Market Rally Could Be Expanding Beyond AI – but Here’s the Catch

2024.06.25 10:11

A reader sent me an analysis calling for a “Monster [bullish] reversion trade for the ages” based on the extreme under-performance of the Equal Weight SPX (NYSE:) to the Headline .

The writer concludes that after such an extreme divergence the spring back in RSP vs. /SPX is strong and the broader market is the place to be for out-performance.

Can’t argue with that.

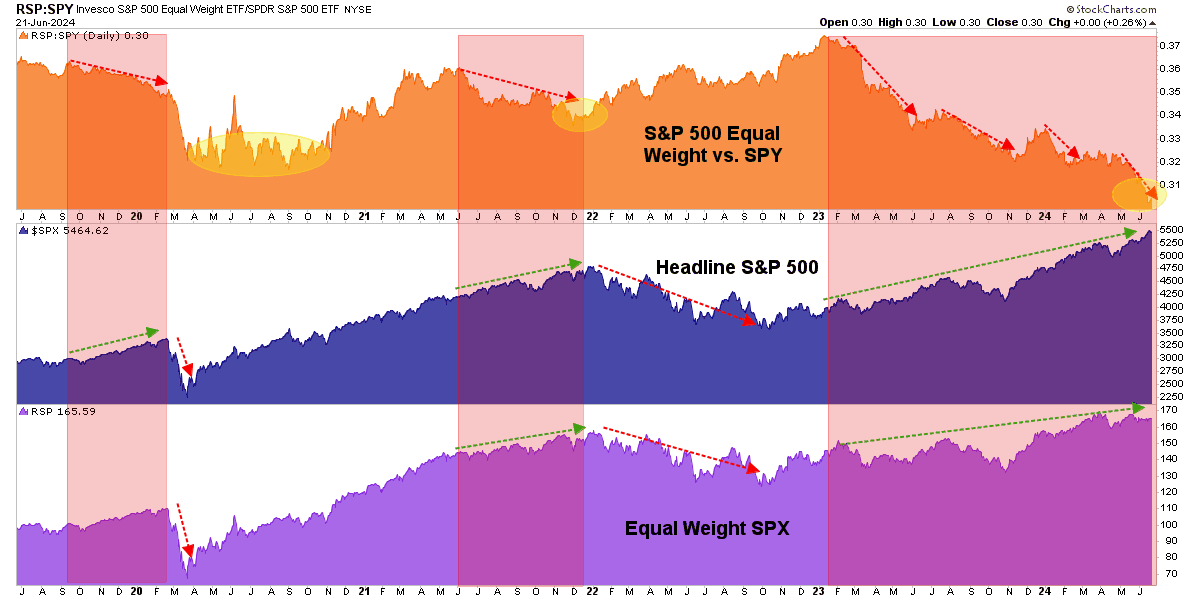

Here is the daily chart of Equal Weight/Headline comparison we often review along with its bearish implications (divergence) prior to the last two bear cycles. I have added the nominal view of RSP for context.

True enough, after the market corrections Equal Weight sprang back to out-performance mode. The lesson is you want to buy the broader market after a previous cycle has thinned out to the headliners and then finally the whole mess tanked.

But the key here is “after” market corrections. The analyst projects “monster” gains for the broader market because the ratio at top has tanked to the degree of previous extremes that preceded “monster reversion trades.”

I have a distaste for terms like “monster”, “rocket”, “a train leaving the station”, or the media’s “investors cheered” [insert here whatever eyeball-harvesting news of the day triggers the cheer]; not to mention others like the “got gold?” jingle and the commodity “super cycle” that has been coming any day now for the last 16 years, the “Great Rotation”, the BRICS “de-dollarization” pitch and a whole host of other nicknames, jingles and promos that instigate greed and emotion in investors.

So let’s throw away the word “monster” and simply review the situation. The analyst is correct, bottoms in the ratio have indeed preceded periods of broader market out-performance as the market seeks equilibrium AFTER a negative divergence like today’s has already tanked the markets, broad and equal weight alike. So it would appear that an important qualifier was omitted. Indeed, the article’s view is that it can keep going.

Here’s the bottom line: The stock market rally can keep going. Better yet, all stocks should begin to participate in the coming months and years.

Market breadth readings indicate an undeniable truth: most stocks in the S&P 500 are vastly underperforming a handful of mega-cap behemoths.

