Market Predictions Are Meaningless: Here’s What You Should Really Be Doing

2023.08.29 05:06

- Recent market pullback has got investors wondering: Is this the start of a bear market or just a correction?

- But what they really need to understand is that markets are uncertain by nature

- Taking a long-term perspective and focusing on things we can control is the key to investing success

When it comes to the market’s ups and downs, investors create their own stories on what could happen next.

A simple 5% dip, like the recent one from early August to just a couple of days ago, could be seen in two different lights: a bear market comeback or a regular short-term correction.

The thing is, each one of us crafts our own narrative, a story we tell ourselves about how we think the markets might play out.

Amid all this, we’re bombarded with opinions from experts, journalists, commentators, economists, and traders, which can complicate things and sometimes divert us from the most basic fact: Markets are uncertain by nature.

Think about it: For every investor or trader who correctly predicts short-term movements, there are 99 others who get it wrong.

And this pattern just keeps repeating. The only entity that’s consistently right is the market itself. It’s a bit like the house in a casino – it always comes out on top.

So, here’s what we should really be doing instead:

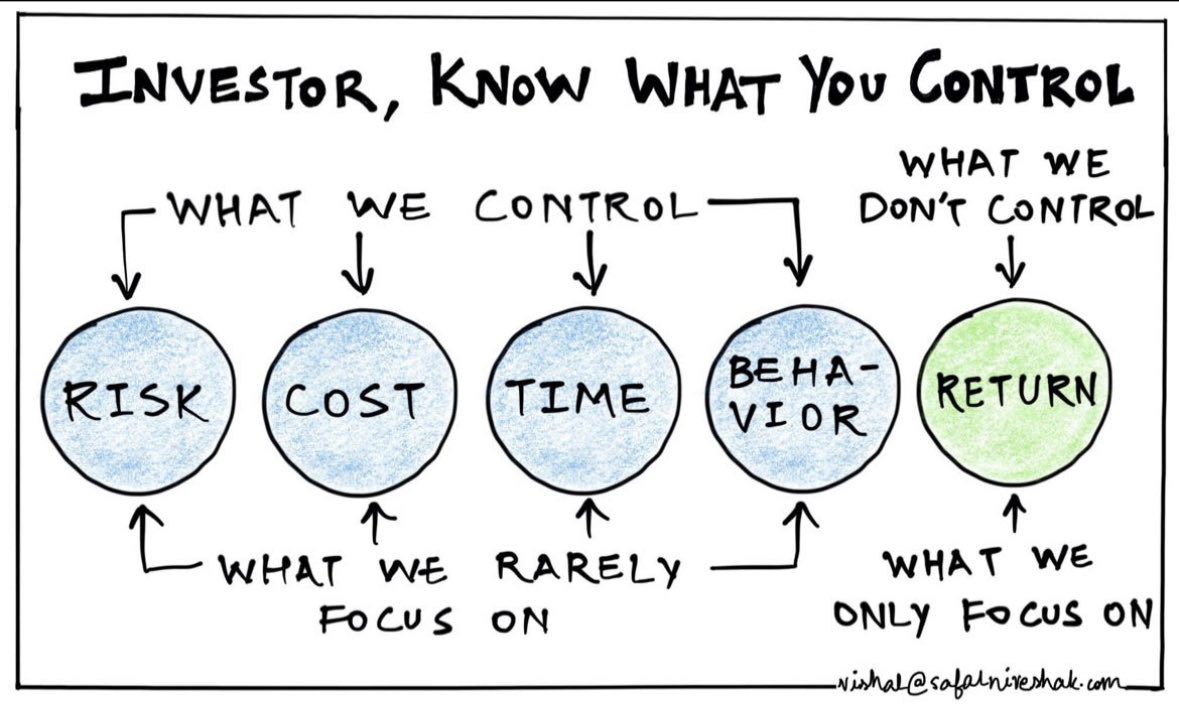

Focusing on Things We Can Control

Look below, and you’ll find a really well-made graphic that shows what we can actually manage (the parts highlighted in blue). These are the factors we should be mindful of.

Source: Vishal

Source: Vishal

- Risk: This means figuring out how you allocate your assets, manage your money, and diversify.

- Costs: Keep these as low as possible since they directly affect your overall performance.

- Time: Make the most of it – extend how long you stay invested to increase your chances of getting positive returns.

- Behaviors: How you react to market dips and moments of market euphoria really matters.

These are the areas where we have the most control, even while the market keeps changing its tune.

Yet, what’s beyond our control are the short-term returns of the market, which are inherently unpredictable.

Legendary investors such as Howard Marks and Warren Buffett consistently emphasize that they don’t waste a single moment trying to forecast the future of interest rates, inflation, or market movements – because, quite simply, you can’t.

Buffett’s primary focus lies on understanding the operations of individual companies, while Marks takes a broader approach by gauging the overall landscape (favorable or unfavorable for a particular asset class), followed by an evaluation of valuations.

A Different Perspective

Are we sure we are looking at the market’s movements from the right perspective?

S&P 500 Daily Chart – Zoomed Out

S&P 500 Daily Chart – Zoomed Out

In the charts above, I’ve captured the movements of the index over a span of a little over a month (chart 1), a full year (chart 2), and from the previous low of the Bear Market in March 2009 (chart 3).

While the daily fluctuations of the market can sometimes throw us off course, it’s equally true that when we broaden our view, we stumble upon some intriguing insights.

For instance, despite the daily highs and lows, the markets have been steadily climbing for a remarkable 14 years.

Within this period, we’ve navigated through recent challenges like the 2020 pandemic and a significant correction in 2022, not to mention all the other twists and turns in between.

So, the choice is ours: we can squander our time and energy attempting to predict how the markets will perform tomorrow, or we can take the simpler path – ride along with them, occasionally rebalance, set goals and allocations, and allow the market to do its thing.

***

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.