Is the Transportation Sector Starting to Lead?

2023.04.18 02:45

Over the weekend we covered the weekly charts of the Economic Modern Family.

- Given that yields begin this week higher.

- Given that earnings season kicks into gear with banks, the weakest sector so far, surviving.

- Given that the seasonality of April point bullish for the S&P 500.

- Given all of that, we have a keen eye on our Tran.

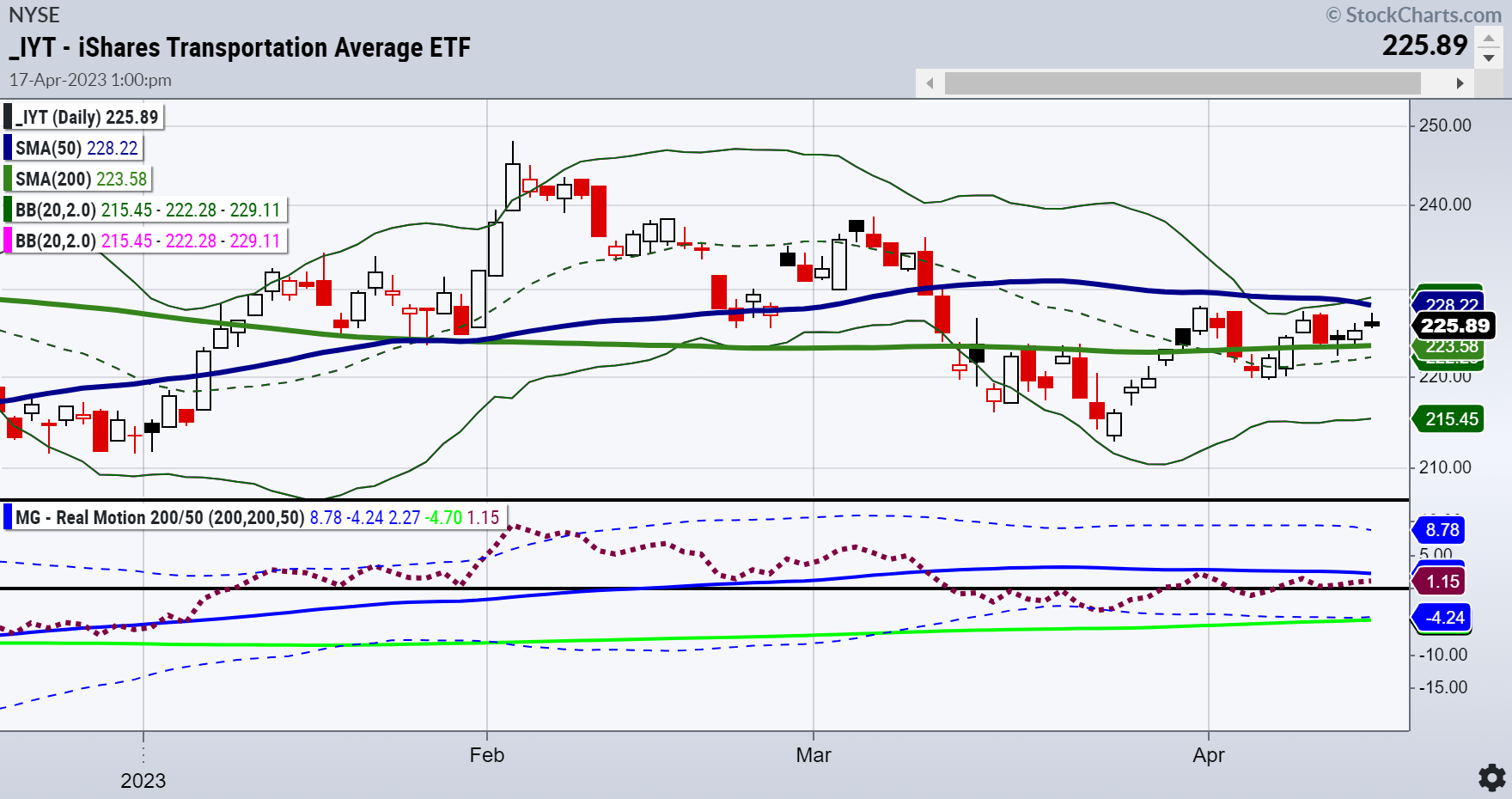

The iShares Transportation Average ETF (NYSE:) looks interesting on the Daily chart.

Above the 200-day moving average (green) yet below the 50-DMA 9Blue), IYT is compressing at a critical juncture.

Furthermore, momentum according to our Real Motion Indicator shows no divergence yet does have some upward movement along with price.

Given the importance of our demand sector of the Family, what else needs to happen?

If you thought to yourself Mish will probably show the 23-month moving average for IYT-gold star!

Last week, Transportation (IYT), closed over the 50-week moving average and is in a bullish phase.

The monthly chart though, is key. Should IYT breakdown below 223, I would take that to mean caution.

However, should IYT clear 240 and hold, especially if the April positive seasonality factor kicks in?

Then, our Tran, the trains, planes and automobiles sector, could defy at least for a while, the Sell in May platitude crowd.

ETF Summary

- S&P 500 (SPY) Tight range to watch this week 412-415

- Russell 2000 (IWM) 170 support- 180 resistance

- Dow (DIA) Peeking over the 23-month MA 336-impressive if holds

- Nasdaq (QQQ) 312 support over 320 better

- Regional banks (KRE) 41.28 March 24 low held and now has to clear 44

- Semiconductors (SMH) 258 resistance with support at 250

- Transportation (IYT) 219-228 the wider range to watch

- Biotechnology (IBB) 130 major pivotal area-135 resistance

- Retail (XRT) 58- 64 trading range to break one way or another