Marketmind: China’s loan danger

2022.12.12 17:00

[ad_1]

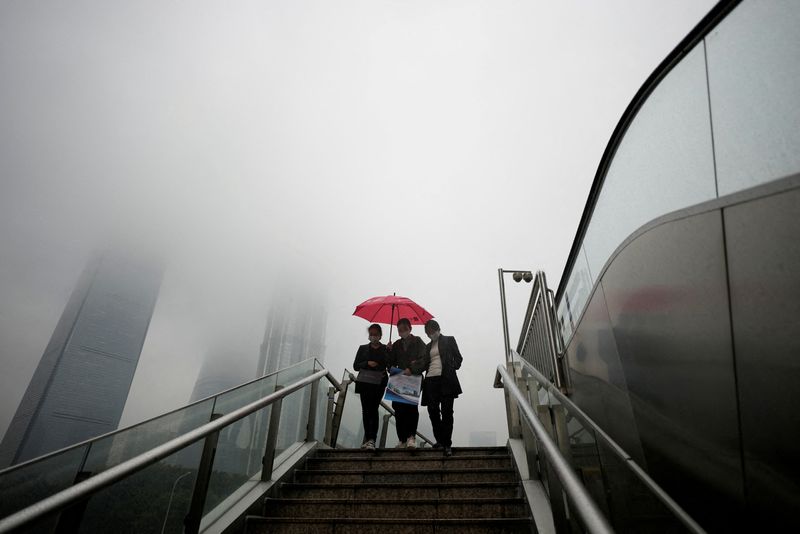

© Reuters. FILE PHOTO: People wearing masks walk on an overpass at Lujiazui financial district, as coronavirus disease (COVID-19) outbreaks continue in Shanghai, China, December 9, 2022. REUTERS/Aly Song

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

As investors enter something of a holding pattern ahead of key central bank policy decisions this week, China’s markets are on the defensive after yet another indication that the country’s economic growth engine is far from purring.

New bank lending may have doubled in November from a historically low level the month before, but still fell short of analysts’ expectations. This follows surprisingly weak trade and relatively soft inflation figures last week, and was enough to help push stocks and the exchange rate lower.

It was a reminder to investors that recent optimism surrounding the easing of China’s zero-COVID curbs may be a little overdone, and that the path to recovery will be extremely challenging even if economic re-opening is accelerated.

China’s ambassador to the United States said on Monday that China’s COVID-19 policy has always been “dynamic, not rigid,” adding that measures will be further relaxed in the near future and international travel to the country will become easier.

The yuan fell for only the second time in two weeks, while Shanghai stocks posted their biggest decline in two weeks. Asian stocks retreated too, and have now fallen every day bar two since Nov. 24.

The caution in Asia contrasts with the bright start to the week on Wall Street, where investors are betting that a benign reading of U.S. November inflation on Tuesday will ensure a ‘dovish’ 50 basis point rate hike from the Fed on Wednesday.

The three main U.S. indexes rose more than 1% on Monday, which should give Asian markets a shot in the arm first thing on Tuesday.

In truth, however, there has been little substantive move in Fed expectations for a while – the implied U.S. terminal rate has mostly hovered within a range of 10 basis points either side of the 5.00% mark for about a month.

Three key developments that could provide more direction to markets on Tuesday:

– U.S. CPI inflation (November)

– Australia NAB Business Conditions (November)

– South Korea money supply (October)

[ad_2]

Source link