Markel’s Premiums Skyrocket 49% in Q2: True Value or Potential Overreach?

2023.08.25 10:43

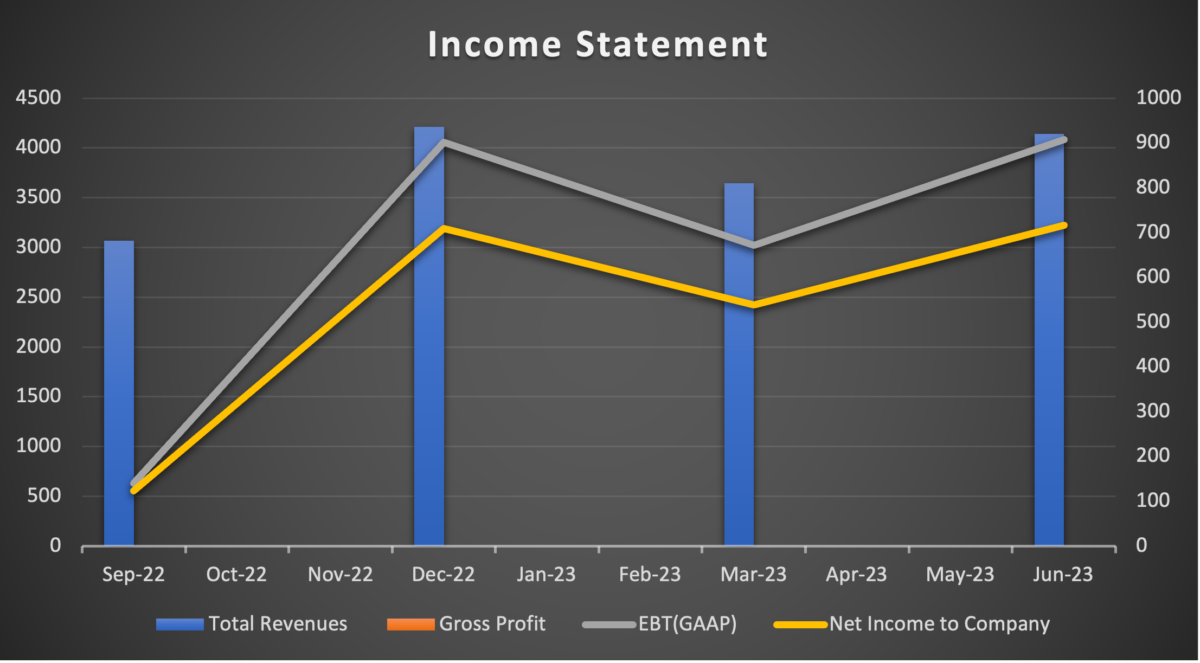

- Markel’s Q2 2023 results shine: $4.14B operating revenues (+131% YoY), consistent underwriting + diverse ventures drive growth.

- Key highlights: 11% increase in insurance premiums, robust performance in Markel Ventures (+40% operating revenues), and 75% surge in investment income.

- Resilient growth trend: 5-year outlook shows sustained expansion in total revenues, premiums, underwriting profits, and investment income.

Markel’s Outstanding Q2 2023 Results

In the second quarter of 2023, Markel Group (NYSE:) a strong financial performance, supported by respectable results from its Insurance, Markel Ventures, and Investment segments. The company’s remarkable growth trajectory is attributable to its disciplined underwriting practises, strategic expansion, and long-term focus. The three-engine system comprised of Markel’s Insurance, Markel Ventures, and Investment operations has proved to be a strategic differentiator, providing resilience and generating a collective impact that is greater than the sum of its parts.