Since 2007, this trend has rarely lasted long. More importantly, the setup is incredibly bullish for the under-loved stocks in the market.

If history is a guide, we will be looking at a monster reversion trade where the equal weighted S&P will play catch up to the market bellwethers.

Well of course, it “can” keep going. This market with its crossed signals and failed (or at least delayed historical quants) has been a challenge. Like riding a bucking bronco or worse, a nasty and pissed-off bull. But the fact is that when coloring the above analysis with actual historical facts, the RSP/SPY ratio negatively diverged during phases where the nominal SPY, and RSP for that matter, were rising. Just like today.

The big bullish “monster” trade [even there, I see no monster, just healthy broad breadth leadership] did not materialize until after widespread price damage was done to most markets.

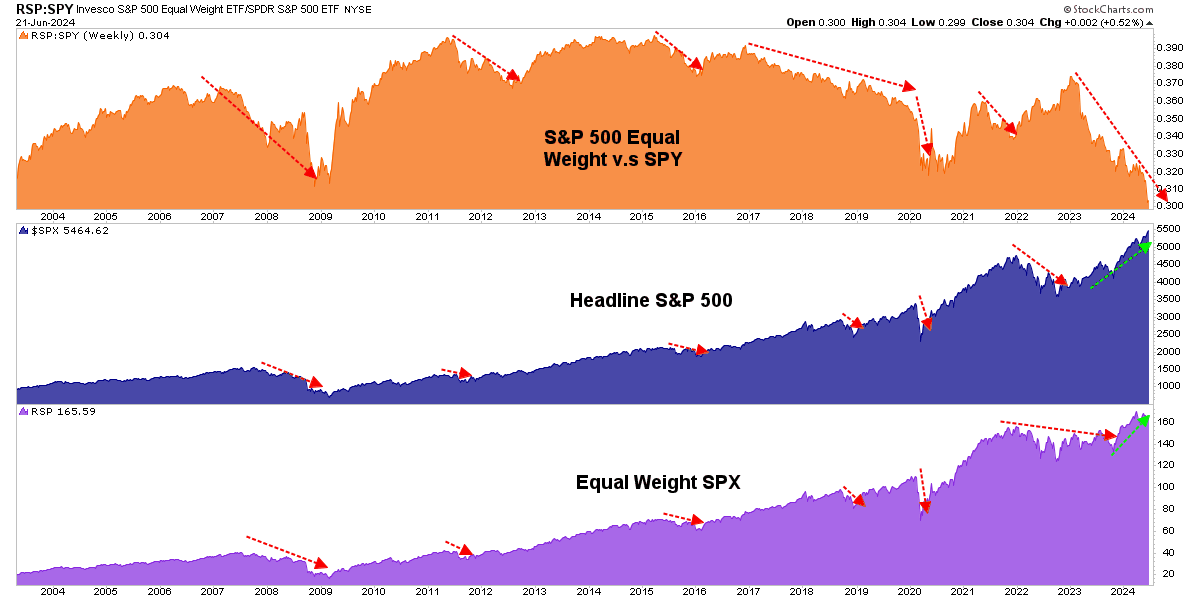

The writer uses 2007 as the historical ‘look back’ period, so let’s widen our view. Never in the history of this view has the “monster” bullish signal come about while the nominal stock market was still rising, let alone making new highs. That seems to me to be an important qualifier. The big reversion trade in 2009 came after a pervasive market crash. The big reversion trade in 2020 also came after a market crash, of sorts.

Now, let’s take it a step further. You may recall that the fact that RSP/SPY was rising during the supposed bear market of 2022 aided our view that it was not a real bear market but rather, an extended correction. RSP/SPY was a positive breadth underpinning. So for the sake of integrity, you need to know that I will call what I see, not what my dogma sees.

What I saw in 2022 was positive beneath the surface. What I see now is an as-yet-unrealized negative divergence to the stock market as a whole. The implication, based on history, based on quant, is that sure the broad market may well play catch up to and outperform the sexy headline stuff (cough cough Nvidia (NASDAQ:), cough cough Microsoft (NASDAQ:)).

But it will do so AFTER the current divergence and thinned-out market resolve into a bear market, including the broader stuff as represented by RSP. So yes, I think that’s an important qualifier, don’t you?