Is Darden Restaurants, Inc.’s First Quarter 2024 Performance Truly Impressive?

2023.09.26 16:16

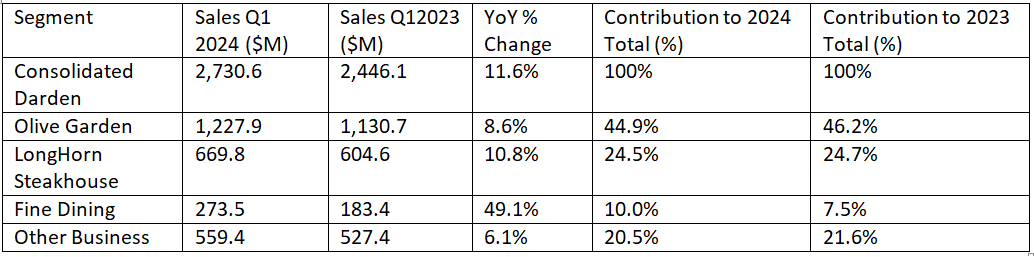

- Overall Growth: Darden exhibited a robust 11.6% year-over-year (YoY) sales growth in 2024.

- Fine Dining Segment: The Fine Dining segment showed exceptional growth with a staggering 49.1% YoY increase, despite contributing just 10% to total sales.

- Strategic Expansion: Darden expanded its footprint through the acquisition of 77 Ruth’s Chris Steak House restaurants and the introduction of 46 new restaurants.

Darden Restaurants, Inc. (NYSE: NYSE:), a leading player in the restaurant industry, has showcased impressive growth and resilience in the first quarter of 2024. The company’s strong performance highlights its diverse brand portfolio, strategic expansion initiatives, and proactive measures to enhance shareholder value. Darden’s commitment to customer satisfaction, technological advancements, and operational efficiency further contribute to its growth trajectory.

Strong Q1 2024 Performance and Growth Strategy:

Darden’s revenue witnessed a robust 11.6% year-over-year growth, amounting to $2.7 billion in the first quarter of 2024. This impressive growth can be attributed to the solid performance across all segments, with the Fine Dining segment leading the way with a remarkable 49.1% growth. Despite contributing only 10% to the consolidated sales, this segment’s rapid expansion signifies Darden’s success in the upscale dining market. Olive Garden, Darden’s largest segment, experienced an 8.6% growth, contributing 44.9% to the total sales. LongHorn Steakhouse followed suit with a commendable 10.8% year-over-year growth, maintaining a consistent contribution to Darden’s overall performance. The Other Business segment observed a modest 6.1% rise in sales, although its contribution slightly decreased from 21.6% in 2023 to 20.5% in 2024. Overall, Darden’s diverse brand portfolio showcases a balanced growth trajectory, with each segment playing a pivotal role in the company’s financial ascent.

Darden’s Strategic Initiatives and Commitment to Shareholders:

Darden’s strategic initiatives include the acquisition of 77 Ruth’s Chris Steak House restaurants, further diversifying and solidifying its footprint in the dining industry. The company’s expansion efforts extend beyond acquisitions, with the introduction of 46 new restaurants, highlighting its commitment to capturing new market opportunities. The company’s proactive approach to enhancing shareholder value is evident in its dividend declaration of $1.31 per share and the repurchase of 0.9 million shares of common stock, amounting to approximately $143 million. These measures signal Darden’s dedication to prioritizing shareholder returns and instilling confidence in the company’s long-term growth prospects.

Embracing Technology and Leading in the Restaurant Industry:

Darden’s adoption of technology as a competitive advantage sets it apart within the restaurant industry. With a secure and robust digital platform, including online ordering and mobile applications, the company addresses evolving customer needs and enhances the overall dining experience. By leveraging technology-enabled solutions, Darden improves financial control, cost management, guest service, employee effectiveness, and e-commerce capabilities. Despite some softness among higher-income households, possibly due to increased international travel, Darden’s focus on brand execution and competitive pricing ensures sustained customer loyalty. The company remains vigilant to evolving consumer behavior, particularly within the casual dining segment, and closely monitors commodity costs, especially beef prices, to devise effective cost and pricing strategies. The leadership transition, with Cynthia T. Jamison recently elected as Board Chair, ensures continuity while fostering innovation within Darden. This seamless transition further reinforces the company’s commitment to its strategic direction and long-term growth.

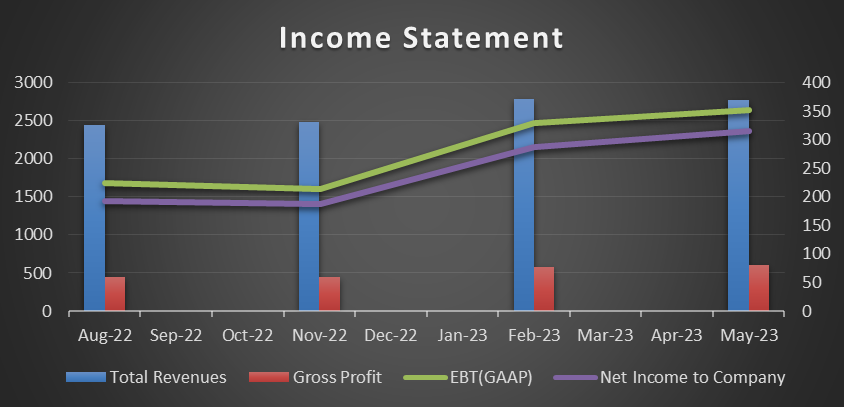

Q-o-Q Trend

Conclusion

Darden Restuarant Chart

Darden Restaurants, Inc. has showcased remarkable resilience and growth potential in the first quarter of 2024. With a diverse brand portfolio, strategic expansion efforts, a shareholder-centric approach, and technological innovations, the company is primed for sustained success. These factors are pivotal in underpinning its ability to approach the bullish price target of $175.00 within the next year. In summary, Darden Restaurants, Inc. presents an enticing investment prospect in the restaurant industry, with a strong foundation for growth. Nevertheless, prudent monitoring of market dynamics is required to navigate potential challenges and capitalize on the company’s promising trajectory.

Disclosure: We do not hold any position in the stock.

Original Post