Japan warns against speculative yen moves, markets wary of further intervention

2022.09.26 00:43

[ad_1]

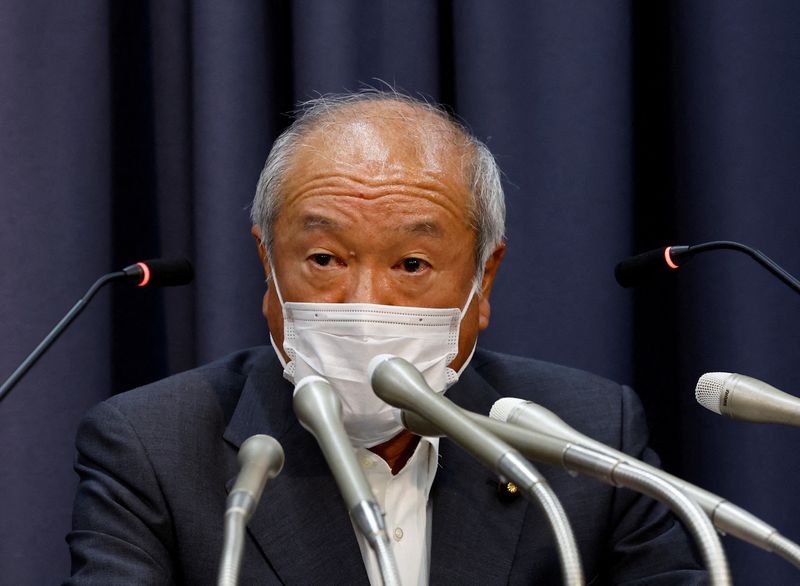

Japanese Finance Minister Shunichi Suzuki said authorities stood ready to respond to speculative currency moves, a fresh warning that comes days after Tokyo intervened in the foreign exchange market to stem yen falls for the first time in over two decades.

Japanese Finance Minister Shunichi Suzuki said authorities stood ready to respond to speculative currency moves, a fresh warning that comes days after Tokyo intervened in the foreign exchange market to stem yen falls for the first time in over two decades.

Suzuki also told a news conference on Monday the government and the Bank of Japan (BOJ) were on the same page in sharing concerns about the currency’s sharp declines.

“We are deeply concerned about recent rapid and one-sided market moves driven in part by speculative” trading,” Suzuki told a news conference. “There’s no change to our stance of being ready to respond as needed” to such moves, he added.

The remark came after the government’s decision on Thursday to intervene in the currency market to stem yen weakness by selling dollars and buying yen for the first time since 1998.

The yen’s recent sharp declines, which have pushed up households’ living costs by boosting imported fuel and food prices, have been driven in part by widening divergence between the U.S. Federal Reserve’s aggressive monetary tightening and the BOJ’s ultra-loose monetary policy.

BOJ Governor Haruhiko Kuroda will deliver a speech to business leaders in Osaka, western Japan, later on Monday where he may comment on the yen and the government’s intervention.

The dollar added 0.29% to 143.78 yen on Monday, continuing its climb back toward Thursday’s 24-year peak of 145.90. It tumbled to 140.31 that same day after Japanese authorities stepped into the market.

While government officials’ jawboning may keep markets nervous of the prospects of further intervention, stepping in repeatedly in the currency market and selling huge sums of dollars could be difficult due to the criticism Japan may face from its G7 counterparts.

“It’s unlikely Japan will continue intervening to defend a certain line, such as 145 yen to the dollar,” former top Japanese currency diplomat Naoyuki Shinohara told Reuters.

The yen is not alone in its downward spiral. Several other currencies, including the British pound, the euro and the , have taken a hammering partly driven by the U.S. Federal Reserve’s aggressive interest rate increases in recent months.

[ad_2]

Source link