Is Everyone Still Bullish? Not the Majority of Analysts Anymore

2024.01.08 08:19

- Despite initial concerns, the S&P 500 ended 2023 above 4,700 points, challenging the pessimistic expectations at the beginning.

- Looking ahead to 2024, analysts offer conservative projections, with Yardeni Research standing out for a double-digit return prediction.

- While it remains to be seen how 2024 might end, but in the short to medium term, 5000 points is in the cards for the S&P 500.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

Despite the early negative sentiment among analysts, 2023 was a year of strong gains.

Even after the initial pessimism and expectations of a down year for the – the first since 1999 – it concluded at 4,770 points.

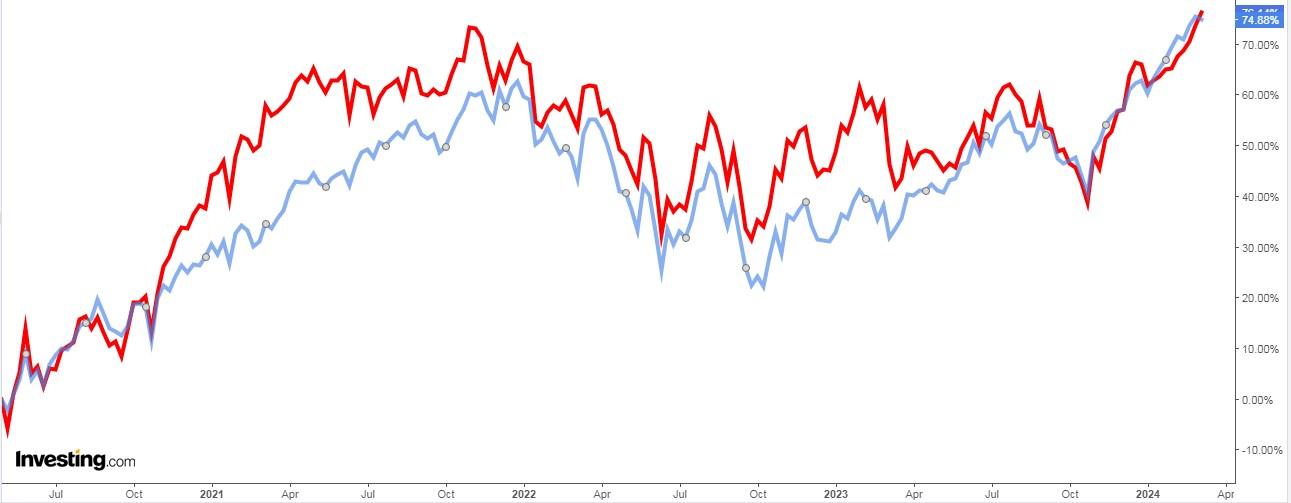

The 60/40 portfolio, which faced skepticism following the 2022 collapse, rebounded remarkably, marking its third-worst year on record.

It bounced back with its second-best performance since 1998, delivering an impressive 18% year-on-year gain.