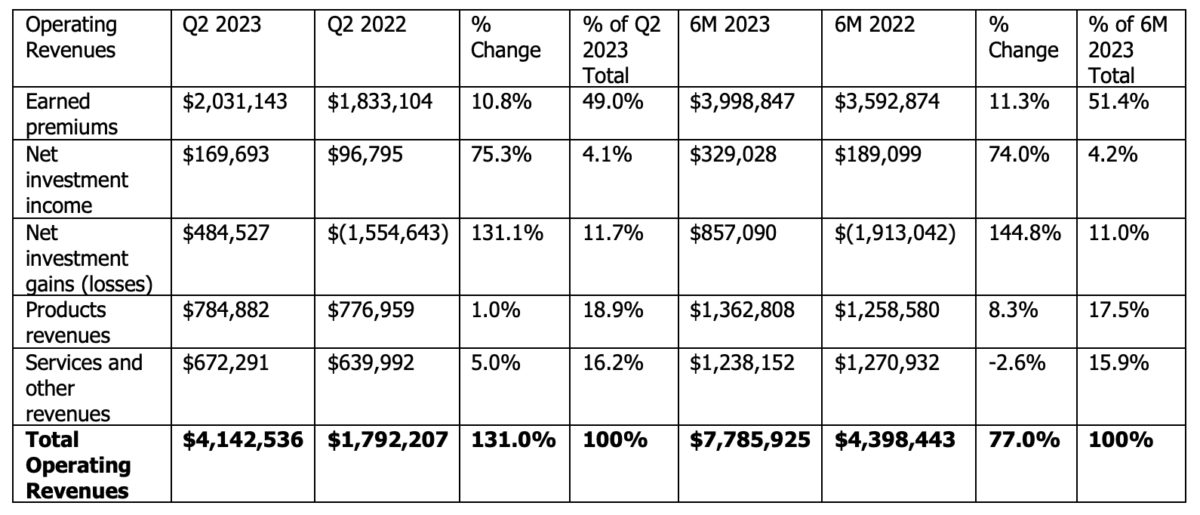

Operating Revenues

Consistent Capability of the Insurance Market:

In the second quarter of 2023, earned premiums for the Insurance segment of Markel increased by 11%. The segment’s consistent underwriting profit reflects the company’s proficiency in risk management. Over the past two years, Markel has consistently generated underwriting profits, with cumulative profits reaching $1.3 billion. This performance demonstrates the Insurance segment’s proficiency in meeting customer needs and its substantial contribution to Markel’s overall financial results.

Markel Ventures:

Successfully Navigating Obstacles In diverse ventures, Markel Ventures, the company’s diversification engine, has reported robust margins and cash flows. In the second quarter of 2023, the segment’s operating revenues increased by 40% due to higher operating margins in the products segment. Individualised treatment of each business by Markel Ventures has been instrumental to its development and has enabled the segment to effectively navigate labour shortages and inflationary challenges.

The Investment Segment’s Adaptive Development:

The Investment segment’s net investment income increased by 75% in the second quarter of 2023, a substantial increase. Adaptive investment strategies at Markel and the effect of rising interest rates have contributed to this expansion. Despite market volatility, the Investment segment has maintained its strategy of investing in companies with high capital returns and reasonable valuations, resulting in an increase in recurring interest income.

Five-Year Growth Trend for Markel:

The five-year outlook for Markel demonstrates consistent growth and accelerating momentum across key financial metrics. From 2018 to 2022, total revenues, earned premiums, underwriting profits, and net investment income all exhibited an upward trend. This sustained growth validates Markel’s comprehensive approach and strategic orientation, instilling confidence in the company’s future success potential.

The Resilient Business Strategy:

The company is well positioned for future development due to its disciplined underwriting, focus on favourable market cycles, and strategic expansion. Creating a resilient and self-reinforcing ecosystem, Markel’s integrated three-engine system permits it to absorb market volatility and capture unexpected opportunities.

Conclusion

Strong underwriting profits, robust operating revenues from Markel Ventures, and solid investment income demonstrate the company’s resilience and adaptability to market conditions. Changes in the organization’s strategic leadership bolster its operational capabilities. Markel Group Inc. is an attractive investment opportunity due to its track record of sustainable growth and well-established business model.

