Market Hammered Again On Hot Jobs Report

2022.10.11 00:23

[ad_1]

A week that began so promising ended with a thud Friday thanks mostly to a monthly that would have looked bullish in almost any other year. But this year isn’t like most others.

Presidents used to brag about jobs growth like September’s 263,000 reported by the Department of Labor. However, major stock indexes crumbled between 2% and 4% today as investors concluded that the healthy jobs picture would bake in an even more hawkish Fed. The main takeaway is that the Fed is not close to achieving its goals.

The headline number was in line with expectations and down from 315,000 in August. That may sound like progress on the inflation front, considering that slower jobs growth could mean less wage pressure, but that was easily outweighed by the data’s many bearish aspects.

Certain statistics from the jobs report—including the , the participation rate, and certain sector employment growth—indicate that the Fed’s effort to cool off the sizzling U.S. job market isn’t paying off. The Fed might have to raise rates more to tame this persistent inflationary labor market growth.

Think back a few months to when the Fed said the labor market was way too tight. Since then, the economy has added more than one million additional jobs. As people in the market digested today’s numbers a little more, the camp saying we’d have a less aggressive rate-hike cycle had to throw in the towel for the time being. It was like a recipe for a bad day on Wall Street, with rates and the rising in the wake of the report.

For an even worse one-two punch, investors had to contemplate yesterday’s post-market announcement from semiconductor firm Advanced Micro Devices (NASDAQ:), which warned of a Q3 revenue shortfall. That’s something that doesn’t speak well for the technology industry in a world supposedly becoming more digital, and it’s not a good sign for the economy in general considering how many products semiconductor chips are used in.

The jobs report is just one data snapshot, of course, and last week’s earlier labor-related reports could be evidence that the Fed has been getting at least part of the inflation-fighting job done. Job openings fell significantly, according to Tuesday’s report, and ticked up Thursday from five-month lows.

Potential Market Movers

Data-wise, this week brings the September Producer Price Index () and the Consumer Price Index () reports. These data, are among the most closely watched on Wall Street

Monday’s focus returns to the Fed when Fed Vice Chair Lael Brainard is scheduled to speak at the National Association for Business Economics meeting in Chicago. The speech is titled, “Restoring Price Stability in an Uncertain Economic Environment.”

The CME FedWatch Tool finished the week with an 82% probability of a 75-basis-point rate hike at the close of the next Federal Open Market Committee meeting November 1-2. That’s compared with 75% on Thursday and 56% a week ago. It looks like expectations are getting cemented for a fourth-straight 75-basis point hike.

This week also marks the official start of Q3 earnings season. PepsiCo (NASDAQ:) kicks things off Tuesday following pretty strong showings recently from some smaller food and beverage companies.

Earlier we said earnings season can sometimes have a calming effect on the market, though by some metrics October is typically a volatile month. Just the fact that there’s fresh corporate numbers and news every day can take some of the focus away from stuff that everyone’s been obsessing over the last few weeks like Fed speakers, geopolitical anxiety, and problematic economic data. Not that any of that goes away, naturally. It’s just that earnings often dominate the news cycle.

Reviewing the Market Minutes

Once again, good news is bad news and vice versa for the market right now. Friday’s strong payrolls data was just one more example. Earlier last week, the market rose on the news of increased initial jobless claims, and got a lift from poor construction spending and data. Things are a little upside down right now.

The fell 2.8% to 3,639.66, erasing most of the progress it had made during the rally Monday and Tuesday but staying above the nearly two-year low below 3,600 posted last week.

The finished the day off 2.21% to close at 29,296.79, while the lost 3.8% to close at 10,652.41. The fell nearly 2.9%.

The ended the day at 3.88%, up from lows below 3.6% earlier this week, while the U.S. Dollar Index (DXY) finished just slightly higher but closing in on 113.

The climbed again last Friday, pushing past 30 to the 32 mark after falling below 30 earlier in the week. Resistance for VIX could be around recent highs in the 33-34 range. A move through that level would put VIX on pace to surpass its May highs, and would likely be seen as a very bearish signal for stocks.

Once again, technology stocks were among the worst performers on Friday, with semiconductors taking yet another leg lower. Though the Philadelphia Semiconductor Index () didn’t quite scrape against recent two-year lows, it did plummet more than 5% at times during Friday’s session, hurt partly by the AMD news.

Elsewhere, delivery and retail stocks swooned last Friday after Reuters reported that an internal memo from FedEx (NYSE:) indicated the company’s division that handles most of its e-commerce plans to lower volume forecasts because customers plan to ship fewer holiday packages. The weakness spilled over into shares of Amazon (NASDAQ:), United Parcel Service (NYSE:), and Shopify (NYSE:).

