JPMorgan’s Trading Desk Sees S&P Rallying Up to 10% on Soft Inflation Data

2022.12.12 16:16

[ad_1]

(Bloomberg) — With equity investors defensively positioned, a soft reading in Tuesday’s consumer price index could spark a powerful rally — with the jumping as much as 10%. That’s the bold forecast from JPMorgan Chase & Co (NYSE:).’s sales and trading desk.

In a scenario analysis that maps out the game plan for clients, the team including Andrew Tyler suggests that an annualized inflation print of 6.9% or lower has the potential to lift the equity benchmark between 8% and 10%. Such a move would extend the index’s surge from its October low well past 20%, marking a technical end of the 12-month bear market.

While the chances of that happening are rather slim — an event that the JPMorgan teams assigns a 5% probability, the analysis reflects a prevailing view that November’s CPI plays a key role in determining the near-term fate of the market. The data, expected to come in at 7.3% by economists, arrives just one day before the Federal Reserve’s final policy meeting of the year.

A cooler reading from the prior month triggered a 5.5% daily surge in the S&P 500.

“The logic here is that not only is inflation dissipating, but its pace is accelerating,” Tyler wrote in the note. “This would give increasing confidence in projections of headline inflation falling ~3% in 2023. Further, if inflation is at 3%, irrespective of the labor market conditions, it seems unlikely that the Fed would hold the terminal rate at 5%. Any Fed pivot will rip equities.”

The most likely scenario, the team says, is a CPI print between 7.2% to 7.4% where the S&P 500 climbs by 2% to 3%.

On the flip side, any near or above the prior reading of 7.7% may spell trouble. The equity index is likely to sink as much as 5% should inflation exceed 7.8%, JPMorgan’s analysis shows.

“The CPI print has the potential to dictate market direction and magnitude until earnings kick off in mid-January,” Tyler said. “Equity positioning is less light but remains historically low; investors seem to have a view that this report comes inline or slightly dovish.”

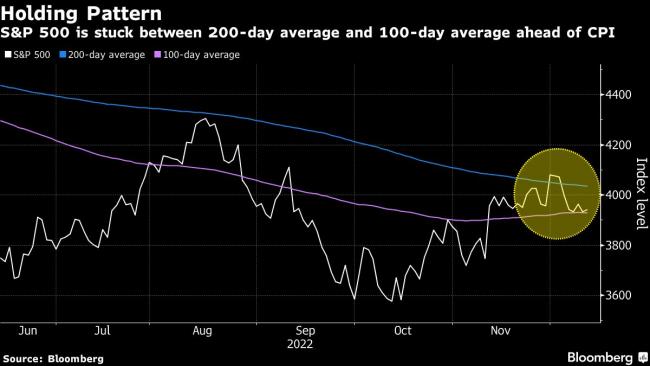

With the stock market stuck in a range trading of late, this busy week of market events is billed as the one where the S&P 500 can make or break its recent chart pattern. While the index this month failed to hold above its average price over the past 200 days, a widely watched trend line, it has managed to stay above another key threshold, the 100-day average.

To Goldman Sachs Group Inc (NYSE:).’s Tony Pasquariello, anyone betting on a big share bounce should be aware that the extreme bearish stance that existed during the fall has lessened. Take index futures, where net positions among non-dealers reached a record short of $120 billion in September. That has shrunk after a meaningful unwinding last month, the firm’s data show.

“I don’t register this to make a bearish claim — again, the current measure is flat — it’s more to say this magnitude of demand is very unlikely to sustain itself come Q1,” Pasquariello wrote in a note over the weekend.

©2022 Bloomberg L.P.

[ad_2]

Source link