Japanese Yen Flirts With 145, Core CPI Ticks Upwards

2023.06.30 05:29

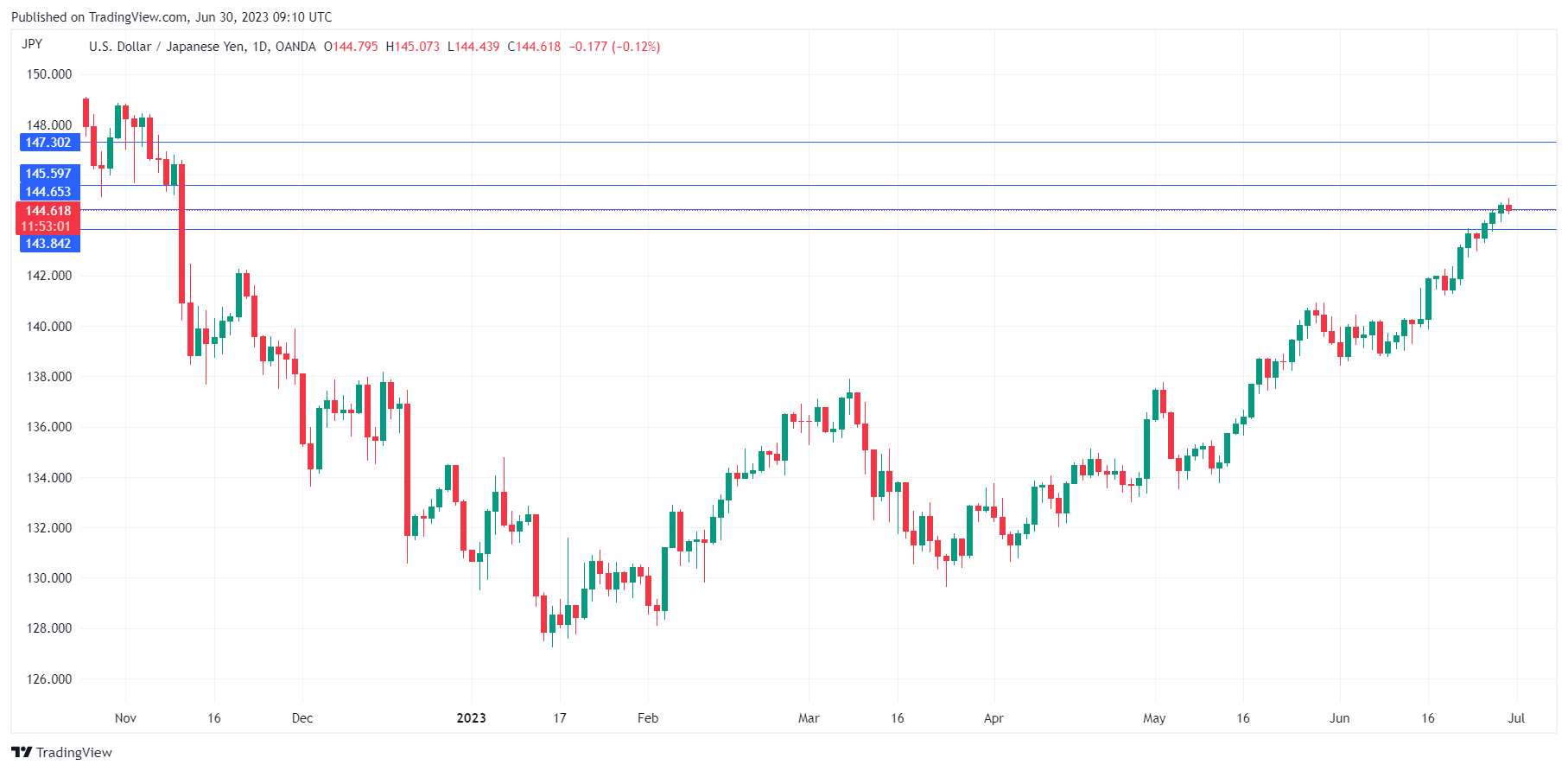

- Japanese yen briefly falls below 145 line

- Tokyo Core CPI rises to 3.2%

- US GDP revised higher, unemployment claims slide

is showing limited movement, trading at 144.62 in the European session. The yen briefly fell below the symbolic 145 line earlier today.

Tokyo Core CPI inches higher

, a key inflation gauge, moved slightly higher in June. The index came in at 3.2% y/y, up from 3.1% in May but below the consensus of 3.3%. This marks the 13th straight month that Tokyo Core CPI has remained above the Bank of Japan’s 2% target.

The Tokyo inflation release, considered a leading indicator of inflation trends nationwide, points to inflation remaining high across the economy and puts into question the central bank’s stance that high inflation levels are temporary. BoJ Governor Ueda has stated often that he will maintain the Bank’s ultra-loose policy until stronger wage growth keeps inflation sustainably around the 2% target. I’m not sure how Ueda defines “sustainable”, but it’s clear that the BoJ has no intention of tightening rates anytime soon.

The BoJ’s ultra-loose policy has sent the yen on another sharp decline – USD/JPY is up a massive 9% since April 1st. The yen breached 145 on Friday, and Finance Minister Suzuki responded with a warning that Tokyo “would respond appropriately if the moves become excessive.” The Finance Ministry intervened in the currency markets late last year when the yen fell below 150, and intervention will become more likely if the yen continues to lose ground.

US GPD revised upwards, jobless claims sink

The US economy remains in solid shape. Final for the first quarter rose 2.0%, a major revision from the 1.3% gain in the second estimate. Still, the Fed’s aggressive tightening is dampening economic activity. GDP growth in the third and fourth quarters of 2022 was 3.2% and 2.6%, respectively, and has declined to 2.0% in Q1. The US labor market continues to thrive despite the Fed’s rate hikes. Initial jobless claims plunged to 235,000, down from 239,000 prior and below the consensus of 264,000.

The GDP revision and the strong unemployment claims report have caused the markets to reprice upwards the probability of a rate hike in July. The CME FedWatch tool has priced in a 25-bp hike at 89%, up from 72% just one week ago.

USD/JPY Technical

- There is resistance at 144.65 and 145.36

- 143.94 and 142.94 are providing support

Original Post