Is The Worst Behind Us?

2022.06.22 09:46

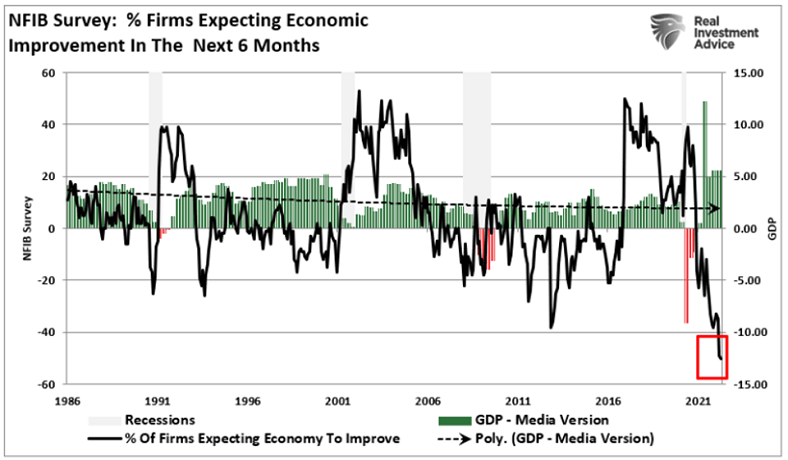

How scary is the “double whammy” of higher inflation and higher borrowing costs? Businesses have never been more pessimistic about the near-term future.

NFIB Survey Chart

NFIB Survey Chart

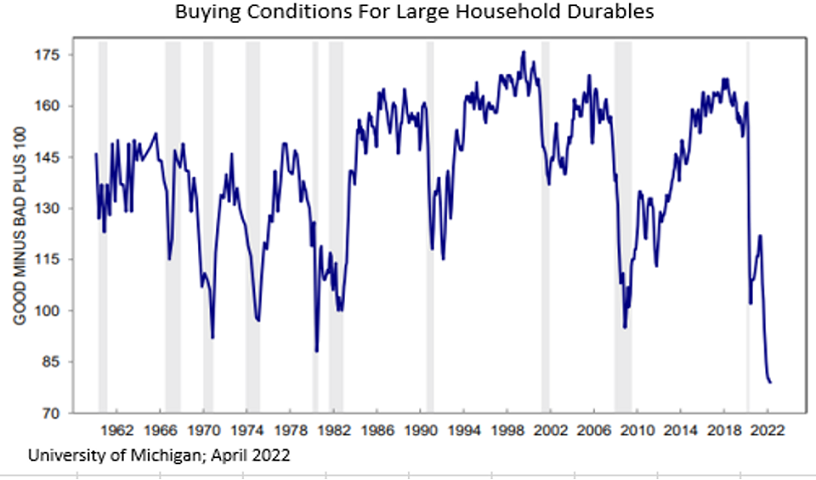

Companies may be taking their cues from consumers. In particular, people are unlikely to spend on things like appliances, tools, computers, televisions or cars/trucks.

Buying Conditions For Large Household Durables

Buying Conditions For Large Household Durables

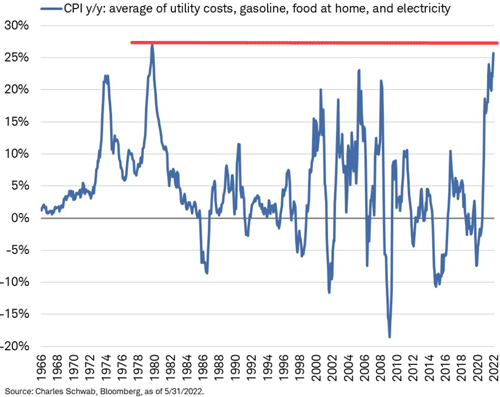

It is difficult to spend freely when so much of the household budget goes toward gasoline, food, electricity, and other utilities. Inflation for these “essentials” is as ugly as it was back in the late 1970s.

CPI Chart

CPI Chart

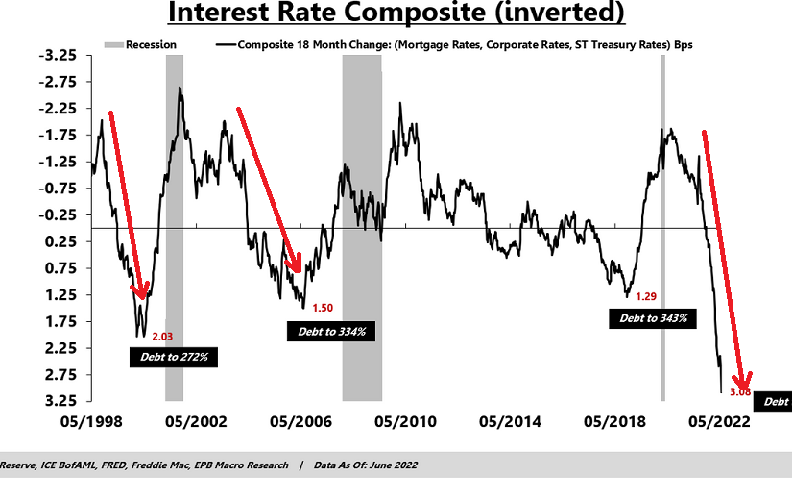

One way for a government to bring inflation back down? Its central bank can manipulate interest rates higher.

Unfortunately, quickly shifting from an easy borrowing environment to a restrictive one usually leads to recession.

