Japanese Yen Shrugs After PMI Releases

2023.10.24 05:06

- Japanese PMI points to softness in manufacturing and services

- Speculation arises that BoJ could tweak the yield control policy

The edged higher on Tuesday. In the European session, USD/JPY is trading at 149.44, down 0.18%.

Japan Posts Soft PMIs

Japanese Flash PMIs for October failed to impress, but the impact on the Japanese yen was muted. Manufacturing activity declined for a fifth consecutive month, remaining unchanged at 48.5, shy of the market consensus of 49.0. The neutral 50 level separates contraction from expansion. Manufacturing output fell to an eight-month low and employment contracted for the first time since February 2021, pointing to acute weakness in the manufacturing sector.

The Services PMI eased to 51.1 in October, down from 53.8 a month earlier, indicative of marginal expansion. The reading was lower than the market consensus of 52.9. The drop in business activity in services is of significant concern, as the services sector has been the main driver of Japan’s economy.

With global interest rates on the march higher, the Bank of Japan is under increasing pressure to tweak its yield curve control (YCC). The BoJ raised its YCC to a 1% cap just three months ago, but yields on 10-year Japanese government bonds have risen to 0.85%, which may require another hike to the yield cap in the short term.

The BoJ hasn’t signaled any plans to change its YCC, but there is speculation that it could raise the cap as early as next week or at its policy meeting on October 30-31. The yen continues to hover slightly below the 150 line, and a breach of this symbolic level will heighten expectations of a tweak in policy before the end of October.

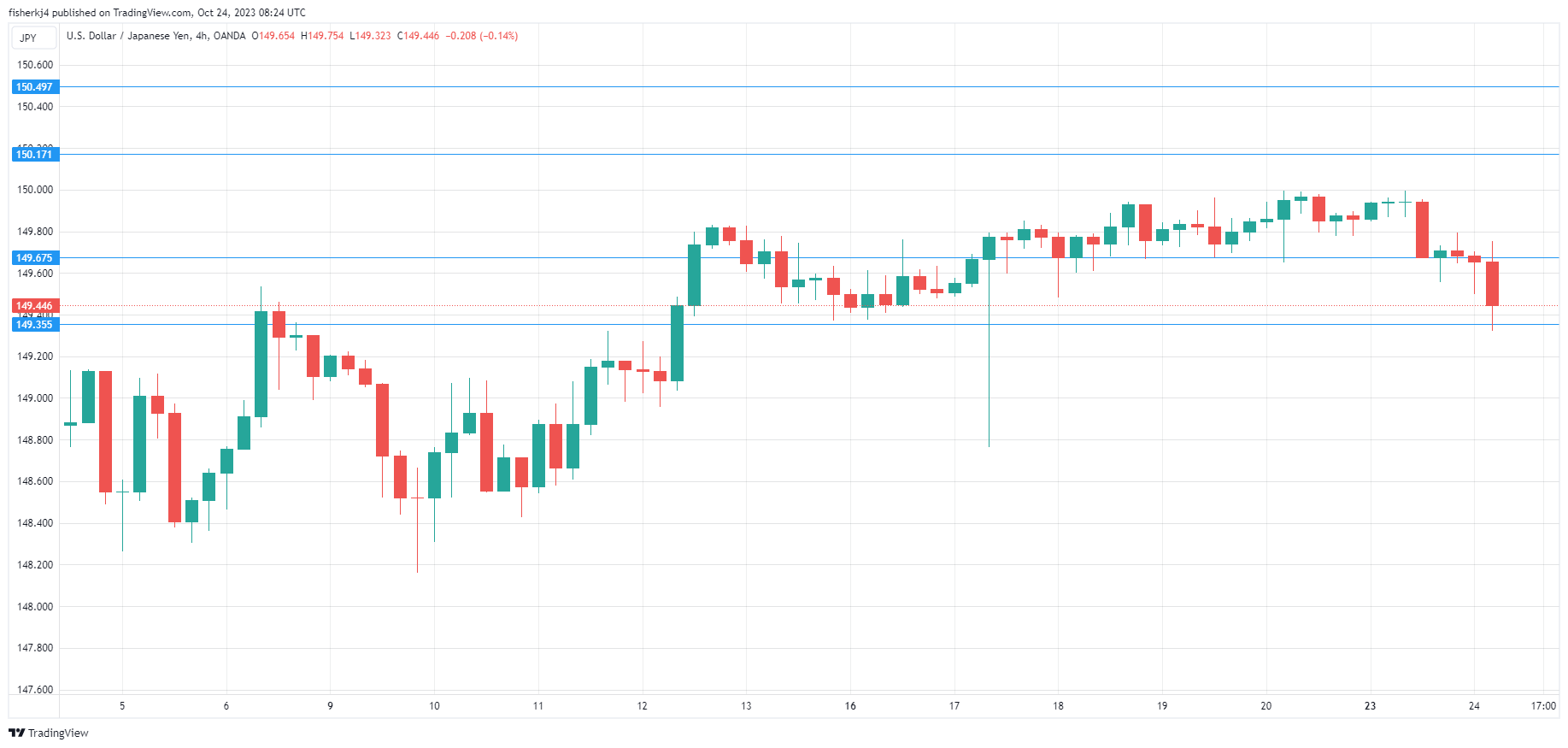

USD/JPY Technical

- USD/JPY is testing support at 149.67. Next, there is support at 149.35

- There is resistance at 150.49 and 150.99

Original Post