60/40 Portfolio Performance

60/40 Portfolio Performance

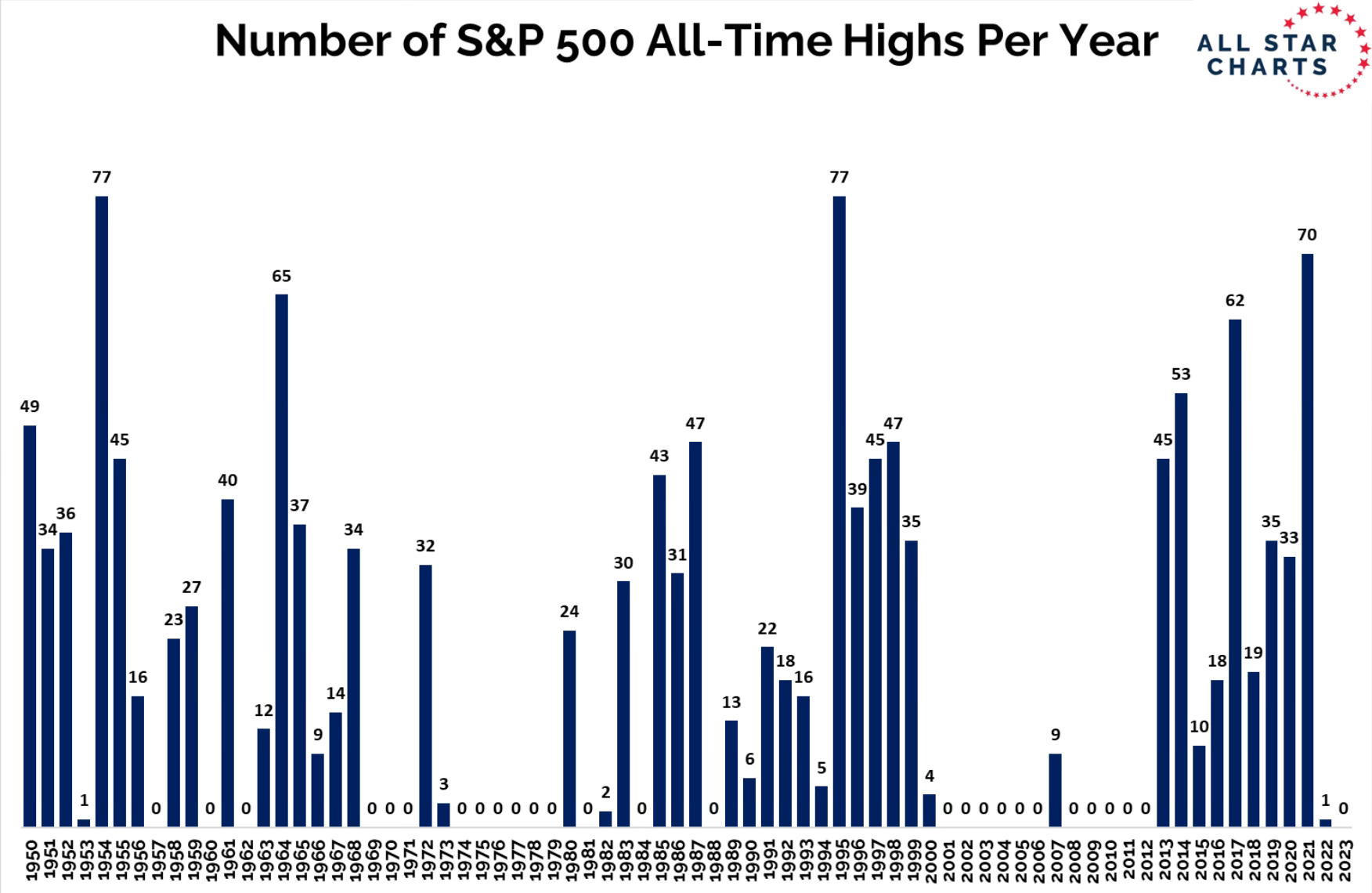

The S&P 500 failed to reach an all-time high despite a strong rise in 2023. The first year since 2012 without an all-time high.

Number of S&P 500 All-Time Highs

Number of S&P 500 All-Time Highs

Source: All Star Charts

Now, the question on many investors’ minds is:

What can we anticipate for 2024?

According to analysts, expectations are still quite conservative, with only Yardeni Research predicting a double-digit return in 2024, with a target of 5400 points.

The average return among all expected targets is about 2% from current levels, at 4785 points.

Is everyone still bullish? Not the analysts.

I am more bullish for 2024 than the average forecast just seen.

As I wrote in the last analysis, looking at various data, the trend remains bullish and our strategies are based on an objectively positive environment.

