Japanese Yen Shrugs As BoJ Core CPI Ticks Lower

2023.07.25 08:01

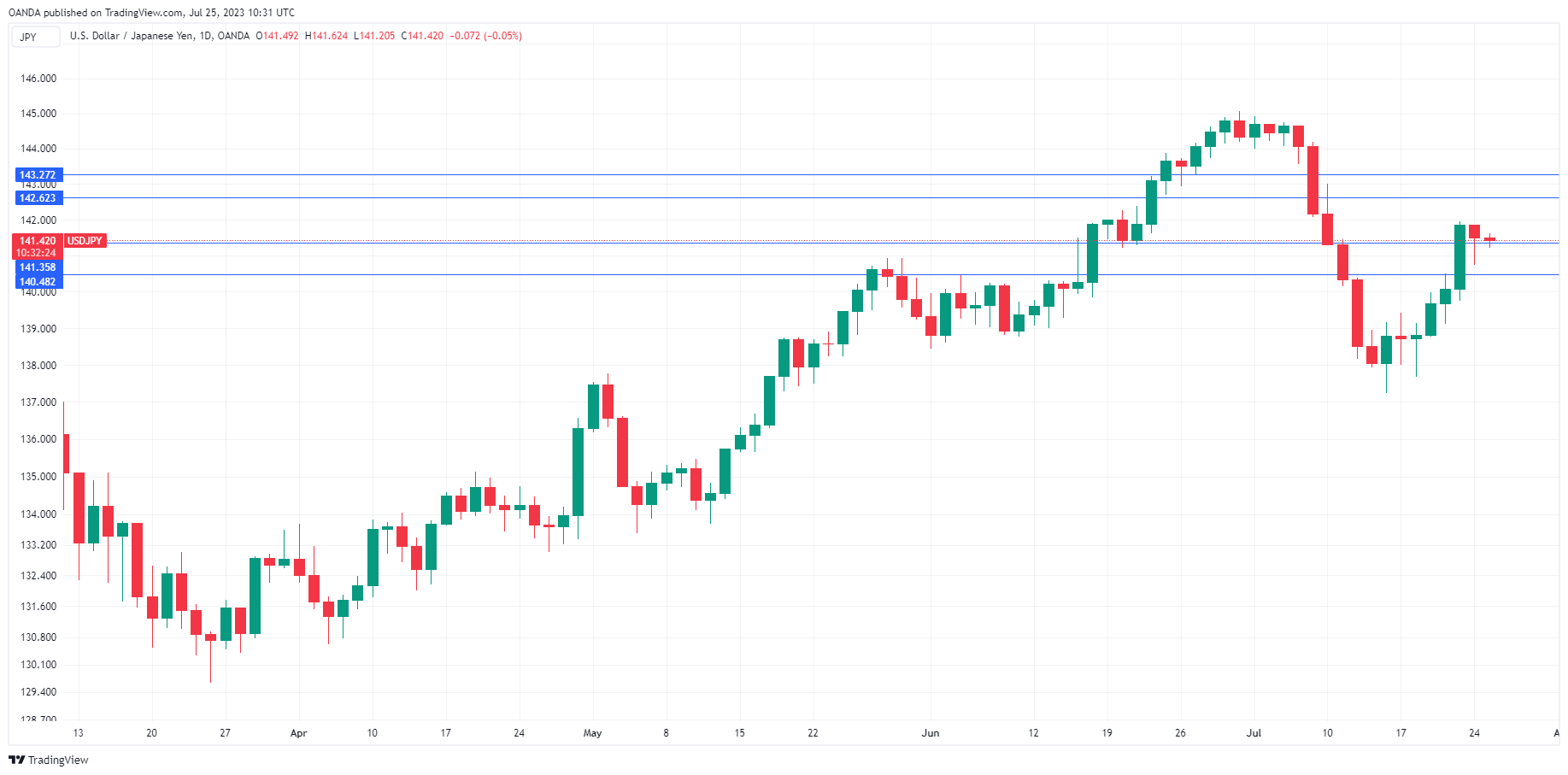

The Japanese yen has taken traders on a roller-coaster ride for much of July, but the yen has been calm so far this week. In Tuesday’s European session, is trading at 141.36, down 0.08% on the day.

BoJ’s inflation gauge dips to 3.0%

The Bank of Japan’s preferred inflation indicator, BoJ Core CPI, ticked lower to 3.0% in June, down from 3.1% in May and matched the consensus estimate. The Japanese yen’s reaction was muted, but traders continue to keep a very close eye on inflation reports ahead of Friday’s BoJ meeting.

Inflation has become a hot topic in Japan, even though inflation is running around 3%, which is quite low compared to most other major economies. It wasn’t that long ago that Japan was grappling with deflation and inflation reports had little impact on monetary policy. The war in Ukraine has changed all that and inflation continues to hover above the 2% target, which is putting pressure on the BoJ to tighten policy. In June, headline inflation rise to 3.3%, compared to 3% in the US. This was the first time since 2015 that inflation was higher in Japan than in the US.

The Bank of Japan is expected to maintain policy settings at Friday’s meetings, but the BoJ has caught the markets by surprise in the past, and a Reuters report on Friday stated that the decision on whether to shift policy or not could be a close call. If the BoJ were to make a move, it would likely be a tweak to its yield curve control (YCC) policy. The central bank widened the target band on government bonds from 0.25% to 0.50% late last year, and the yen climbed sharply in response. If the BoJ were to widen the band to 0.75%, we would likely see the yen, which has been struggling, rise sharply.

The US releases consumer confidence and manufacturing data later on Tuesday, with both expected to improve. The Conference Board Consumer Confidence index, which rose sharply in June to 109.7, is expected to rise to 111.8 in July. The Richmond Fed Manufacturing index, which has been mired in negative territory, is expected to improve in July to -2, up from -7 in June.

USD/JPY Technical

- USD/JPY is testing support at 141.35. Below, there is support at 1.4049

- There is resistance at 142.62 and 143.27

Original Post