Is the Short Correction Already Behind Us? Here’s What to Watch

2023.08.24 08:01

- Two key events were set to dictate the markets this week: Jackson Hole and Nvidia

- Nvidia’s thrilling earnings have coincided with the S&P 500 finding a short-term low

- Fed’s stance on inflation and interest rates key for market direction going ahead

This has been a pivotal week for the market, with Nvidia’s (NASDAQ:) , unveiled yesterday, followed by Jerome Powell’s speech at the tomorrow.

Both of these events are likely to exert a significant influence on the markets, each in its own manner. However, let’s proceed systematically to dissect their potential impacts.

Readers of my column would know that I have been discussing a potential correction during the summer due to both seasonality (August and September tend to be relatively weak months in the markets) and the fact that after a strong run since the beginning of the year, the markets needed a breather.

As possible support levels, we looked at the 4300-point range (previous high) and the 4240 level (200 MA) for the .

In August, the market initiated a brief correction (around 5%) and found a short-term low around the 4340-point area.

In August, the market initiated a brief correction (around 5%) and found a short-term low around the 4340-point area.

Yesterday was a positive day, and today, following Nvidia’s strong quarterly report, we might see an opening uptrend (although we have to wait until tomorrow evening for a more comprehensive picture).

Out of the two anticipated events, the first one was definitely favorable. Nvidia exceeded earnings per share (EPS) and profit expectations and provided encouraging guidance (though, in my view, it remains risky in terms of valuation.

I prefer looking for other equally good stocks with significantly lower risk margins. One has to question how long such a high growth can be sustained, that’s the essence of it).

Interestingly, bonds also declined yesterday, with the Treasury yield falling below 5%.

Now we have to wait for tomorrow, especially for Powell’s speech. However, some Fed representatives maintained a firm stance yesterday, like Barkin, who mentioned that we should be prepared for an acceleration in the US economy.

A possibility of sustained high might call for another rate hike. Let’s see if Powell shares the same view.

In the meantime, amidst occasional corrections, the market is delivering a strong 2023, and there are still many investors who fail to recognize it due to recency bias, which was influenced by the negative 2022.

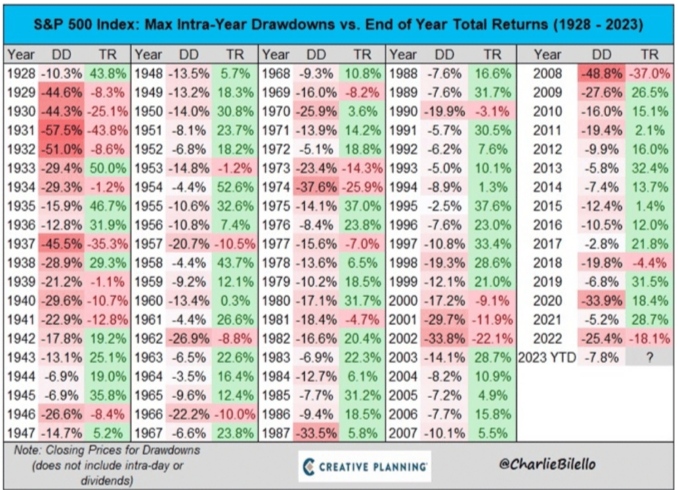

It’s worth noting that corrections are an integral and normal part of markets, as we can see in the image below. Even in positive years like this one, we will always experience corrections.

Source: Charlie Bilello

***

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.