Marketmind: Global gloom descends on Asia

2022.08.22 23:30

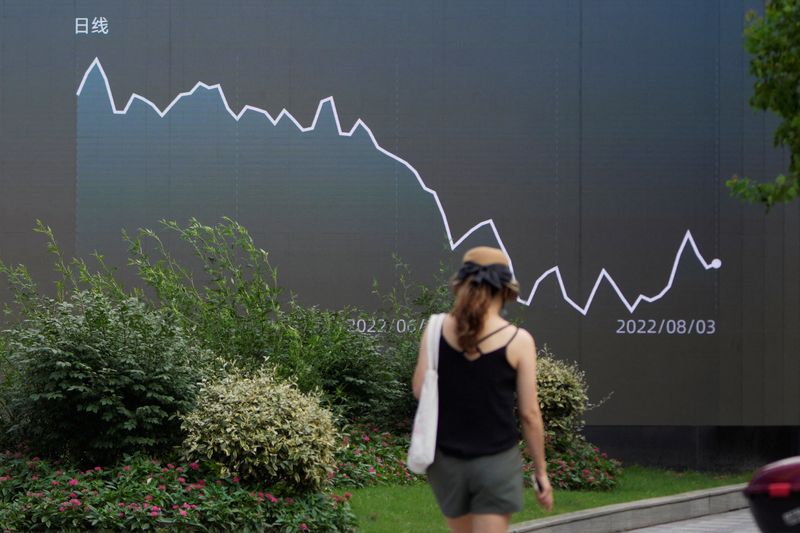

FILE PHOTO: A pedestrian walks past a giant display showing a stock graph, in Shanghai, China August 3, 2022. REUTERS/Aly Song

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever

The outlook for Asian markets on Tuesday is pretty bleak, as investors digest Wall Street’s battering and surge in global bond yields the day before, and look nervously ahead to PMI data from Australia and Japan.

Indonesia’s central bank could also add to the gloom, if it delivers a surprise interest rate increase at its scheduled policy meeting. Economists polled by Reuters expect it to hold its 7-day reverse repo rate steady at 3.50%.

Rising bond yields – the 10-year U.S. Treasury yield shot back above 3% on Monday – helped slam stocks, lift the dollar, and deepen U.S. recession fears, while Gazprom (MCX:GAZP)’s announcement that it will halt natural gas supplies to Europe for three days later this month blackened the mood there even further.

U.S. 10-year Treasury yield: https://tmsnrt.rs/3QGLlrO

This is the backdrop to the Asian trading day Tuesday, with local sentiment already wobbling after yet another rate cut in China and the yuan’s slide to a two-year low against the rampant dollar.

The latest purchasing managers index data out of Australia and Japan could show the services sectors in the two countries slipping closer to contraction territory, offsetting the relative strength of manufacturing activity in recent months.

On the corporate front, China’s e-commerce firm JD (NASDAQ:JD).com releases second-quarter earnings.

JD.com is one of the 723 companies the U.S. Securities and Exchange Commission said last December were at risk from finalised rules to potentially prohibit trading in Chinese companies under the Holding Foreign Companies Accountable Act.

Also last December, technology giant Tencent announced the divestment of around 86% of its stake in JD.com, worth $16.4 billion.

Key developments that should provide more direction to markets on Tuesday:

PMI data for euro zone, Germany, UK (August)

U.S. new home sales (August)