Limited support for central bank digital currencies in global investment industry survey

2023.07.25 20:33

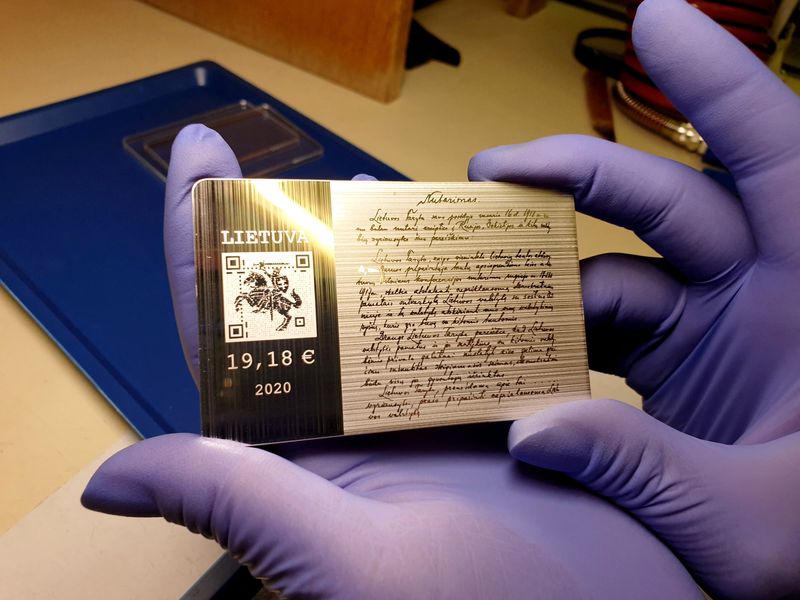

© Reuters. FILE PHOTO: A worker at the Lithuanian mint holds a silver coin, produced to be exchanged for sets of digital currency released by Lithuanian central bank in Vilnius, Lithuania June 1, 2020. REUTERS/Andrius Sytas/File Photo

By Marc Jones

LONDON (Reuters) – The most comprehensive survey of the global investment industry on central bank digital currencies to date has shown both limited support and a lack of understanding of how a digital dollar, euro, yen or pound would work.

The survey carried out by the CFA Institute, a worldwide association for bankers, investors and finance chiefs, found that only 42% of the more than 4,150 respondents who took part believed that central bank digital currencies, or CBDCs, should be launched.

A number of countries including the Bahamas and Nigeria have already launched CBDCs, and around 130 more representing 98% of the global economy are exploring whether to do the same.

“Even for a sophisticated and financially literate cohort like our members there is very little understanding of what CBDCs are,” the CFA Institute’s Olivier Fines told Reuters.

There was also “a general feeling of scepticism” about their possible benefits, especially in developed economies where people can already pay for things instantly online or using mobile phones, he said.

Only 37% of respondents from developed markets said they favoured a CBDC versus 61% from emerging markets.

Just 31% of those in the United States supported the creation of a digital dollar, followed by 38% in Canada, 45% in the European Union and 46% in the United Kingdom.

In China, in contrast, where the People’s Bank of China is currently running the world’s biggest CBDC pilot project, the support rate was 70% while in India, which hopes to launch an e-rupee next year, it was 66%.

“There is a clear and very significant divide,” Fines said, putting it down to a likely “perception in developing economies that a CBDC could fill a gap that may not exist in the developed world”.

Central banks themselves, including the head of the Bank of England, Andrew Bailey, have raised questions about CBDCs, saying they may be “a solution looking for a problem”.

Among UK respondents who opposed launching a CBDC, the top reason cited by almost half was a belief that their introduction would not address a compelling need.

By far the biggest outright concern about CBDCs globally was the risk of cyberhacking, at 69%. Data privacy was also a major concern for 64% of respondents in developed markets and 57% in developing economies.

Age is also correlated with the level of support for or opposition to CBDCs. Less than a quarter of respondents under 30 opposed them, the survey found, compared with 37% among those over 55.

“Clearly the younger you are the more receptive you are to a CBDC, like with crypto assets more generally,” Fines said. “The question is will this stabilise over time or as people get older will their mindset shift?”

Overall, though, the main questions were what benefits CBDCs will bring compared with existing payment systems. “I don’t think the argument has been settled on whether this is absolutely necessary,” Fines said.