Liquidity: A Crucial and Widely Misunderstood Driver of Financial Markets

2023.01.25 11:03

[ad_1]

The Fed intends to drain liquidity at a rapid pace in 2023.

And while the pace might be more friendly for the next months, don’t get distracted.

Banks, the repo market, and Wall Street will soon start feeling the heat.

In this piece, we will:

- Explain what liquidity really is in plain English;

- Go over the drivers of US liquidity in 2023;

- Assess how they will interact with each other and drive markets.

Let’s start with the basics: liquidity = bank reserves.

It’s one line item you can easily track on the Fed balance sheet (liabilities), and you don’t need any fancy formula to calculate it.

Bank Reserves Are Money for Banks

Banks use reserves to transact with each other and with the Fed: to settle transactions, buy bonds (!) from each other, and lubricate the biggest funding mechanism in the world – the repo market.

A regime of ample reserves helps banks in providing liquidity to financial markets.

In that regime, banks will facilitate the smooth functioning of the repo market and have an appetite for absorbing high-quality bonds (Treasuries, high-rated corporate bonds and mortgage-backed securities, etc).

As repo markets work smoothly and banks bid high-quality bonds, investors tend to take more risks.

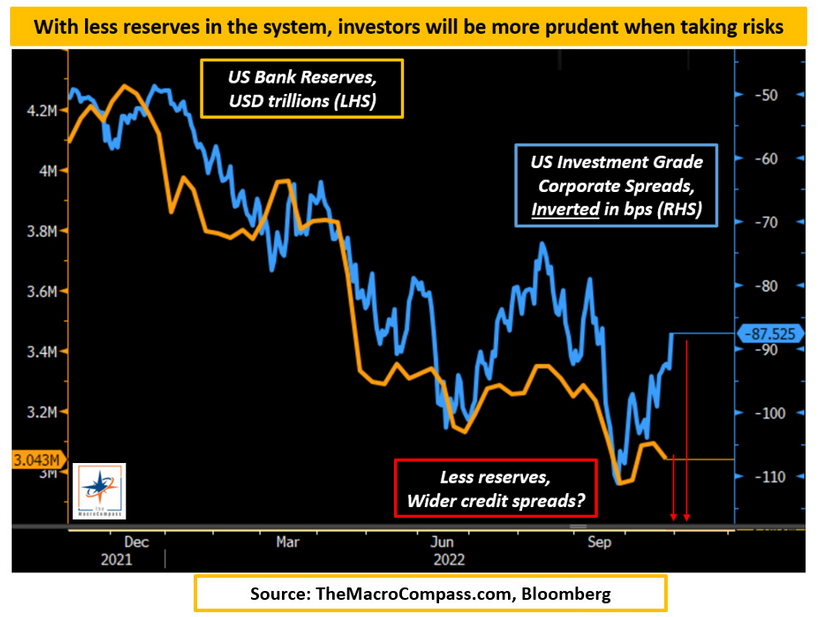

Instead, tighten “liquidity” rapidly and over time investors’ risk appetite could fade.

No, I will not draw a line chart of liquidity versus the and tell you that is the magic formula.

Because that’s macro gaslighting, or aka bull…

Banks don’t use reserves to buy stocks because equities are not a regulatory well-treated asset (HQLA).

Monetary plumbing is not so easy. But yes, the amount and the rate of change of bank reserves matter for repo markets and risk appetite.

And in 2023, a lot will be going on with bank reserves.

Quantitative Tightening

Stylized Balance Sheet

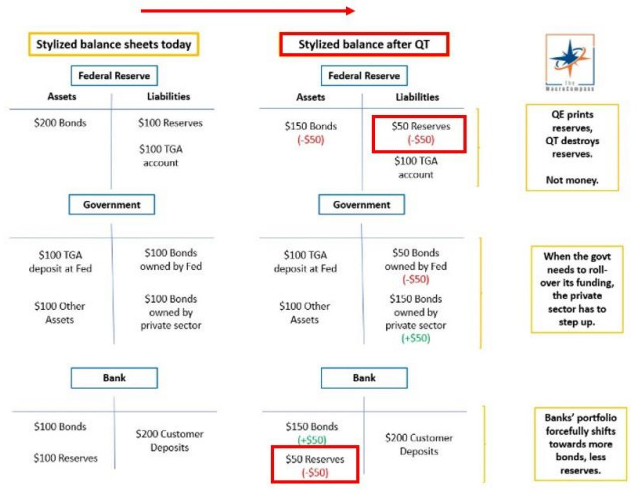

In its simplest form, QT shrinks the balance sheet of the Fed on the asset side (bonds not reinvested) and on the liability side – here, the standard is that bank reserves are destroyed.

As the government keeps issuing bonds over time, it’s up to the private sector to absorb bond issuance.

Reserves are destroyed, and private investors have less room to allocate toward riskier assets.

The Fed will be running QT at a yearly pace of > $1 trillion.

Now the big question is: does this mean reserves are going to linearly shrink by $95 billion per month?

And most importantly: how will other factors like the Treasury General Account (TGA) or the Reverse Repo Facility (RRP) impact US liquidity?

Understanding liquidity is crucial to navigating markets.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds – check out which subscription tier suits you the most using this link.

[ad_2]