JPMorgan was urged to cut ties to Jeffrey Epstein, lawsuit claims

2023.04.12 20:43

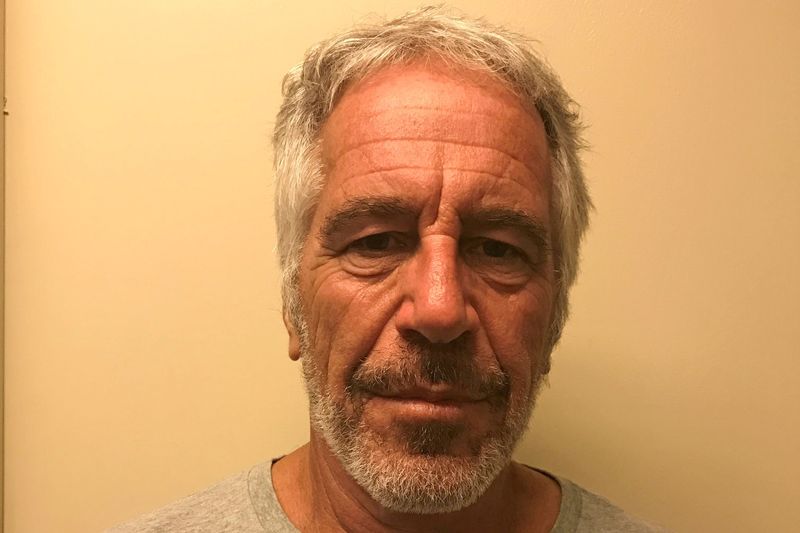

© Reuters. FILE PHOTO: U.S. financier Jeffrey Epstein appears in a photograph taken for the New York State Division of Criminal Justice Services’ sex offender registry March 28, 2017 and obtained by Reuters July 10, 2019. New York State Division of Criminal Justice

By Jonathan Stempel

NEW YORK (Reuters) – A new version of a lawsuit accusing JPMorgan Chase & Co (NYSE:) of aiding in Jeffrey Epstein’s sex trafficking includes claims that the bank ignored pleas to cut ties with the financier, and that someone joked about whether Epstein knew Miley Cyrus.

In a complaint made public on Wednesday, the U.S. Virgin Islands said JPMorgan compliance officials urged the bank to sever ties with Epstein years before it did so in 2013.

The complaint details internal warnings that the financier “should go,” that there was “Lots of smoke. Lots of questions,” and that anti-money laundering officials asked that the bank “exit this relationship.”

It also elaborates on the previously-disclosed accusation that Epstein’s behavior was so widely known at JPMorgan that senior executives joked about his interest in young girls.

One example was where Mary Erdoes, now head of asset and wealth management, in 2008 “received an email asking her whether Epstein was at an event ‘with miley cyrus,'” the singer and actress then starring in Disney Channel’s “Hannah Montana.”

JPMorgan declined to comment on the complaint, which includes fewer redactions than a version released on April 3.

The U.S. Virgin Islands is seeking unspecified damages from the largest U.S. bank for Epstein’s alleged abuse of young girls and women on Little St. James, a private island he owned.

Other accusations included that by 2006, JPMorgan knew Epstein “routinely” made $40,000 to $80,000 cash withdrawals several times a month, and was aware of accusations Epstein paid cash to have underage girls and young women brought to his home.

The complaint also said Erdoes, former private banking chief Jes Staley, former general counsel Stephen Cutler and former Americas head of investment management Catherine Keating met in 2008, 2011 and 2013 amid concern about the risks Epstein posed.

Erdoes testified in a recent deposition that JPMorgan terminated Epstein as a customer in 2013 after she learned that his withdrawals were “actual cash,” the complaint said.

JPMorgan is also being sued by women who claim that Epstein sexually abused them.

Last month, the bank sued Staley, claiming he concealed what he knew about Epstein.

The New York-based bank wants him to cover its losses in both lawsuits, and forfeit eight years of compensation.

Staley has expressed regret for his friendly relationship with Epstein, and denied knowing about his alleged crimes.

He left JPMorgan in 2013, and later spent six years as Barclays (LON:) Plc’s chief executive before resigning in November 2021.

Erdoes, Cutler and Keating have not been accused of wrongdoing.

Epstein killed himself at age 66 in a Manhattan jail cell in August 2019 while awaiting trial on sex trafficking charges.

The cases in the U.S. District Court, Southern District of New York are: Jane Doe 1 v JPMorgan Chase & Co, No. 22-10019; Government of the U.S. Virgin Islands v JPMorgan Chase Bank NA, No. 22-10904; and JPMorgan Chase Bank NA v Staley, in Nos. 22-10019 and 22-10904.