Is The Dow Likely To Keep Outperforming The NASDAQ?

2022.10.31 06:34

[ad_1]

- Value keeps winning comfortably against growth in 2022

- The blue-chip Dow might put in its best monthly performance since 1976

- I assert the Dow will keep rallying relative to the growth-heavy NASDAQ Composite into year-end

What a month it has been for the domestic stock market. Amid a still-high and interest rates that are not far from their cycle highs, equities staged an impressive comeback during the back half of the month. Even with a shaky earnings season, too, both the and the jumped last week.

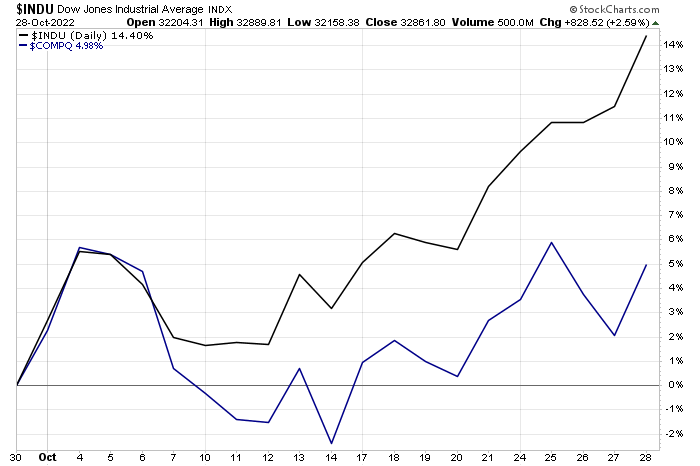

For the month, through last Friday, the Dow was up a massive 14.4%, pacing for its best month since 1976, while the NASDAQ was higher by just 5%. That nearly ten percentage point difference is among the biggest monthly gaps we’ve seen in the last four decades outside of the year-2000 dot-com crash.

