. It was the first meeting in five that the Fed did not hike by 75 bps.

But Powell was more hawkish in his outlook than investors had expected, indicating that there is further tightening ahead and that rate cuts next year, which are currently implied in market pricing, are not on the table.

“The inflation data received so far in October and November show a welcome reduction in the pace of price increases, but it will take substantially more evidence to give confidence inflation is on a sustained downward path,” said Powell.

Fed’s 2023 projections over time

Wall Street wiped out earlier gains to close in the red, and rates futures traders pushed the implied terminal rate back up toward 5.0%. They still expect 50 bps of easing next year.

Powell offered little pushback against the recent loosening of financial conditions. According to Goldman Sachs (NYSE:), U.S. financial conditions have eased more than 100 bps over the last two months, during which time the Fed raised rates 125 bps.

This could continue to support risk appetite.

Chinese and broader emerging market financial conditions have eased notably over the fourth quarter too, which has helped spur the year-end recovery in regional stocks – the MSCI Asia ex-Japan Index is staging a solid rebound following a wretched run of five quarterly declines.

Hopeful that this will continue into year end, investors also point to China relaxing its zero-COVID policy and loosening restrictions, which should spur the economy more broadly.

This potential economic recovery is getting domestic and international support – Beijing is considering a trillion-yuan ($143 billion) package to support the country’s semiconductor industry, while the Biden administration plans to remove some Chinese entities from a red flag trade list.

In a further sign of U.S.-China detante, Washington said on Wednesday it is willing to help China deal with a surge of COVID-19 infections if Beijing requests assistance.

Right now, however, China’s economic numbers are not great and the November data scheduled for release early on Thursday are expected to show a deterioration from the previous month. On the docket are house prices, business investment, industrial production, retail sales and unemployment.

Three key developments that could provide more direction to markets on Thursday:

– Japan trade (November)

– Indonesia trade (November)

– Australia unemployment (November)

[ad_2]

Source link