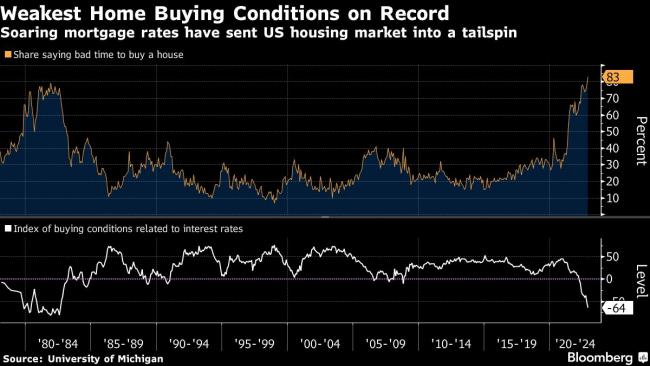

It’s the Worst Time to Buy a Home in a Generation, US Survey Shows

2022.11.11 13:40

[ad_1]

(Bloomberg) — US consumers are seeing home buying conditions at their worst in a generation as mortgage rates soar in response to the Federal Reserve’s aggressive tightening cycle.

About four in five consumers now describe buying conditions for homes as bad, a record in data going back to 1978, according to the University of Michigan’s consumer sentiment survey for November. The number of people who attribute the erosion in conditions to higher interest rates is at the highest level in 40 years, figures showed Friday.

The housing market, which is especially susceptible to higher borrowing costs, has been crumbling since the Fed began raising interest rates in an effort to curb demand across the economy and tame rampant inflation. Mortgage rates have been hovering around the highest levels in two decades, and as of last week were above 7%.

A separate gauge from the university showed home-buying conditions related to housing prices slipped in November. While somewhat improved since earlier this year, it remains deep in negative territory and well below the peak in mid-2020.

Higher rates aren’t just weighing on the housing market. Buying conditions for household durable goods slumped this month after surging in October, and the share of consumers who said purchase conditions for motor vehicles were bad because of rising borrowing costs climbed to the highest since 1982.

The University of Michigan’s main consumer sentiment gauge retreated to a four-month low in early November while inflation expectations rose.

©2022 Bloomberg L.P.

[ad_2]

Source link