Market Does a Turnaround Tuesday to Start September

2024.09.04 03:38

By now I am sure you have heard how horrible September usually is for the markets.

Indeed, the start of September looks a lot worse than it did at the end of August.

Nonetheless, be careful trading on adages.

And be careful not to become too extreme in sentiment.

is down, true, but Granny is trying to hold around the 50-DMA.

is well above the 50-DMA and holding the July 6-month calendar range high.

You have to look at the inside sectors for perspective.

On another note, since we are in a new season, I thought this a good time to also make the Daily more consistent in terms of themes for each day.

Hence, going forward:

- Technical Monday: That will feature a technical setup that looks interesting.

- Turnaround Tuesday: This will cover a stock, sector, or commodity that either turned direction up or down or looks to be ready to do so soon.

- Hump Day Wednesday This Daily will focus on the midweek setup with expectations for the remainder of the week.

- Thursday: No Daily that day.

- Finale Friday: As per usual, we will cover the week’s performance in the Economic Modern Family and how to plan for the upcoming week.

Since today is Tuesday, the turnaround theme looks obvious with the sell-off, especially in tech, but what else looks ripe for a turnaround?

Here are two stocks to look at.

In the true spirit of turnaround Tuesday, the 2 stocks I am featuring are both very beat up, which would make the turnaround quite spectacular if happens.

Full disclosure, we have no position in either of these stocks.

Stratasys (NASDAQ:) is a 3-D printing company. The stock peaked in July 2023 and has had a massive move lower.

After a gap lower post earnings, the stock reversed that same day and now is trading within the range that day (2 trading days ago).

We like 3-D printing and yet, the companies are perhaps the worst in turning profits.

If SSYS leaves an island bottom, we will be keen to see follow-through.

MP Materials (NYSE:) reported and announced a huge buyback program. This company mines rare earth minerals.

Another one in a downtrend since April 2022, we like the bullish divergence on our Real Motion momentum indicator.

Therefore, we will watch for a phase change should the price clear back above the 50-DMA (blue line).

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 550 the 50-DMA

- Russell 2000 (IWM) 212 the 50-DMA

- Dow (DIA) 410 support

- Nasdaq (QQQ) Unconfirmed warning phase with 455 some support

- Regional banks (KRE) 57 pivotal

- Semiconductors (SMH) weakest sector with support at 217 the 200-DMA

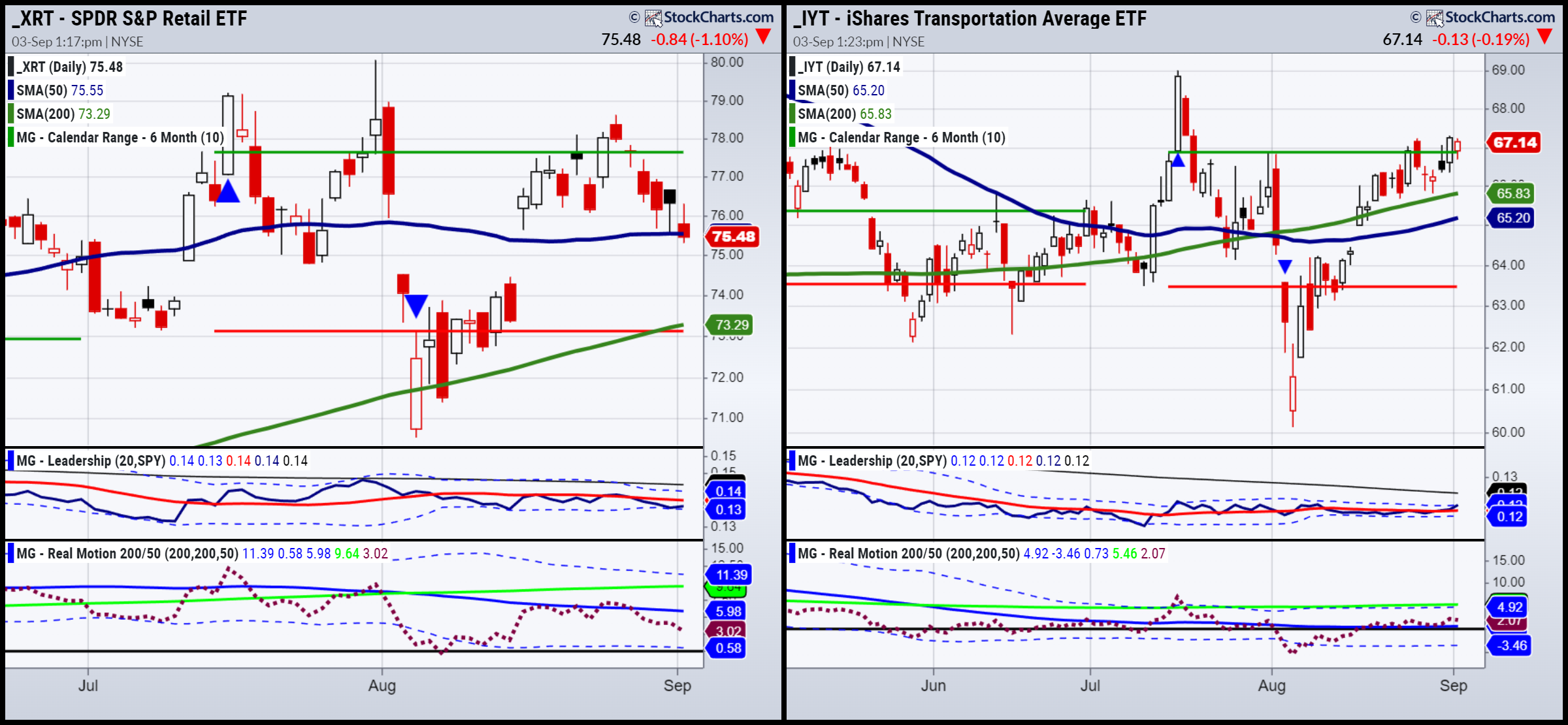

- Transportation (IYT) Inside day and still some relative strength

- Biotechnology (IBB) 145-150 new range

- Retail (XRT) Failed the 50-DMA and needs a second day to confirm or not

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) Weaker but still risk on unless it breaks 78