Marketmind: Kickin’ up a storm

2022.09.29 18:00

[ad_1]

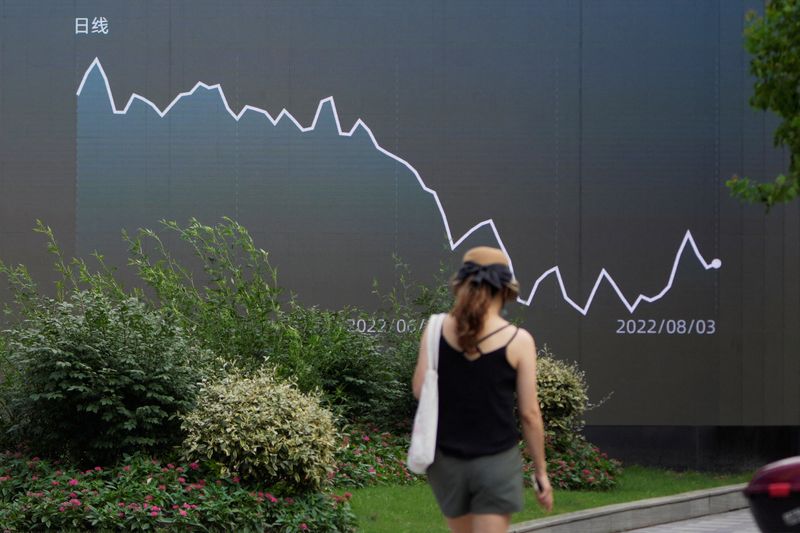

© Reuters. FILE PHOTO: A pedestrian walks past a giant display showing a stock graph, in Shanghai, China August 3, 2022. REUTERS/Aly Song/File Photo

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever

As Hurricane Ian batters parts of Florida, investors are once again battening down the hatches to protect themselves from the storm of financial stress and volatility ripping through world markets.

Thursday’s churn served only to show the fleeting nature of Wednesday’s respite.

World stocks plumbed a new two-year low, the Nasdaq sank more than 3% to test June’s low, while the took it out to extend this year’s peak-to-trough decline to 25%.

It is not all doom and gloom. Some assets that have been hit hard recently steadied – the long end of the UK bond market was calm, and sterling bounced back to $1.10 in its biggest rise in two and a half years.

But sentiment is fragile as a tough quarter ends, and risks are building – implied volatility in the $23 trillion U.S. Treasury market is the highest since 2009, and dollar funding markets are showing year-end stress.

Might some sort of global, coordinated action be needed soon?

Graphics: U.S. Treasury market volatility – MOVE index –

Graphics: Global financial conditions – Goldman Sachs (NYSE:) index –

Investors in Asia have plenty of local meat to chew over on Friday.

India’s central bank is expected to raise its benchmark repo rate half a point to 4.90%. Will that lift the rupee from its record low against the dollar?

Chinese PMIs are expected to show activity contracted again in September. The yuan is under heavy selling pressure, and the PBOC has asked major state banks to prepare for offshore yuan-buying intervention.

Full-year earnings from Hong Kong property developer New World Development could give a glimpse into how badly China’s real estate sector is doing.

A raft of economic data from Japan – including unemployment, retail sales and consumer confidence – as well as South Korea and Australia is also on tap on Friday.

Key developments that could provide more direction to markets on Friday:

India interest rate decision

China PMIs (September)

South Korea industrial production, retail sales (August)

Japan unemployment, retail sales, industrial output (Aug)

Japan consumer confidence (September)

Australia credit growth (August)

Euro zone inflation (September)

U.S. PCE inflation (September)

University of Michigan U.S. inflation expectations (Sept)

[ad_2]

Source link