JPMorgan, Wells Fargo Earnings: Markets Begin to Assess Rate-Cut Impact Tomorrow

2024.10.10 06:14

- Earnings season is underway, with JPMorgan and Wells Fargo due for release on Friday.

- Investors are eager to learn more about the outlook after the Fed’s rate-cutting cycle kicked off last month.

- Big banks face a key question: how will falling interest rates impact future margins?

- Are you looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

As the Q3 earnings season kicks off this week, all eyes turn to the big US banks, with JPMorgan (NYSE:) and Wells Fargo (NYSE:) set to release their financial results tomorrow.

This year, however, the stakes feel higher than ever. Just weeks after the Federal Reserve began its rate-cutting cycle, investors are eager to see how these changes will impact financial institutions and their bottom lines.

The upcoming earnings reports will not only provide insight into the banks’ performances but also answer critical questions about future margins.

As borrowing costs decline, many investors are concerned about how this will affect profitability, particularly given that interest income was a significant revenue driver during the Fed’s rate hikes in 2022 and 2023.

What to Keep an Eye on

When examining the results, keep a close watch on net interest income—the key metric that reflects the difference between what banks earn on their loans and what they pay for deposits.

This indicator is crucial, as it will signal the banks’ expectations regarding the rate cuts and their future profitability.

Although the full impact of these cuts won’t be evident in the Q3 results, the forecasts provided by these banks will give investors valuable insight into the effects of falling rates in the quarters ahead.

JP Morgan, Wells Fargo Analyst Forecasts

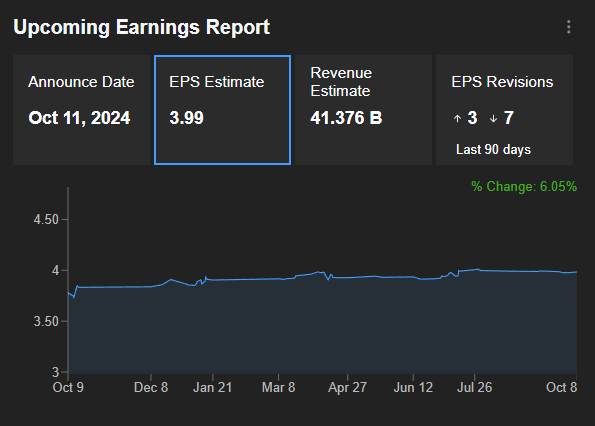

For JP Morgan, the analyst consensus is for EPS of $3.99, down 7.8% on the same quarter last year. Revenues are expected to come in at $41.38 billion, up 3.7% year-on-year.

Source : InvestingPro

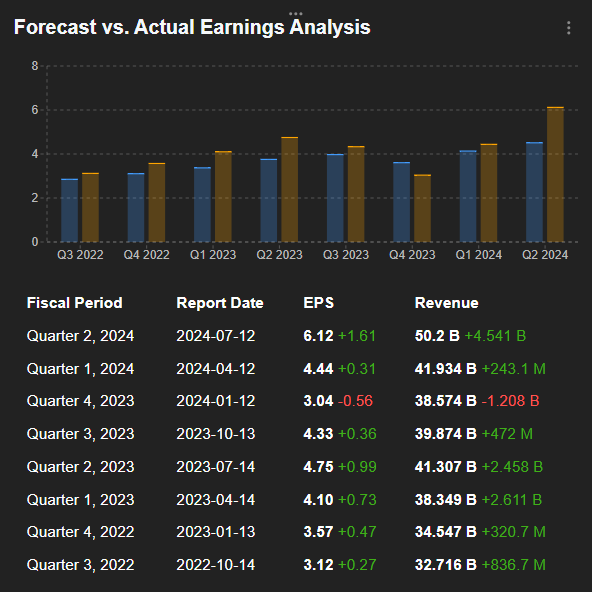

It’s also worth pointing out that JP Morgan has a habit of exceeding analysts’ estimates, both in terms of EPS and revenues. This scenario has occurred in 7 of the last 8 quarterly publications.

