Looking Ahead to 2023: Economic Woes and Stock Volatility

2022.12.27 07:02

[ad_1]

- Inflation was round one of the battle, while round two will be a much weaker growth situation

- With a hawkish Fed and weakening employment picture, monthly job losses will create nervousness on Main Street next year

- Equities have some room to the downside but should price-in poor economic conditions sooner rather than later

I expect more of the same next year. will likely be elevated, but not extreme, while equity prices will rise and fall with key macro risks as well as important signals from the corporate world. We’ll get our first reads on the state of the consumer and economy early in January with the monthly jobs report and key manufacturing data.

While the employment picture appears decent so far, there are signs that monthly payroll declines could be in the offing. Goldman sees sluggish job climbs by the second quarter of next year, while BofA is much more pessimistic in its outlook.

If we land somewhere in the middle of those two forecasts, then the U.S. Personal Saving Rate will probably fall further due to less aggregate income. Consumer balance sheets, while decent right now, will come under pressure.

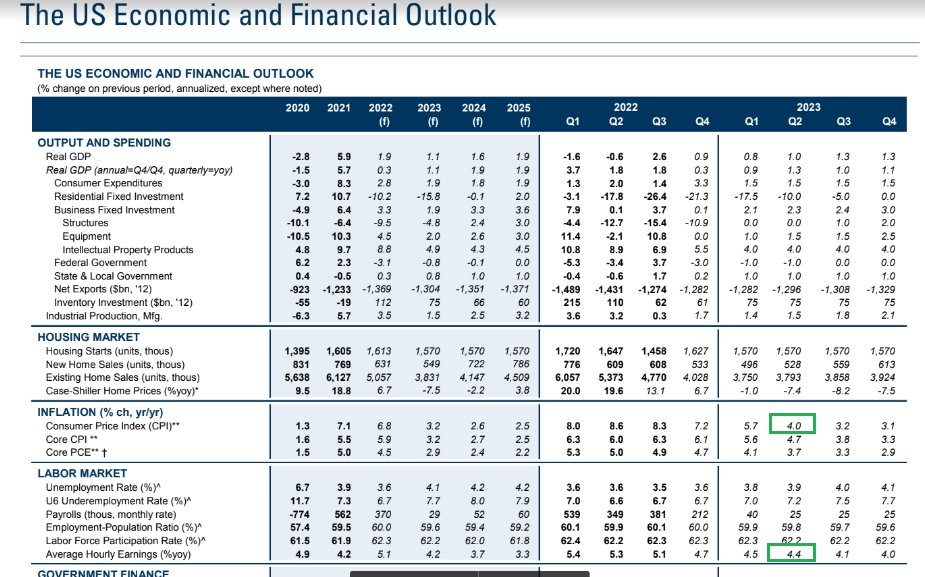

Weak Job Growth Expected in 2023, Inflation Cooling

U.S. Economic and Financial Outlook

U.S. Economic and Financial Outlook

Source: Goldman Sachs Investment Research

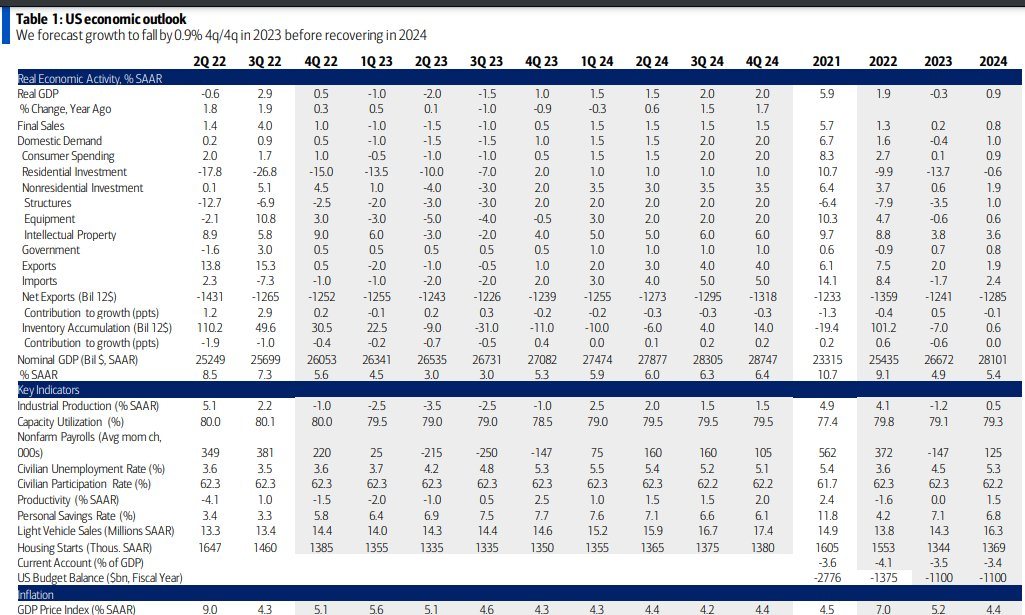