Positives were few and far between Friday, but Lockheed Martin (NYSE:) rose slightly on a report in Politico that the Pentagon approved the re-start of F-35 fighter jet deliveries.

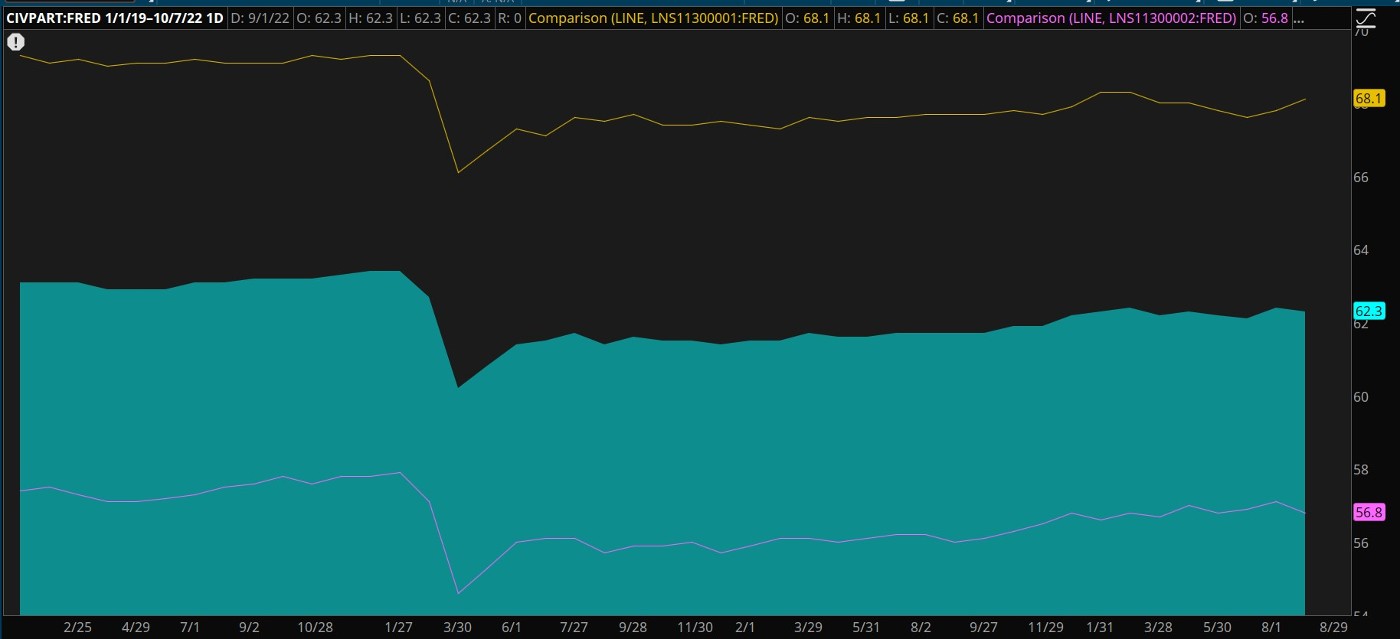

U.S. Labor Force Participation

U.S. Labor Force Participation

Chart source: The thinkorswim® platform

Chart Of The Day

U.S. labor force participation (blue-green area) barely budged in Friday’s September jobs report at 62.3%. It’s an indication that the number of Americans who are working or looking for jobs is sticking to a level well below what was common before the pandemic. Note the divergent paths for male (yellow line) and female (pink line) workers.

Final Thoughts on Jobs

Monthly jobs growth was the lowest since April 2021, but even this relatively small number would have beaten all but four months of jobs growth recorded between January 2018 and December 2019 – the final two years ahead of the pandemic.

Looking for a silver lining?

It’s somewhat healthy from an inflation standpoint that job growth continues to slow month over month. However, it would likely need to fall far more to have the Fed feel better about inflation. Unfortunately, the number of workers available for jobs doesn’t appear to be growing, and a tight supply of job-ready Americans could continue to spark wage inflation.

Obviously, it would be great if we could all get big raises, but the Fed wants to cool that metric to clamp down inflation expectations, which are hard to fix once they become entrenched. Some economists have suggested the Fed has gotten too far out in front on rate hikes and needs to slow down, but this report doesn’t back up that type of thinking at all. Instead, it suggests the Fed remains behind the inflation curve. And that’s not bullish at all for stocks.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]

Source link