Is the sell-off in USDCAD overdone?

2023.03.31 08:44

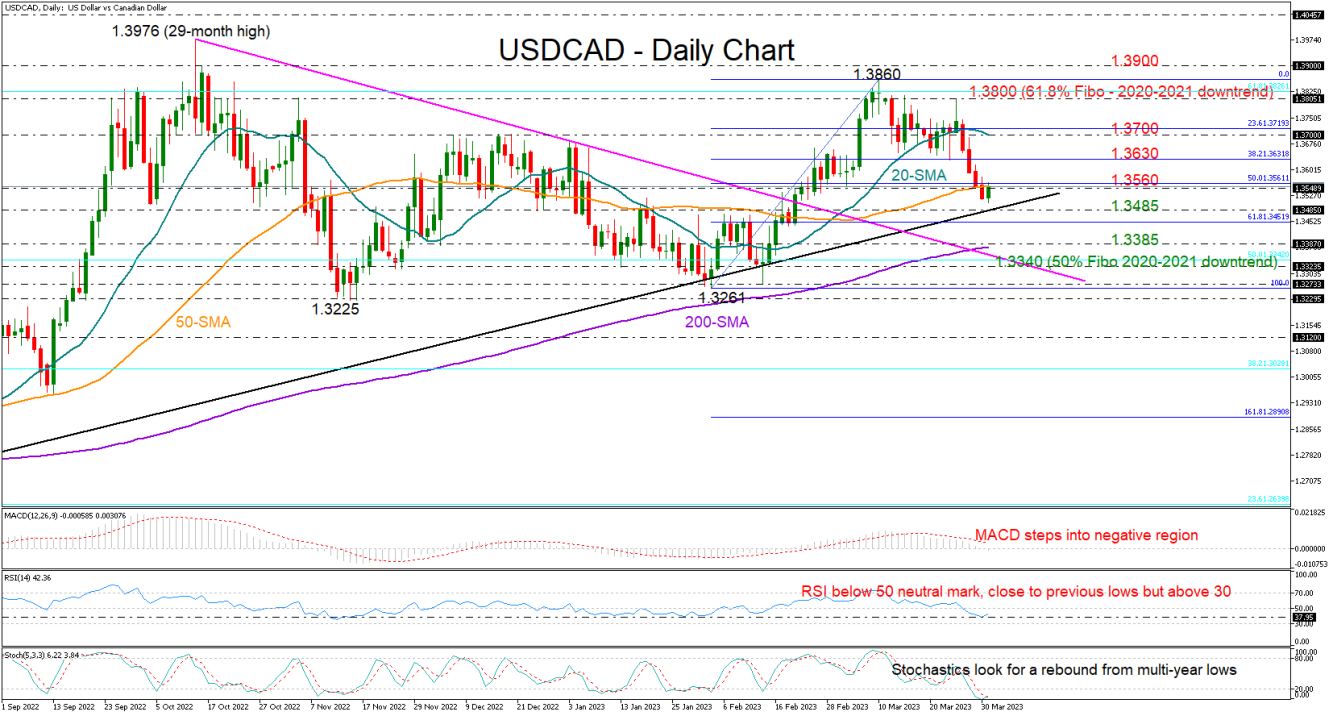

is set to close the month on a negative note despite the rally to a five-month high of 1.3860 on March 10th.

Having dived back below its 20- and 50-day simple moving averages (SMAs) after the formation of a bearish doji candlestick near the 61.8% Fibonacci retracement of the 2020-2021 downtrend, the pair is currently eyeing the important support trendline that connects all the lows from June at 1.3485.

Meanwhile, the Stochastic oscillator is trying to bounce from multi-year lows, increasing speculation that the latest bearish wave is overdone. That said, the RSI, although near its previous lows, has yet to enter oversold territory, while the MACD has just stepped into the negative zone, both suggesting that the bears may stay on course.

A clear close below the trendline could forcefully press the price towards the 1.3400-1.3385 zone, where the 200-day SMA is converging. Slightly lower, the 50% Fibonacci level of 1.3340 and the broken resistance trendline from October’s highs may next come to the rescue, likely postponing a test at the lower boundary of the six-month-old range seen at 1.3273-1.3225. A break lower would worsen the medium-term outlook.

Alternatively, a bounce back above the 50-day SMA at 1.3560 could reach the 1.3630 barrier, which represents the 38.2% Fibonacci retracement level of the previous upleg. Another successful move higher could challenge the 20-day SMA at 1.3700 before crawling swiftly up to the key 1.3800 resistance.

Summing up, downside risks keep lingering in the USDCAD market, though with the pair flirting with a crucial support region at the moment, a pause or an upside reversal cannot be excluded in the coming sessions.