Interest Rate Composite (Inverted)

Interest Rate Composite (Inverted)

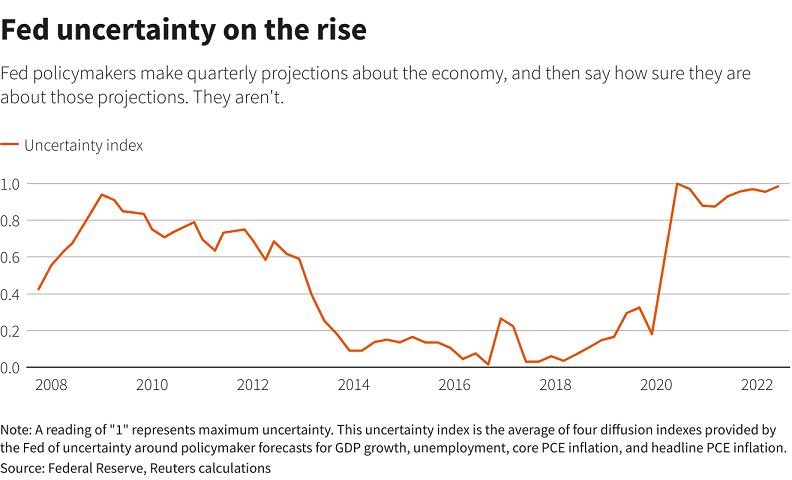

Worse yet, central bank policy markers at the Federal Reserve have rarely expressed so little confidence. Will their actions succeed in moderating inflation without causing employers to lay off millions of workers?

Uncertainity Index Chart

Uncertainity Index Chart

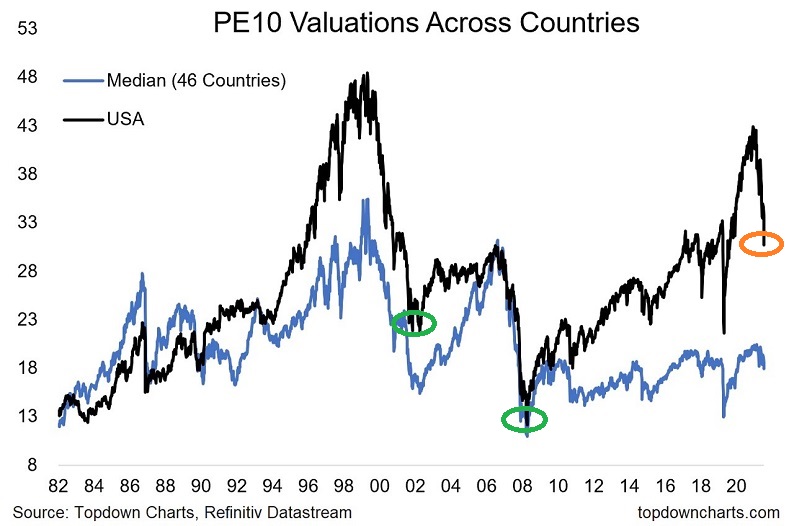

The stock market has already plummeted from bubbly heights, reflecting the challenging business environment as well as the Fed’s uncertainty. Some even wonder if the S&P 500 falling 20%-plus into a stock bear means that the worst is behind us.

Probably not. Cyclically-adjusted 10-year PEs are still quite high.

P/E 10 Valuations Across Countries

P/E 10 Valuations Across Countries

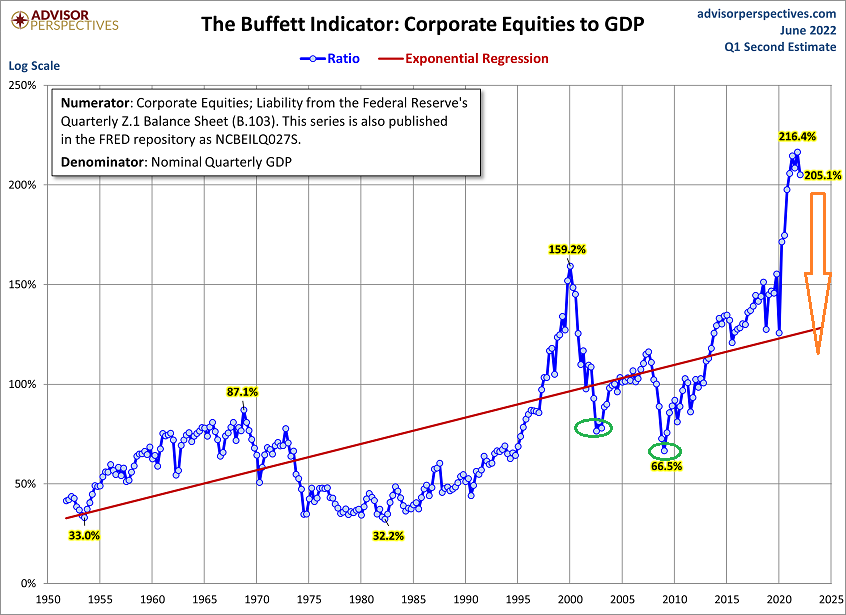

In a similar vein, market-cap-to-GDP (a.k.a. the Warren Buffett Indicator) shows that stocks remain exceptionally overvalued. Stock prices might need to fall 40%-50% from top to bottom before valuations return to their long-term trend.

Corporate Equities To GDP Chart

Corporate Equities To GDP Chart