Is Now the Perfect Time to Sell Defense Stocks?

2024.06.18 13:25

- European defense stocks soar on war fears, tripling in some cases.

- US defense stocks are overvalued, with some starting to decline.

- Time to cash in on defense or look elsewhere? This article explores valuations, growth prospects, and dividend potential.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Defense stocks in Europe have skyrocketed in the past year, fueled by escalating global conflicts and increased investment from the EU and NATO. This trend stands in stark contrast to the performance of their U.S. counterparts.

European Defense Stocks Boom

- Leonardo (OTC:): This Italian company, with a 30% stake held by the government, has doubled in value since June 2023.

- Rheinmetall (OTC:): The German defense giant saw its stock surge 87% over the same period.

- BAE Systems (OTC:): The British defense leader experienced a near 40% increase.

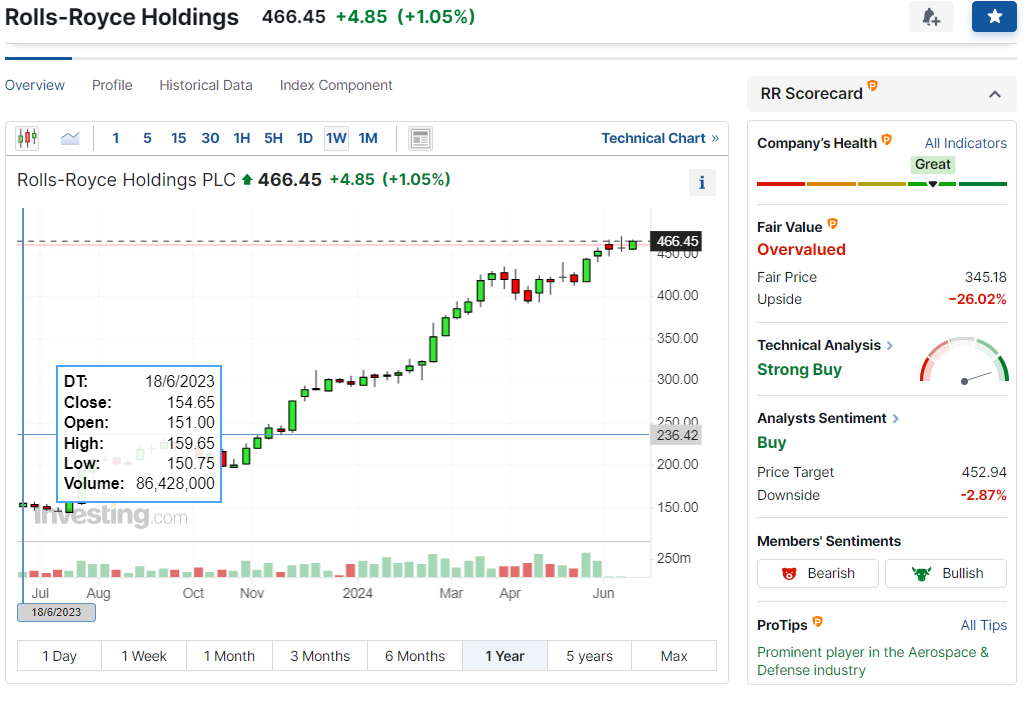

- Rolls Royce Holdings (OTC:): The U.K.’s Rolls-Royce witnessed the most dramatic rise, tripling its share price from £150 to £466 in just twelve months.

Source: Investing.com

Reflecting this boom, the index has surged an impressive 40% in the past 12 months.

