Lots Riding On The Russell 2000

2022.10.13 00:20

[ad_1]

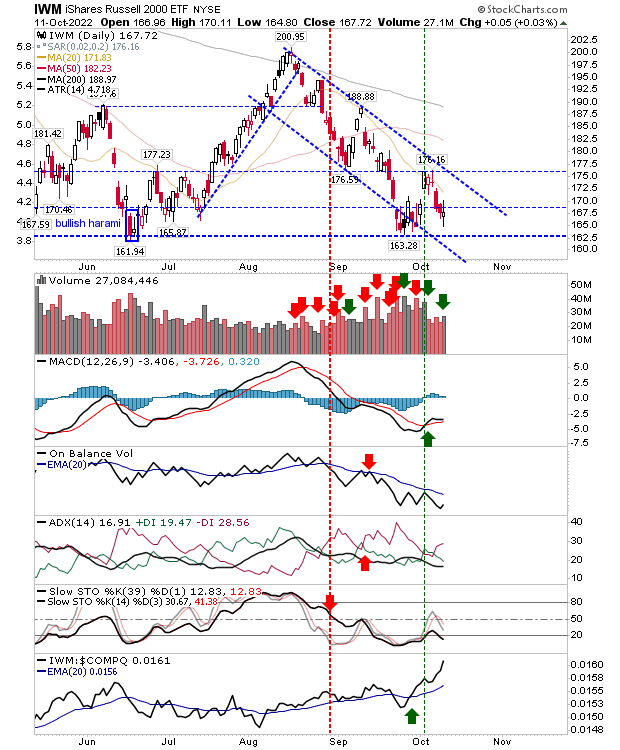

After a long weekend away markets decided to undo the gains they had enjoyed in the early part of last week. It was a damaging loss, with both the and both experiencing undercuts of support – negating what had been positive ‘bear traps’. Whatever remnants of support the June lows offered for these two indices is no more, we are now looking at what the current trend (lower) from August highs can offer. The only index to offer some level of optimism is the , which managed a higher close on Tuesday and is still above June lows. No surprise to see Small Cap growth stocks surge in relative strength – not to mention, it registered as a day of accumulation.

IWM Daily Chart

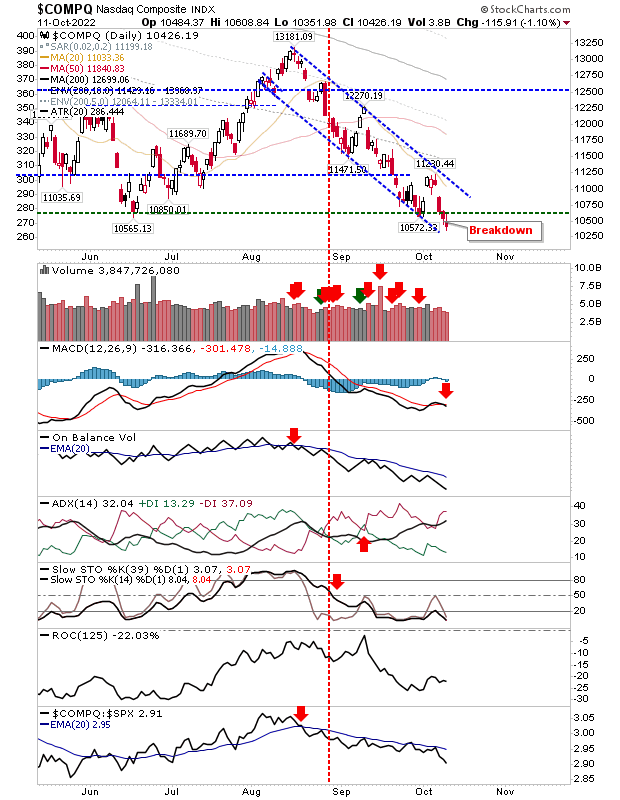

For the Nasdaq, it was an ugly day. The undercut of support came with some consolidation with the lack of volume, but that won’t appease anyone holding on to a losing position. There was a fresh MACD ‘sell’ from below the bullish zero line – typically a signal for an extended move lower – so shorts may have something to work with here. Investors who have bought since the summer of 2022, this is not something to worry about and should be adding to positions, but it’s a different story for long-side traders.

COMPQ Daily Chart

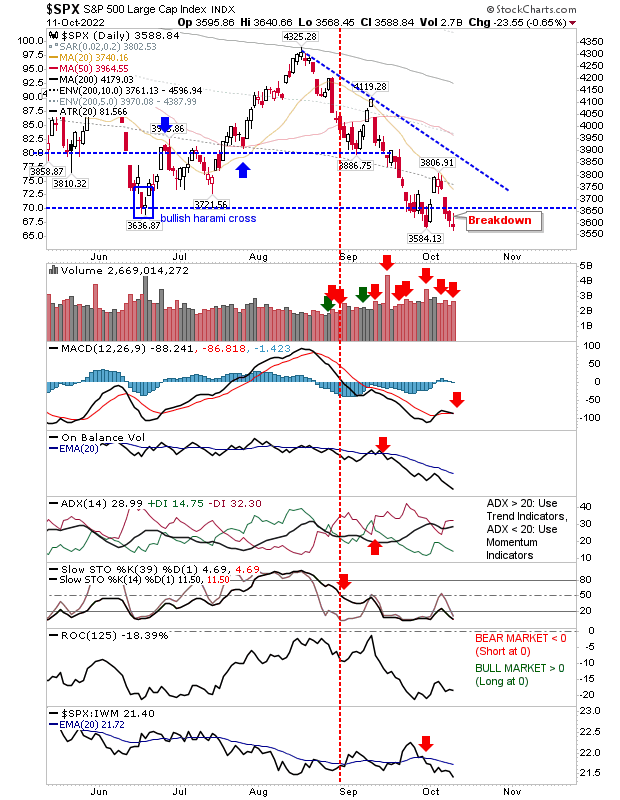

It was a similar story for the S&P with the break of June lows registering on Friday’s losses, with current weakness just compounding these troubles. Unlike the Nasdaq, there was a confirmed distribution day to add to the woes, so if there is a lead off for bears today it will be this index (and yes, it also flashed a new ‘sell’ trigger in the MACD below the bullish zero line).

SPX Daily Chart

For today, we can expect selling pressure to intensify for the S&P and probably Nasdaq too. This will keep a lid on any chance for the Russell 2000 to mount a bounce off today’s neutral ‘spinning top’ candlestick. If bulls are able to offer a recovery after the first half-hour of trading, then look to the Russell 2000 to benefit most.

[ad_2]

Source link