October Performances Through Last Week: Dow > NASDAQ

INDU, NASDAQ Composite Daily Chart

INDU, NASDAQ Composite Daily Chart

Source: Stockcharts.com

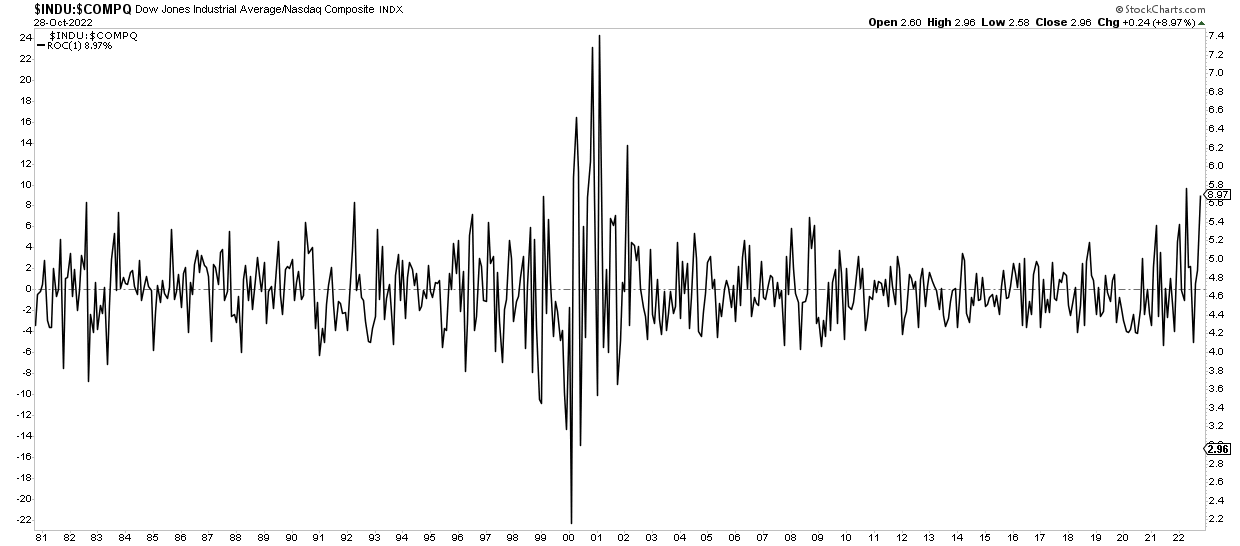

Monthly Relative Returns Last 40 Years: Dow Versus NASDAQ

INDU, NASDAQ Composite Relative Returns

INDU, NASDAQ Composite Relative Returns

Source: Stockcharts.com

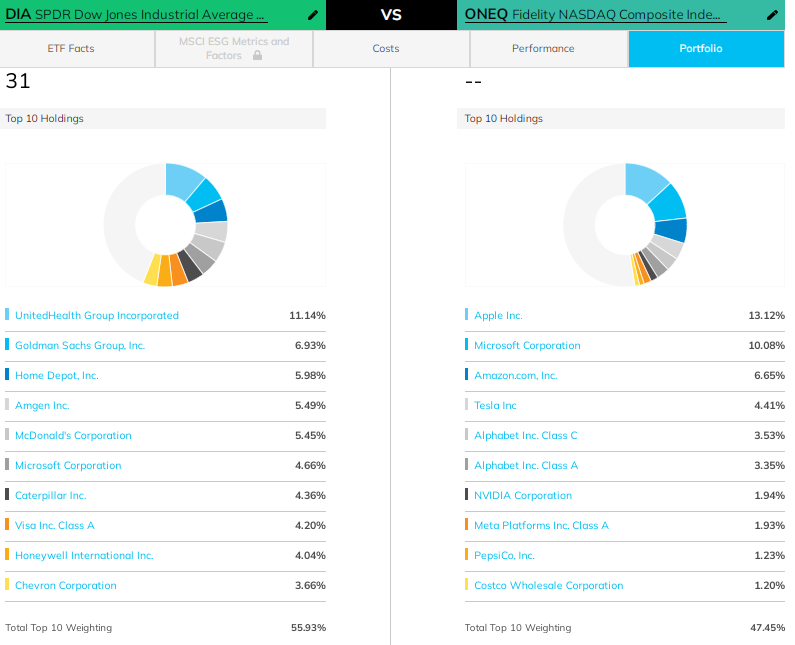

What’s driving the difference? Look no further than sector exposure. The Dow’s price-weighted construct means that the Health Care sector features a massive 22% position in the index. The Information Technology sector is just 19% of the blue-chip average.

Contrast that to the growth-heavy NASDAQ Composite, which has a whopping 43% tilt toward the I.T. sector and is less than 9% exposed to Health Care stocks. Interestingly, the only major NASDAQ Composite ETF is the Fidelity Nasdaq Composite Index ETF (NASDAQ:), while there are several and DJIA index funds.

According to ETF.com, UnitedHealth Group (NYSE:) is 11% of the DJIA. Apple Inc (NASDAQ:), by contrast, is 13% of the NASDAQ and just 3% of the Dow.

DIA And ONEQ Comparison: Major Sector Differences Drive Sharp Return Differentials YTD

DIA, ONEQ Top 10 Holdings

DIA, ONEQ Top 10 Holdings

Source: ETF.com

Active investors might wonder which might be a better play going forward. Like so many top-down investment decisions, it comes down to your stance on how value versus growth performs and which sectors you believe will do better. In general, expect the Dow to keep beating the NASDAQ if value and dividend equities keep up their alpha.

As a technician, I think it’s more likely that the trend should remain your friend heading into year-end. Consider that tax-loss selling sometimes results in the year’s losers going on to underperform in the final weeks of the year. Moreover, momentum, in general, dictates that what has worked should keep working in the short run.

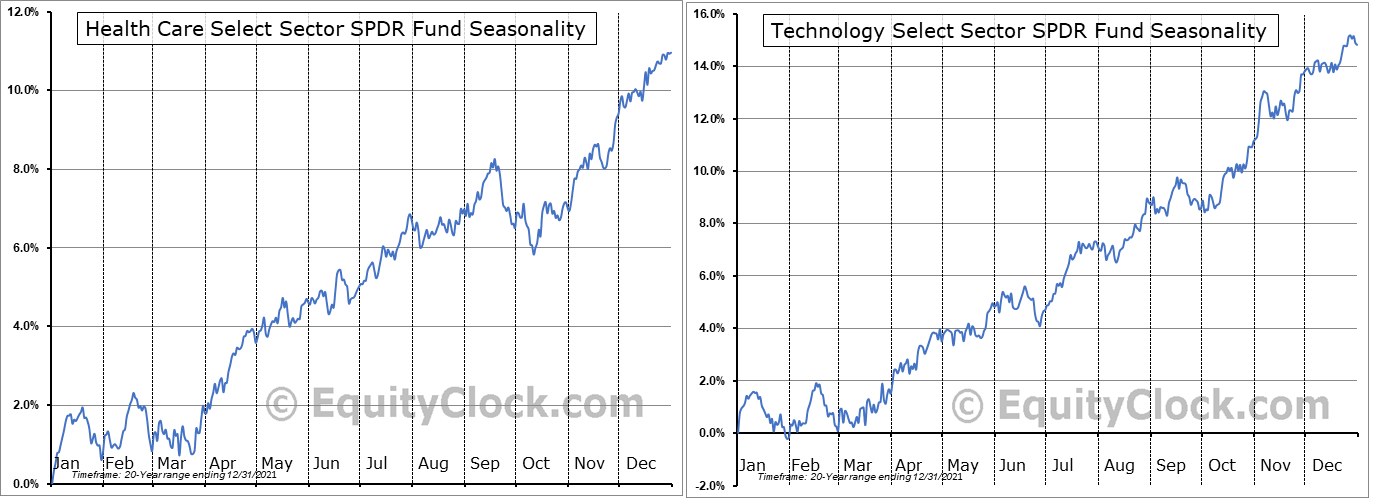

Seasonality Similar Between XLV And XLK

Source: Equity Clock

We can also check in on seasonal trends between the Health Care Select Sector SPDR Fund (NYSE:) and the Technology Select Sector SPDR Fund (NYSE:). According to Equity Clock, using the past two decades of performance data for the period ending Dec. 31, 2021, the edge again goes to Health Care. That sector has tended to rally about four percentage points, more than half its typical annual gain, during the final two months of the year. XLK, however, sees a smaller portion of its yearly advance during November and December, though still about +4%.

The Bottom Line

All the recent hoopla about the Dow’s massive October gain might have you curious about allocating more toward an ETF tracking the century-old index. I assert that could be a winning trade against, say, a growth-heavy index like the NASDAQ Composite. The Dow’s relatively high allocations to sectors like Health Care, Financials, and Industrials with somewhat light weightings in I.T. and Communication Services offer an interesting way to play a continued rebound in the value versus growth trade.

Disclosure: Mike Zaccardi does not own any of the securities mentioned in this article.

[ad_2]

Source link