U.S. Defense Stocks Are Lagging

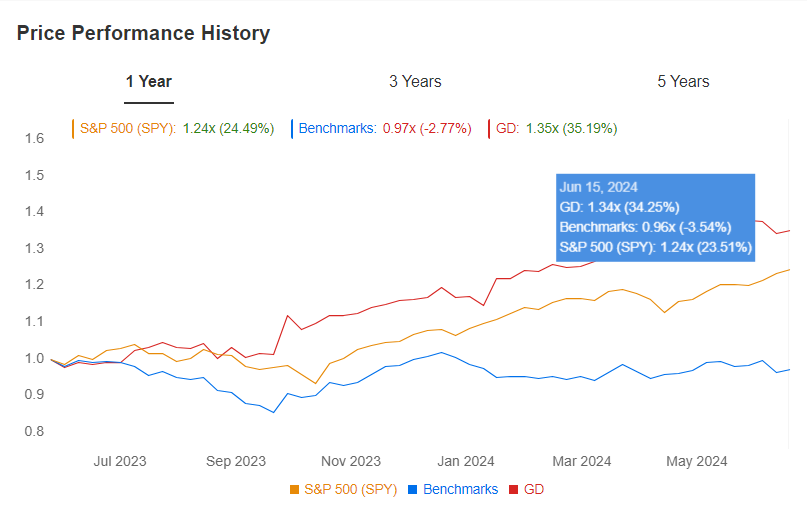

The story is quite different for the Big 5 U.S. defense companies (Lockheed Martin (NYSE:), Boeing (NYSE:), Rtx Corp (NYSE:), Northrop Grumman Corporation (NYSE:), and General Dynamics (NYSE:)). Only General Dynamics managed to outperform the . The others posted modest gains (RTX +6%) or even significant declines (Boeing -18%, Northrop Grumman -6%).

Interestingly, U.S. defense sector indexes like the (+14.45%) and did show positive year-on-year performance. However, these gains still lag behind the broader market rally.

Source: InvestingPro

Time to Cash In on Defense Stocks and Look Elsewhere?

Defense stocks have enjoyed a strong run, fueled by bets on increased military spending, particularly in Europe. But with valuations inflated and growth prospects mixed, is it time to take profits and move on?

This sector is notoriously volatile, heavily influenced by unpredictable geopolitical events. 2024, being an election year, adds another layer of uncertainty to the mix.

While Goldman Sachs predicts a “defense spending supercycle,” with European spending rising at a 4.5% compound annual growth rate (CAGR) by 2027, this trend is far from guaranteed.

High Multiples, Uninspiring Growth

The Russia-Ukraine war sparked a surge in defense stocks, with many large investors piling in on the expectation of increased spending. As a result, valuations have become stretched, with some stocks trading above 36x earnings. Meanwhile, growth outlooks are tepid.

Morningstar analysts expect average revenue growth of just 2-5% and margins of 9-11% for US defense companies over the next five years.

But, Dividend Income Potential Remains

Despite these concerns, the sector still offers income appeal. Defense companies tend to generate strong cash flows, often rewarding shareholders with dividends and share buybacks.

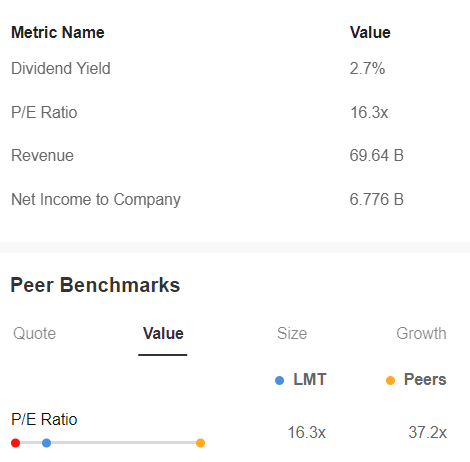

This is particularly true for US companies, where dividend yields can be more attractive than their European counterparts. For example, Lockheed Martin boasts a 2.7% dividend yield and a reasonable P/E ratio of 16.3x, compared to a hefty 37.2x for its European peers.

Source: InvestingPro

In addition, InvestingPro’s fair value tells us that the stock is trading at a discount to its intrinsic value, with a possible upside of 7.1% from $459 on June 17.

In Europe, Analysts Are Betting on Rheinmentall

European defense stocks haven’t offered much opportunity lately. Thales, Airbus, and others appear fairly valued or even overvalued. However, analysts remain optimistic about some potential for further gains.