Source: InvestingPro

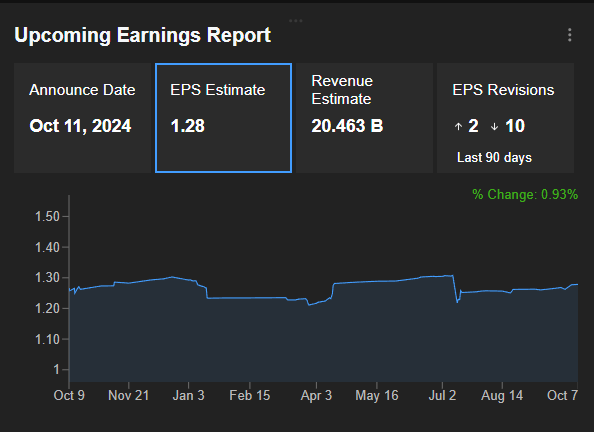

In the case of Wells Fargo, analysts are forecasting an average EPS of $1.28, or 13.5% less than in Q3 2023. Sales are expected to come in at $20.46 billion, down 1.9% on the same quarter last year.

Source : InvestingPro

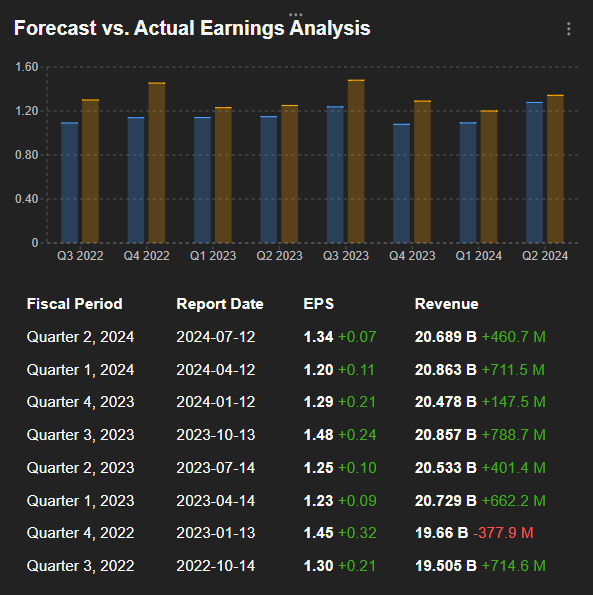

As in the case of JPM, Wells Fargo has accustomed investors to exceeding expectations, whether in terms of EPS or revenues:

Source : InvestingPro

So it’s not out of the question that Wells Fargo will deliver another pleasant surprise on Friday.

