List of Closed-End Funds Trading at a Discount, Yielding Up to 9.9%

2024.09.18 13:00

Discounted closed-end funds (CEFs) are perhaps the sweetest dividend deals that Wall Street offers. I mean, where else can we find a 9.9% yield trading for 87 cents on the dollar?

By offers I mean overlooks! The spreadsheet jockeys can’t be bothered with Neuberger Berman Next Generation Connect (NYSE:). Or its 9.9% dividend. Or its 13% discount to its net asset value (NAV).

Why not? NBXG only has a market cap of $957 million—too tiny a capital pool for the big fish to stash cash. So, these “index huggers” lazily pile into SPY (NYSE:) instead.

We individual investors, on the other hand, can make a nice living (and retirement) in this cozy contrarian corner of the income market. A $900 million market cap is a pond plenty big enough for us. NBXG offers a nice potential 9.9% income catch to those with a line.

Now, please wait a second before you thumb this ticker into your brokerage account. There are more—many more!—CEFs trading at generous markdowns to their intrinsic values.

Let’s compile a reliable list of these CEFs trading at a discount.

It is tempting to ask Google. But everyone’s “go to” search engine is in serious long-term trouble as competitors rush to integrate AI into their search results. AI answers are better—but also subject to lies.

Wait, what? AI is, honestly, the best and worst development in recent tech memory. It can be scarily accurate. And, when in doubt, the robots make stuff up!

AI tools like Google’s Gemini, OpenAI’s ChatGPT and “Google killer” Perplexity can synthesize incredible quantities of information into succinct, actionable summaries. The downside is they have an unfortunate tendency to shamelessly fabricate information and present it as fact.

Here’s a personal example. I share season tickets to our local NBA team, the Sacramento Kings, with three friends. Each year we “draft” our seats using the home schedule for the season.

Our group leader was kind enough to compile a home schedule for us, complete with dates and game numbers. He used ChatGPT to help with the task. Easy—I’ve never been as prepared for a draft.

However, in reviewing the games and dates with him before our call, we realized while the information was indeed 90% accurate, the remaining 10% was fabricated. ChatGPT made up games and dates that did not exist!

Be careful with AI. It is convenient, but it will also lie to you. Trust but verify—especially for investment research.

Source: Google

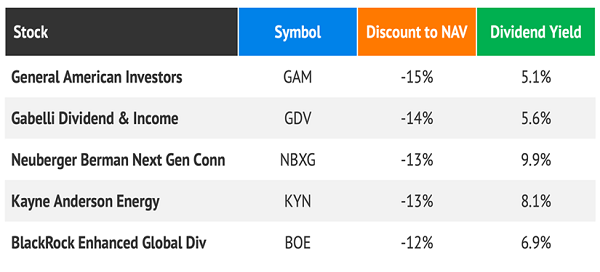

Shall we verify Google’s list above? Nah, for list generation, I prefer to bypass AI and use a specialized investing site. YCharts (paid) and CEFConnect (free) are my two favorite options. Using CEFConnect, which is free courtesy of CEF “Godfather” Nuveen, let’s look at the five most discounted CEFs today (with $600 million or more in assets):

This five-pack is a nice starting point. Nuveen won’t fib like an AI tool but we should still verify the discounts and dividends listed.

After all, CEFConnect’s numbers are only as good as their data. And they don’t tell you their source. So, to check on the Neuberger 9.9% payer we head to its website:

Source: NB.com

And yes, here we verify that we are nearly netting “$2 for free” by purchasing NBXG at its market price.

Note From the Publisher: Now for the “Perfect” Income Portfolio

Kevin Wallen here, publisher at Contrarian Outlook.

As Brett said at the top, discounted CEFs are among the sweetest dividend deals that Wall Street offers.

This five-pack is a good start but let’s be honest, who wants to spend their hard-won retirement scouring bottomless databases for discounts?

The better, easier option is to check out Brett’s Perfect Income Portfolio, where he reveals the safest, juiciest dividends on his radar each month.

We’re talking payouts up to 10.5%!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”