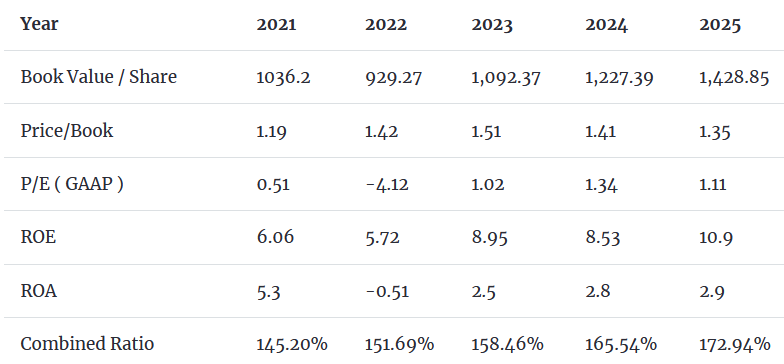

Note: Estimates are based on calculations by Equisights

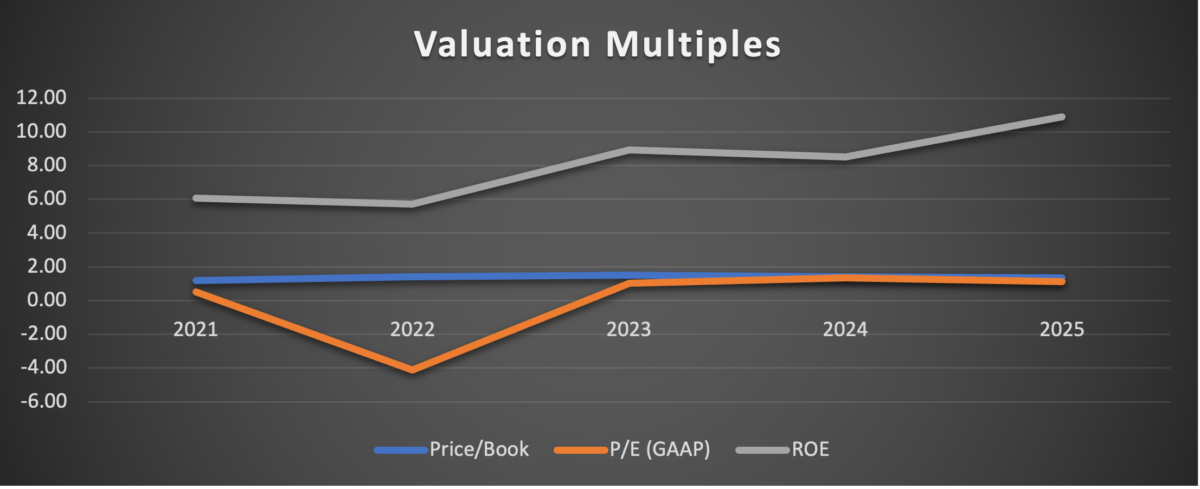

Markel Inc.’s financial indicators suggest a pattern of growth and resilience over the years. The Book Value per Share has consistently risen from 2021’s 1036.2 to a forecasted 1,428.85 in 2025, underlining an increasing intrinsic value. Despite a dip in 2022, the Price/Book ratio demonstrates investors’ growing confidence in the company, peaking at 1.51 in 2023.

The P/E (GAAP) indicates a bounce-back from a negative stance in 2022 to a more positive outlook by 2025. Furthermore, the company’s ability to generate profit from equity, as seen in the ROE, reaches an impressive 10.9% by 2025. Yet, the increasing Combined Ratio might be a concern, hinting at escalating claim and expense liabilities compared to its premium income. However, considering the overall growth trajectory and strong fundamentals, a target price of $1650 for Markel Inc.’s stock appears justified.

Disclosure: We don’t hold any position in the stock.