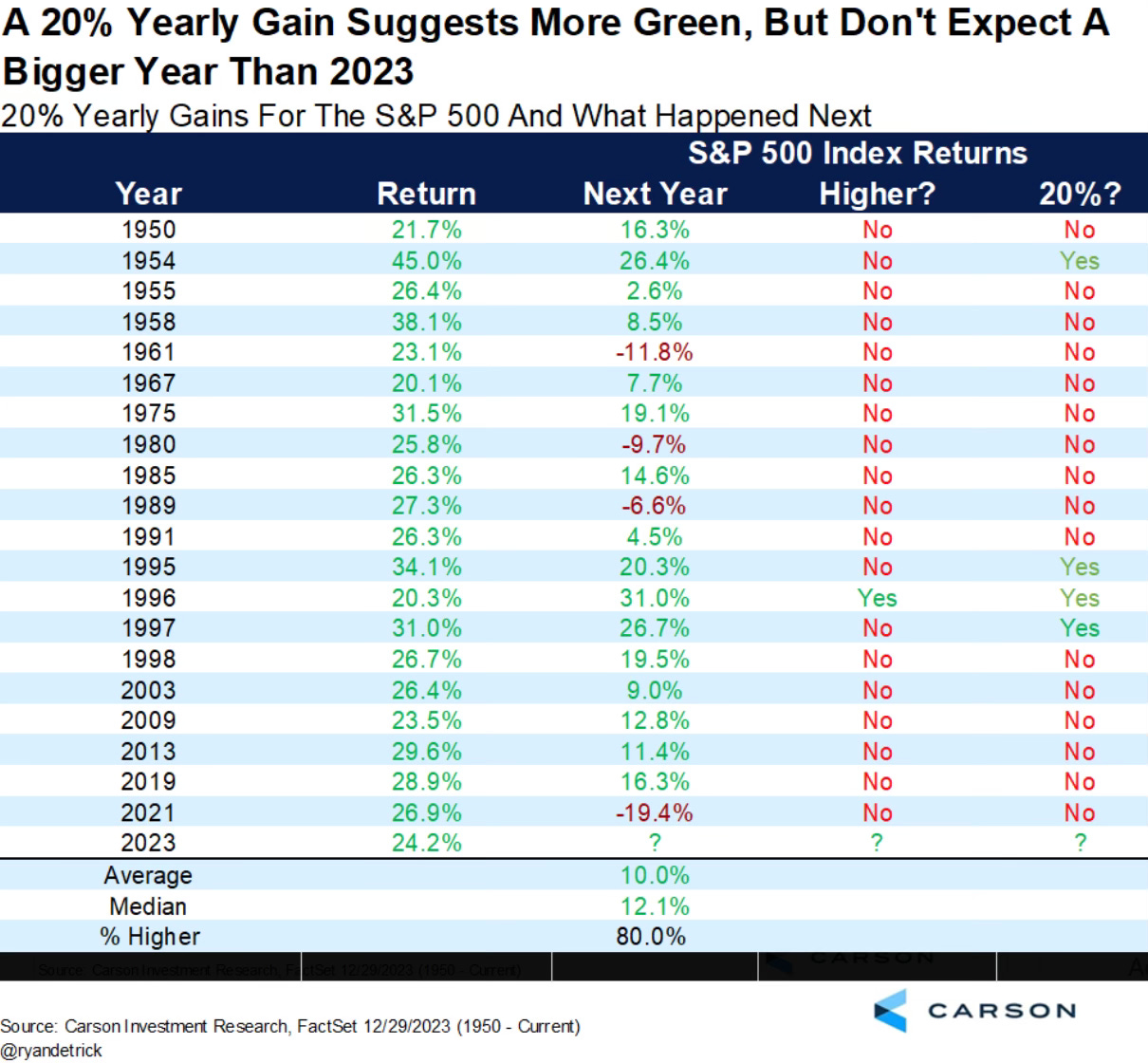

Confirming last time’s analysis is the very interesting chart that examines what happens after annual gains of +20% for the S&P 500.

S&P 500 Post 20% Gain Year

S&P 500 Post 20% Gain Year

Source: Carson

In the year that follows, the market does not perform over +20% like the previous year but ends on a positive note with an average performance of +12% (since 1950) while negative annual closes account for about 20% of the cases.

Bullish Exuberance Keeps Rising

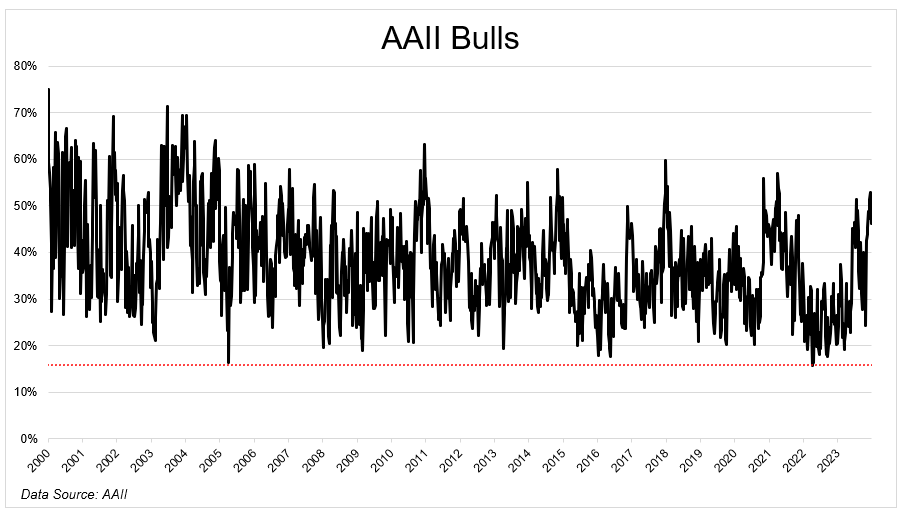

Examining the AAII Sentiment Survey, which gauges individual investors’ opinions on the market’s direction over the next 6 months, there’s a notable shift. In the spring of 2022, a historically bullish event occurred, but enthusiasm for stocks had waned.

Fast forward to today, optimism is at notably elevated levels, currently standing at 48.6%.

This marks the ninth consecutive week where optimism has surpassed the historical average of 37.5%, indicating a sustained period of unusually high investor confidence.

While data can often be noisy and warrant limited consideration, extreme cases, as observed in 2022, merit attention. The current scenario, marked by high optimism at 48.6%, suggests a potential need for vigilance.

In situations like these, where sentiment reaches extremes, it’s prudent to stay alert. The historical context underscores that excessive optimism can precede periods of volatility.

I expect a retracement during the year and it could even be over 10% at some point. But this is market psychology and should be expected.

The question remains: will it just be short-term noise on the course to a rally above 5,000 points?

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship “Tech Titans,” which outperformed the market by 670% over the last decade.

Join now for up to 50% off on our Pro and Pro+ subscription plans and never miss another bull market by not knowing which stocks to buy!

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.