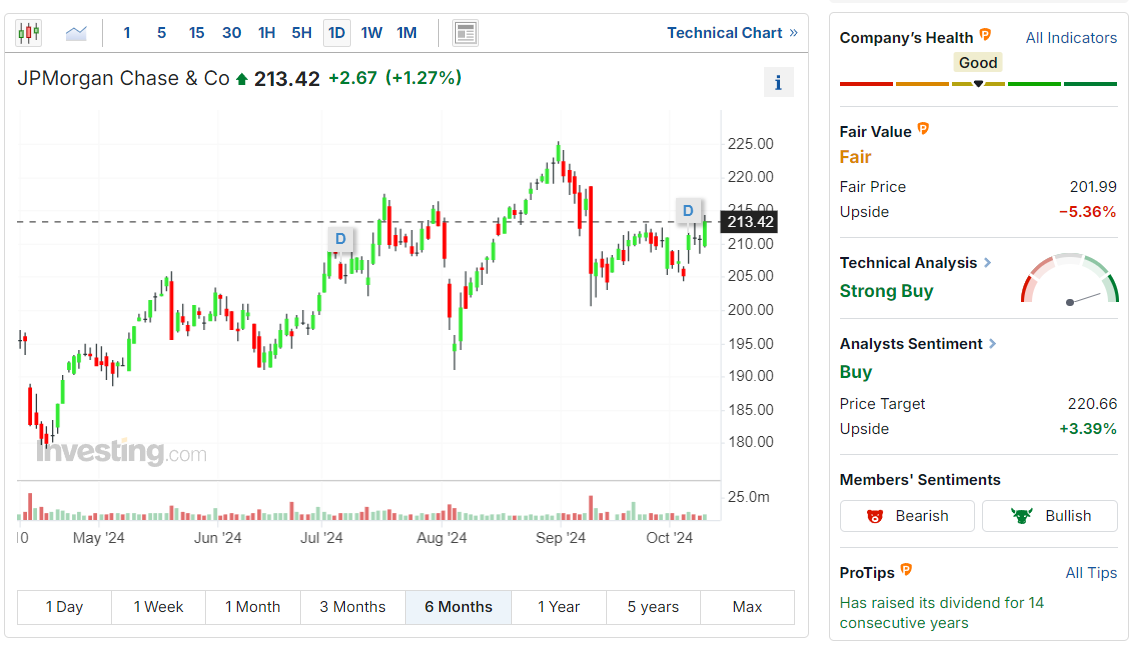

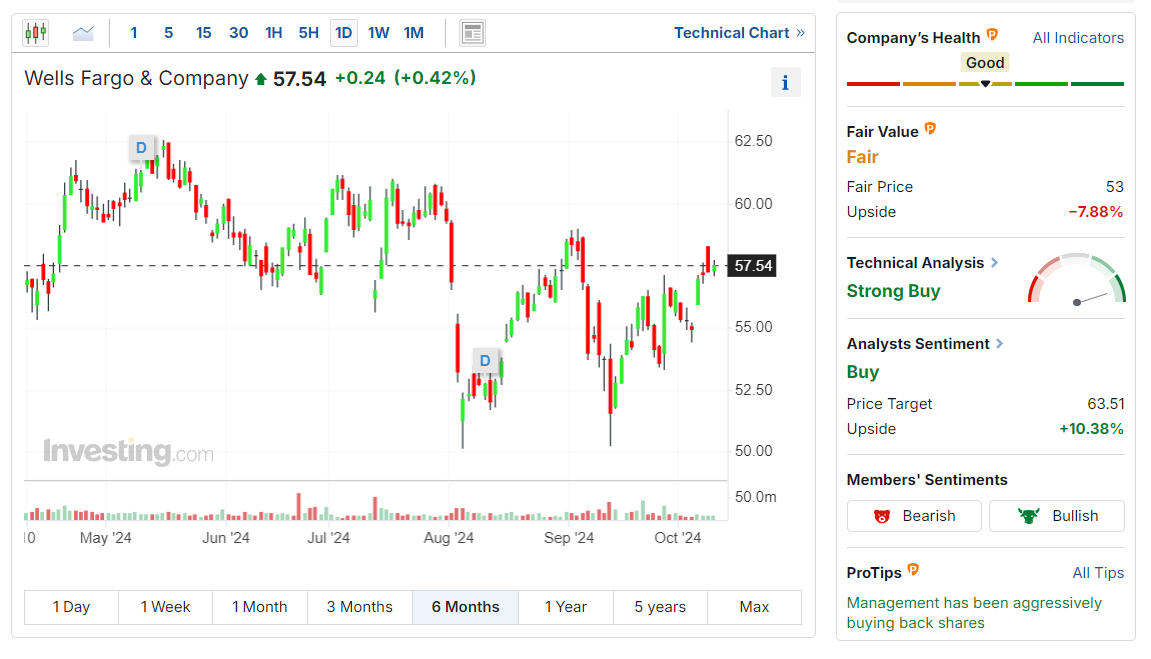

JPM, WFC: A Technical View

To properly approach the quarterly publications of JPMorgan (NYSE:) and Wells Fargo, it is also advisable to find out about analysts’ forecasts, valuation, and chart context.

In the case of JPM, the share plunged at the beginning of September, reaching a low of $200.61 on the 10th, before starting to rebound, closing at $213.42 on Thursday, after a 1.27% rise over the session.

It should also be noted that the InvestingPro Fair Value, which synthesizes several recognized financial models, stands at $201.99, more than 5% below the current price.

Analysts are slightly more optimistic, with an average target of $220.66, or 3.39% above Wednesday’s closing price.

Wells Fargo shares also took a tumble in early September, falling just short of the $50 mark on the 12th, before closing at $57.54 on Wednesday. Overall, however, the stock has been on a downward trend since mid-May.

Moreover, InvestingPro’s Fair Value is below the current price at $53, implying a downside risk of 7.88%.

The analysts’ target, on the other hand, is significantly more ambitious, at 63.51 euros, i.e. over 10% above the current share price.

Conclusion

JP Morgan’s and Wells Fargo’s valuations currently appear high according to valuation models, expressed through Fair Value. In addition, analysts, although more optimistic, see limited potential for the shares.

On the other hand, low EPS expectations and the historical propensity of JPM and WFC to exceed market expectations do not rule out a pleasant surprise.

In any case, the results of JP Morgan and Wells Fargo will offer valuable insights into the general state of health of the banking sector and the economy, which could have an influence far beyond the price of the shares concerned.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.