It’s a Banking Crisis: Avoid These Dividend ETFs

2023.05.10 08:16

The Wall Street Journal Reports:

Retirees Turn to Dividend ETFs for Income

Financial advisers say investors shouldn’t just go for the fund with the highest dividend yield

Gee, thanks. I have something to add, WSJ friends.

IT’S A BANKING CRISIS. DON’T BUY DIVIDEND ETFs AT ALL!

In a rising market, fine. I can hold my nose. Though, you know, even a popular ticker like Schwab US Dividend Equity ETF (SCHD) is a lazy option that’ll cost you.

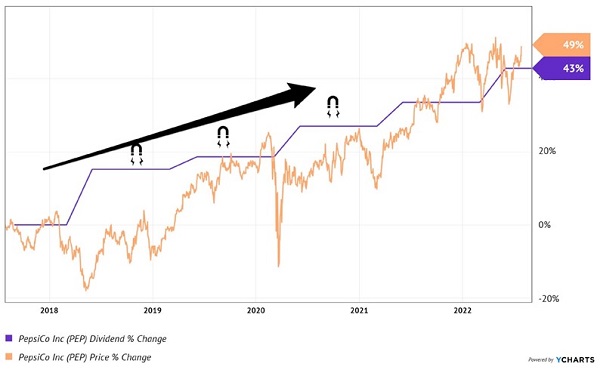

SCHD owns 104 dividend stocks and PepsiCo (NASDAQ:) is its top holding. PEP pays a piddly 2.6% but its yearly dividend growth is decent—not great but , either. PEP’s small raises are the stock’s sugary “” that drives its price higher:

Decent Dividend Growth from Sugar Water

PEP-Price-Dividend

The 104-stock blend gives SCHD investors a 3.3% dividend. Again, not bad.

But SCHD also features the likes of US Bancorp (NYSE:), M&T Bank (MTB) and Fifth Third Bancorp (NASDAQ:). Oh boy.

Fundamentally, these banks are fine. But let’s be honest, each is a bank run away from going to zero.

Reason is, most banking business models are flawed (some fatally so) because they are not paying competitive rates. Banks haven’t paid depositers fairly since the Federal Reserve started hiking.

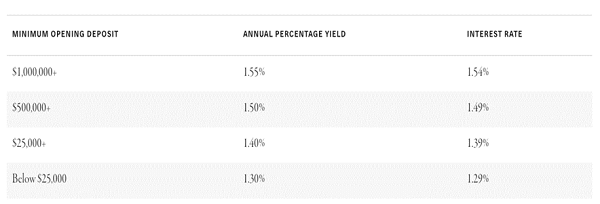

Check out this pre-decapitation screenshot from First Republic Bank’s website. Taken by your income strategist just prior to its fire sale to JPMorgan Chase (NYSE:):

FRC-Interest-Rates

(Brett turns on sarcasm machine.) Wow, what a deal. We can open a savings account with a bank that is about to fail and receive a 1.29% interest rate.

One point two nine percent. In a five percent world!

The rates for big opening deposits of $500,000 or even a million dollars aren’t that much higher. Only up to 1.54%—yikes. And the risk! Why would we put more than the $250,000 limit that the FDIC insures into any bank account these days?

As full-time financial analyst and part-time funnyman Jim Bianco points out in his frequent interviews, we all have phones. We all have mobile banking apps. It’s a few taps for an FRC customer to move savings making 1.29% over to a money market fund paying 5%.

Hence the big problem in the business model of most banks today. They only make money because they underpay their customers.

Dividend history doesn’t mean much when harsh realities set in.

Thus the problem with ETFs. They are sausage factories. In bull markets, we can live with the mystery ingredients.

But when banks are dropping weekly, we must read the labels.

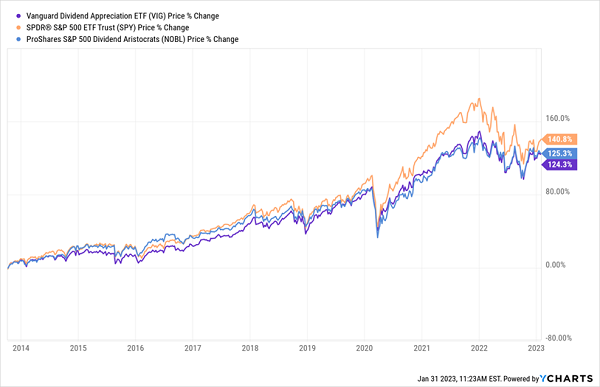

Let’s pick on two other popular dividend ETFs: the Vanguard Dividend Appreciation ETF (VIG) and the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

These two are dividend mainstays for many folks because, like SCHD, they focus on large cap US stocks that regularly grow their payouts. Names like Johnson & Johnson (JNJ), PepsiCo (PEP) and 3M (MMM) populate these two funds’ portfolios.

Sounds pretty safe, right?

NOBL goes one better. As the name says, it holds the Dividend Aristocrats, the S&P 500 companies that have grown their payouts for 25 years or more. Throw in low fees (just 0.06% for VIG and 0.35% for NOBL) and, well, what’s not to like?

Lots, actually.

For one, both of these funds should have a built-in advantage because . This is why in my Hidden Yields advisory we always target dividends that are not only growing but accelerating. These stocks’ “Dividend Magnets” pull their share prices higher over time!

Given the emphasis these ETFs put on rising payouts, beating the market should be a cinch for them, right?

Wrong. You can see that over the last decade VIG and NOBL lagged the S&P 500—shown in purple by the performance of the SPDR S&P 500 ETF Trust (SPY)—despite their rising payouts.

What’s the Point of a Dividend ETF Again?

Dividend-ETFs-Lag

It makes you wonder why you’d bother to research dividend ETFs—especially when you look at their current yields: these two pay around 1.9%, only a bit more than SPY’s 1.6%.

Worse, both funds (like all ETFs) are locked into an underlying index. NOBL must own all the Dividend Aristocrats, and VIG is nailed to the S&P US Dividend Growers Index, which aims to mimic the performance of US firms that have raised their payouts annually for at least 10 years.

In other words, shackled to indices as they are, neither fund can avoid . Last year it slashed its payout as part of its spinoff of its WarnerMedia business. Its membership in the Aristocrats was revoked soon after.

But the truth is, AT&T had been dragging down NOBL for years—and because the ETF couldn’t break with its underlying index, it was powerless to sell!

AT&T Was a Lead Weight on NOBL

T-Lags

This is a major reason why we stay away from dividend ETFs and stick to stocks with accelerating payouts instead. By managing our own portfolios, we can dodge the AT&Ts of the world and put our money into the winners instead.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”