Marketmind: China Politburo smoke signals

2022.12.04 17:04

[ad_1]

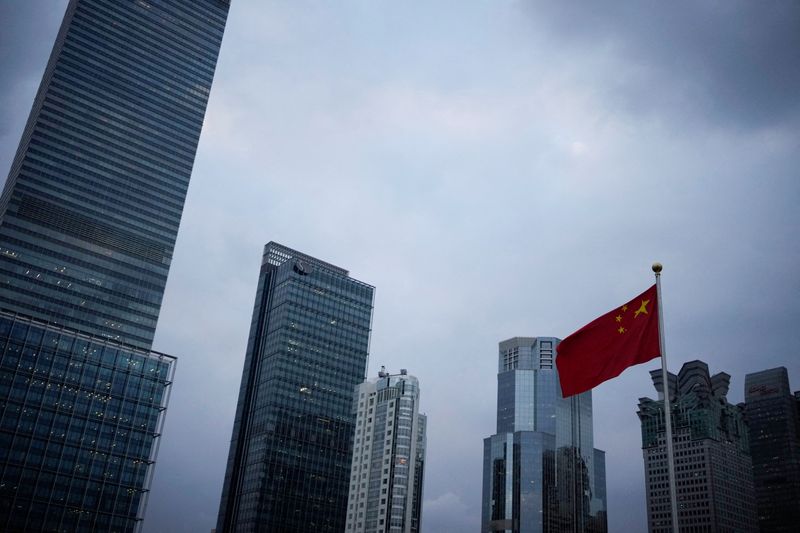

© Reuters. FILE PHOTO: A Chinese national flag is pictured, following the coronavirus disease (COVID-19) outbreak, in Shanghai, China, October 14, 2022. REUTERS/Aly Song

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

Interest rate decisions in Australia and India are the main set-piece events in Asia this week for investors, while China’s Politburo holds its first meeting to discuss the policies that will set Beijing’s economic direction over the coming year.

Investors go into the week with a ‘risk on’ bias, sustained by markets’ dovish interpretation of Fed Chair Jerome Powell’s speech on the U.S. economic outlook and the solid U.S. employment report for November the week before.

The MSCI World equity index has risen two weeks in a row and the MSCI Asia ex-Japan index has gained five weeks in a row, its best run for two years, while the dollar remains under pressure.

If U.S. financial conditions continue to ease and implied market volatility remains well-anchored, bulls will stay on the front foot. On the Asian policy front, further evidence that the burst of ‘jumbo’ hikes is over will also support risk appetite.

On Tuesday, the Reserve Bank of Australia is expected to raise rates by 25 basis points to more than 3% for the first time in a decade. That would be the third quarter-point hike in a row, following four half-point increases.

On Wednesday, the Reserve Bank of India is forecast to raise rates by 35 basis points, a deceleration from three consecutive 50 bps hikes.

The fiscal policy focus this week will be on China, with the Communist Party’s Politburo meeting early this month to lay out the government’s strategy and guidelines for the year ahead.

The challenges to revitalize the economy, boost growth, shore up the property sector, and navigate a smooth transition out of the zero-COVID policy are immense, well-known, and come against a backdrop of unprecedented protests and social unrest.

Analysts at Goldman Sachs (NYSE:) expect policymakers to reiterate a ‘supportive’ stance in light of weak economic activity recently.

“We might get more hints on the future direction of COVID control policies from this meeting – for example, should policymakers claim victory in the past COVID control and delete the not mentioning of ‘dynamic Zero COVID’ policy, we would view these as clear signs of more relaxation of COVID control in the near future,” they wrote in a note on Friday.

If they do, could strengthen through the 7.00 per dollar level for the first time since September 20, 2022. It has appreciated four days in a row, and its rise last week was the biggest since Beijing revalued the currency and shifted to a more flexible FX regime in July 2005.

Graphic: Dollar/yuan – weekly change –

Three key developments that could provide more direction to markets on Monday:

– Global PMIs (November)

– U.S. durable goods (October)

– U.S. services ISM (November)

[ad_2]

Source link