Japanese Yen Steady As Inflation Hits 31-Year High

2022.10.21 05:29

[ad_1]

Inflation in Japan continues to rise. rose to 3.0% YoY in September, its highest level since August 1991. This was up from 2.8% in August and marks the sixth consecutive month that the indicator has exceeded the Bank of Japan’s target of 2 percent. The 3.0% figure matched the consensus, and the response of the has been muted.

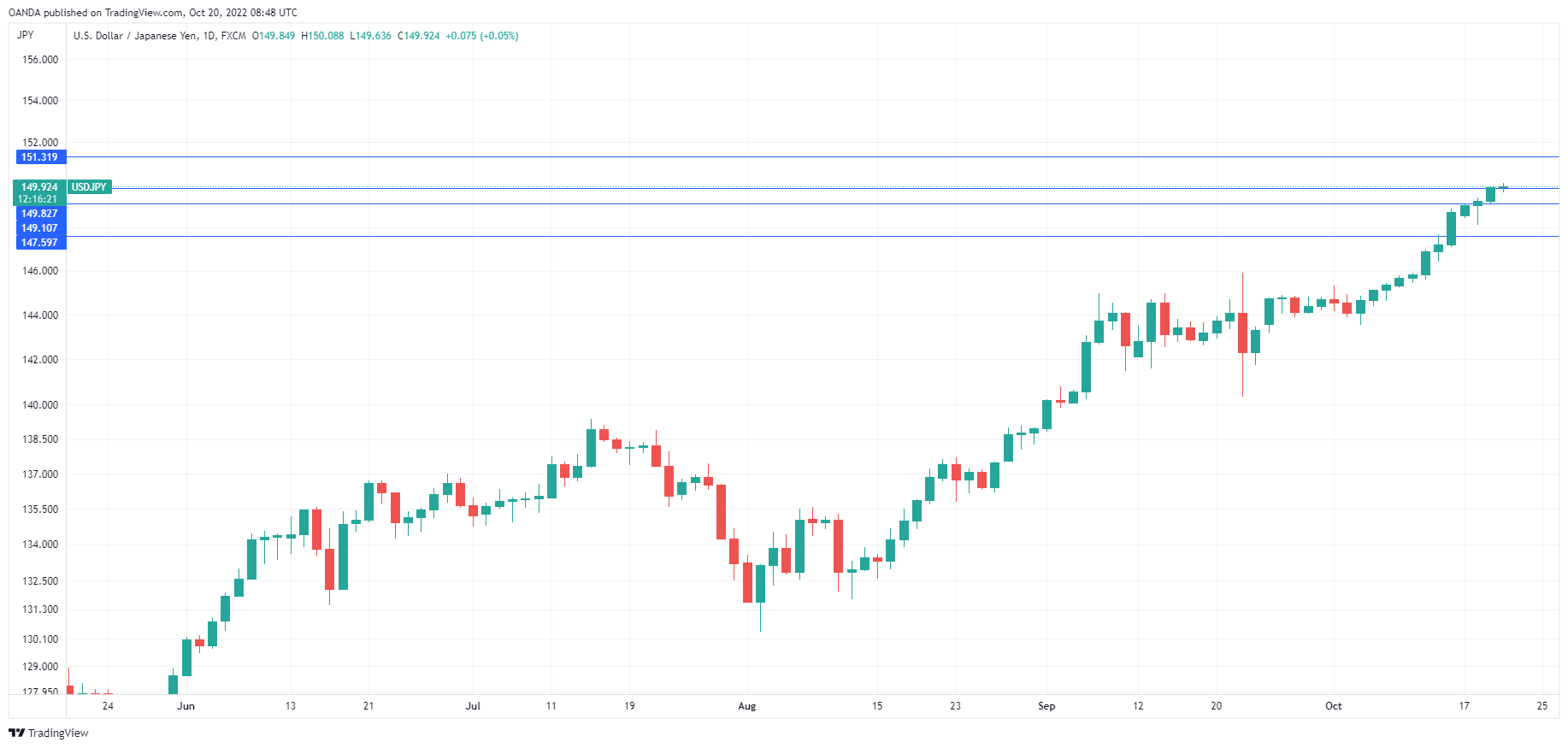

The yen breached the symbolic 150 level on Thursday for the first time since August 1990 and barring another intervention from the Ministry of Finance (MOF), the downturn will likely continue. Finance Minister Shunichi said on Thursday that “excessive volatility in the currency markets must not be tolerated,” and the government “remains committed to taking firm action against these moves.”

This has all been heard before, and these warnings are increasingly falling on deaf ears. The MOF did back up its rhetoric with action last month and intervened when the yen breached 145. However, the bold move did little to slow down the currency’s slide, and here we are at the 150 level.

The Bank of Japan isn’t showing much interest in the yen’s fall, as it is committed to an ultra-loose policy to stimulate the weak economy. Governor Kuroda said on Wednesday that the yen’s rapid fall was “undesirable,” only to step in with an emergency bond-buying package the next day to cap yields on Japanese government bonds.

Such moves make it hard to take Kuroda’s remarks about the yen seriously. Kuroda has insisted that the Bank will not alter its monetary policy until it is convinced that inflation is not transitory. As we saw with other major central banks, that could take a long time.

USD/JPY Technical

- USD/JPY is testing monthly resistance at 150.27. Next, there is resistance at 1.5132

- There is support at 149.27 and 147.58

Original Post

[ad_2]

Source link