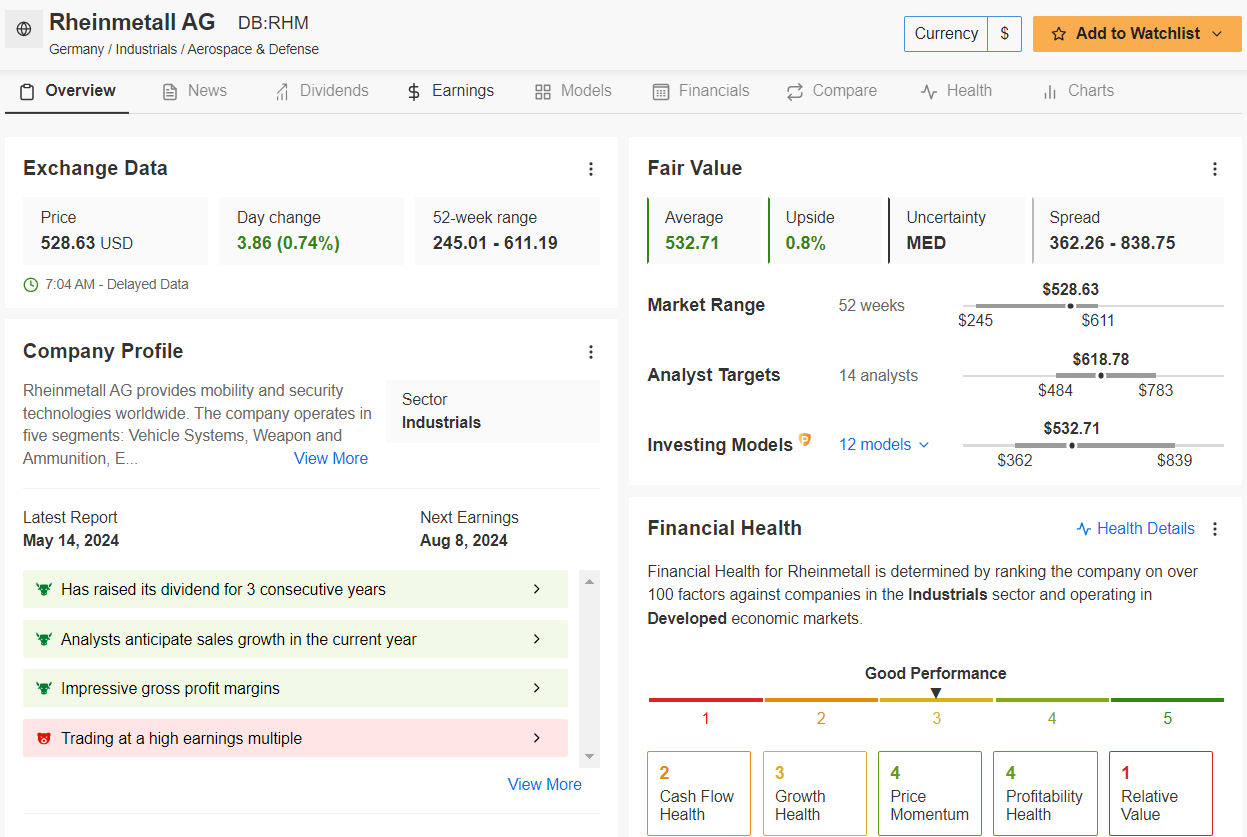

One intriguing case is Rheinmetall. This dividend-paying company (1.2% yield, 3 years of increases) has analysts bullish. A survey by InvestingPro shows an average target price of $618.78 for the next 12 months, representing a 17.9% increase from its current price of $424.77 (as of June 17).

Source: InvestingPro

Despite analyst optimism, Rheinmetall’s P/E ratio sits at 36.6x. Even Fair Value analysis indicates limited upside potential, suggesting the stock is already fairly valued (less than 1% room for growth).

The Bottom Line

The broader defense sector appears somewhat overheated, with some stocks potentially vulnerable if the euphoria fades. On the other hand, buying in now might not deliver significant future returns.

If you don’t already hold these stocks, it might be time to shift your strategy. While selling existing positions could sacrifice a potential safe haven, entering the market at current valuations might not be the most attractive option either. Consider exploring other sectors with more compelling growth potential.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor. The author owns shares in the company mentioned.