BofA Sees Monthly Job Losses of 250k in 3Q23

Source: BofA Global Research

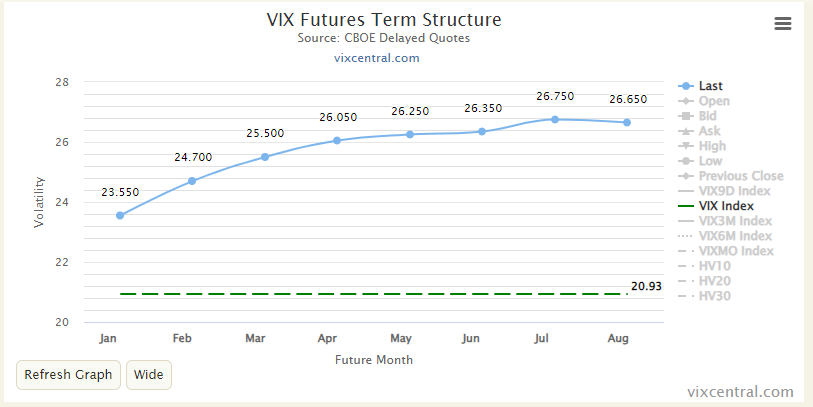

VIX Term Structure: Volatility Likely to Stay High Through 1H23

VIX Futures Term Structure

VIX Futures Term Structure

Source: VIX Central

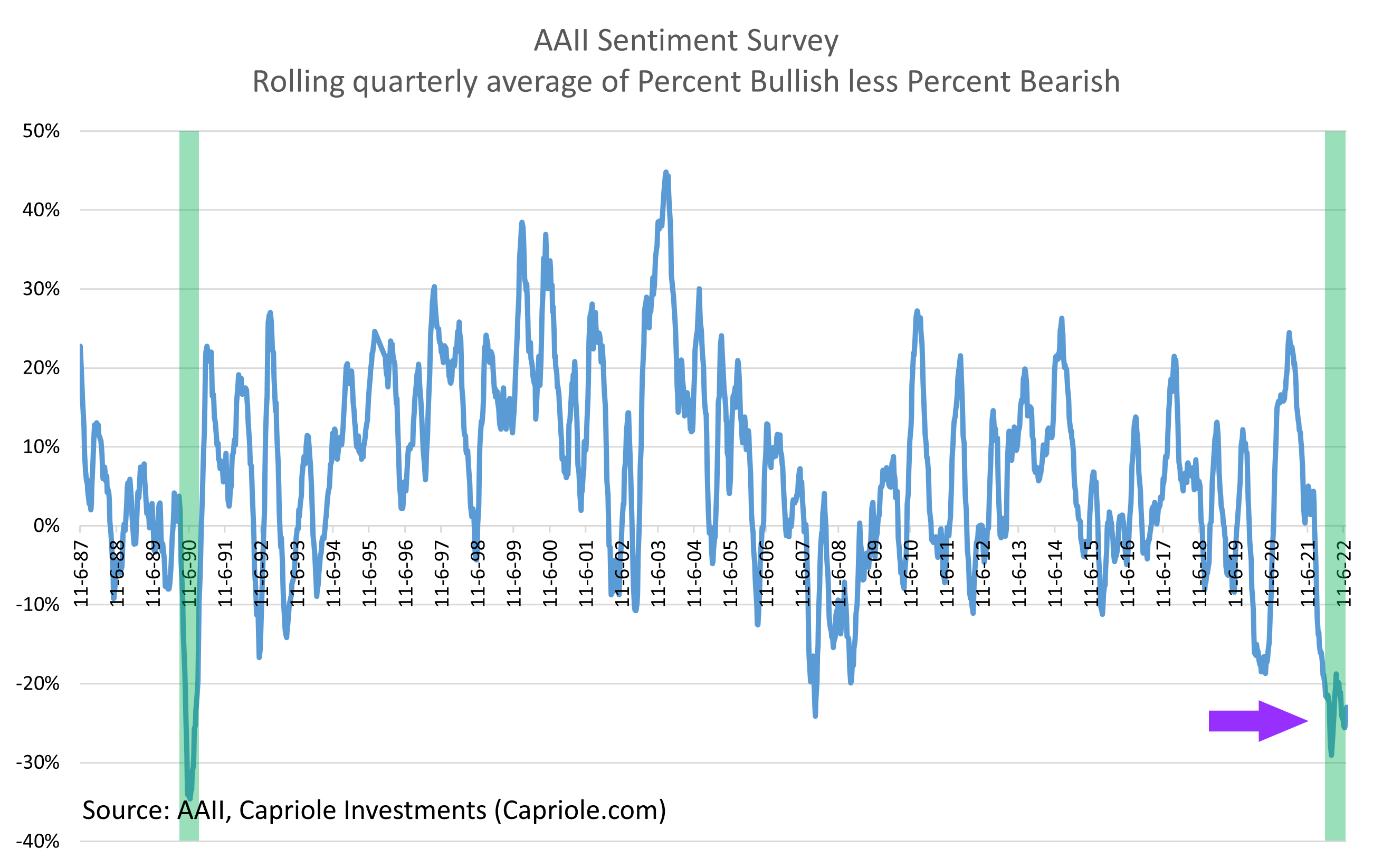

That dismal economic view will surely make Main Street anxious about the broad economy and the stock market. It comes after a year of high and lower stock and bond prices. Bearish sentiment on financial markets and frustration with the economy are likely to persist. We will go from concerns and worries about inflation to fears of a contracting employment situation.

Extreme Bearish Sentiment Toward Stocks, No Trend Change in Sight

Source: Charles Edwards

The good news is that most economists expect just a minor economic dip next year, focused on the first half. When most folks hear “recession” these days, their minds immediately jump back to the Great Financial Crisis and the turmoil that went along with it. I expect 2023 to be nothing like that. Moreover, we are already coming off a tough bout of inflation, so perhaps a small technical recession early in the year is the final part of the cycle we must endure.

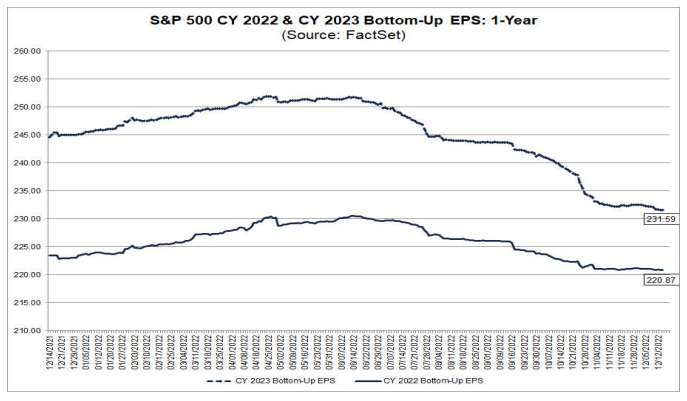

As for stocks, with the trading at 16.6 times next year’s earnings heading into a period of weakening corporate profits, the market is by no means extremely cheap. I think the current consensus of $232 of 2023 per-share earnings on the S&P 500 is lofty and will verify around $215. That would imply a low in stocks somewhere in the low to mid 3000s.

But investors should be careful not to assume that the market will trade at recession-level earnings and a trough valuation for too long. If EPS recovers to $230 and the SPX trades with a 17-multiple toward the end of next year, that would still be a positive total return for the year.

Overall, I see value continuing to rally against growth, foreign markets rebounding amid a weaker dollar, small caps outperforming large caps, and volatility gradually dropping in the rate markets, which should provide some confidence to markets by year-end. I acknowledge that it seems to be about the consensus forecast, though.

S&P 500 Earnings Forecasts Continue Retreat: More Downward Revisions Likely

S&P 500 Bottom-Up EPS Expectations

S&P 500 Bottom-Up EPS Expectations

Source: FactSet

The Bottom Line

I expect a soft technical recession in the first half of next year, but the NBER might not deem it that if payrolls hold up. Larger job losses might be seen in the middle of 2023. Stocks may see a low not too far down from the current level.

It’s also important to recognize that equities often move about six months ahead of changes in GDP, so much of the damage has been done, and picking the bottom could be a risky venture.

*Happy Holidays and a Blessed New Year!*

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.

[ad_2]