Is it Time to Short Shopify Again?

2023.05.09 04:04

Shopify Inc (NYSE:) reported its Q1 numbers Thursday morning. Revenue was in-line with expectations. SHOP’s revenue growth was driven by the growth in the Merchant Solutions segment, which provides payment processing, shipping, fulfillment and working capital loans to merchants that sign-up for this platform. But the stock shot up 24% on Thursday, incredibly, because the Company unexpectedly reported net income vs the consensus estimate for another loss. As discussed below, the “net income” is phantom GAAP non-cash “net income.”

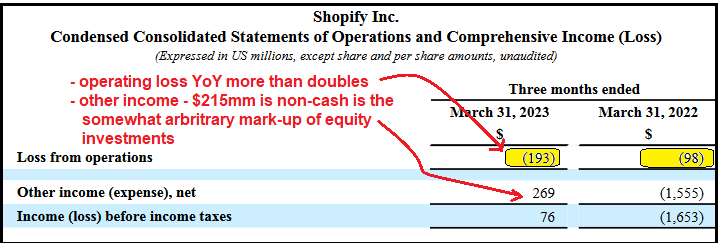

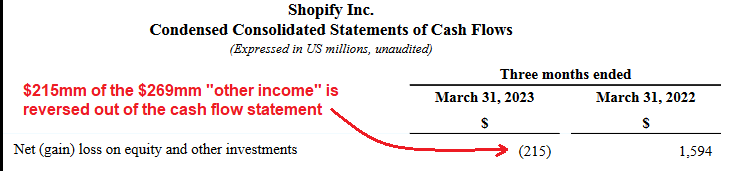

The market didn’t care about the $193 million operating loss, nearly double the operating loss from Q1 2022. The source of the positive GAAP net income was “other income” of $269 million. In digging through the footnotes, the source of this “other income” is “unrealized gains on equity and other investments” net of other investment noise.

$215 million of that unrealized gain was non-cash per the reversal of that amount in the statement of cash flows. This reeks of SHOP’s management playing the GAAP earnings management game to “surprise” the stock market with an earnings report that showed net income.

From SHOP’s Q1 10-Q – truncated income and cash flow statements:

While revenues in the Merchant Solutions segment grew 31%, the cost of providing merchant services grew 45%. This is why the gross profit grew by just 12.3%. Most of that positive “growth” can be explained by price inflation. However, SHOP’s gross margin declined YoY in Q1 from 53% to 47.5%.

This likely reflects the implementation by management of aggressive promotional pricing deals to attract new merchants. Many will drop off when the free subscription period expires. Additionally, SHOP competes with AMZN and other online retail sales platforms like ETSY, OSTK and W. The big drop in SHOP’s gross margin also reflects cut-throat competition in the consumer products e-commerce space as e-commerce platform providers fight for a shrinking revenue pie.

SHOP also announced that it is selling its logistics division to Flexport. Flexport is a private logistics company on which there is not any material financial information. “Logistics” is a fancy name for a company that delivers products from the seller to the buyer. Trucking, rail, FedEx (NYSE:), and UPS are examples of logistics companies. The high cost of free delivery deals – i.e. fulfillment – is one of the primary reasons AMZN is unable to achieve material profitability.

SHOP sold its logistics division in exchange for a 13% equity interest in Flexport. The move enables SHOP to migrate a division that loses money away from its GAAP financial statements. It also allows SHOP to cover up the fact that it paid $2.1 billion in cash and stock for the logistics business just a year ago. A year later it sold the business for far less than $2.1 billion and SHOP received hard-to-value stock in a private company that needs to raise capital intermittently to fund its operations.

Other than disclosing the payment of 13% of Flexport’s private equity, the actual dollar value assigned to the deal was not disclosed. This means that the value received by SHOP is not a material amount in relation to SHOP’s balance sheet. “Material” in GAAP is defined as 5-10%. SHOP’s balance sheet is $10.7 billion. Thus, the amount that would be assigned to the transaction was likely under $1 billion and possibly less than $500 million. Whatever the amount, it was paid in Flexport’s private, illiquid shares and may never be monetized. I will be curious to see if SHOP takes a charge against income in Q2 for the difference between the $2.1 billion paid for the logistics business and the amount of money it lost selling it to Flexport.

Along with selling the logistics business, SHOP announced that it is cutting 20% of its workforce. This move to cut operating costs reflects management’s outlook for difficult business conditions the rest of this year.

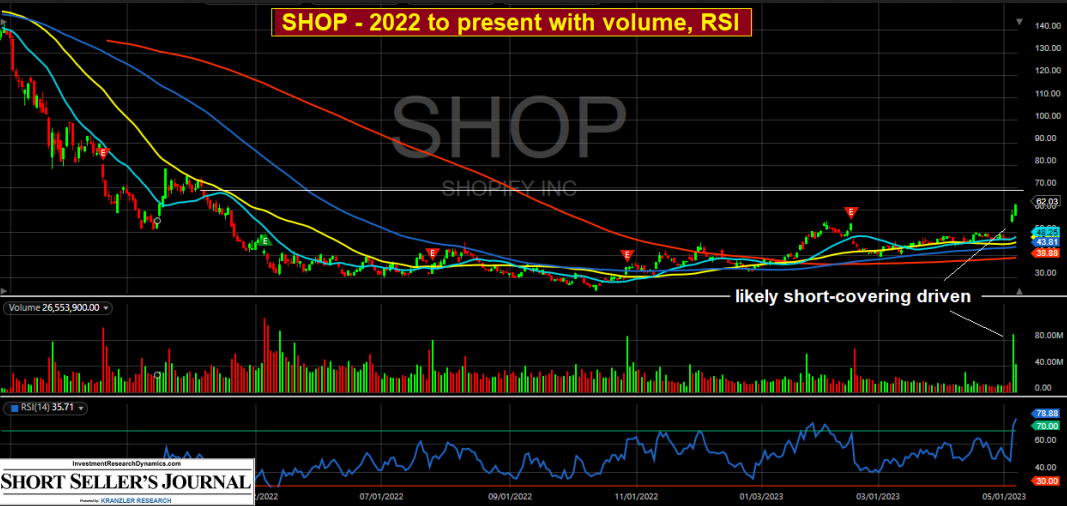

The market’s reaction to SHOP’s non-cash phony net income in Q1 is a reflection of the degree to which the stock market has reverted back to the silliness that was occurring in the run-up to the Nasdaq’s peak in November 2021, when the bear market in the began.

The RSI is the most overbought since early November 2021. SHOP faces strong economic headwinds going forward, particularly the dwindling disposable income of its customer base, a retail environment that is becoming more cut-throat as e-commerce retailers fight for a shrinking pie of consumerism and general economic weakness.