Is a Mean Reversion Imminent for Small Caps and Retail Stocks?

2023.05.24 03:50

While Monday, Granddad Russell () was offering a helping hand to his wife, Granny Retail (), today, they both looked more vulnerable.

IWM-Daily & Monthly Chart

IWM-Daily & Monthly Chart

Just as the failed to clear its 23-month moving average, we are hoping that IWM not only holds its 80-month MA (green on the monthly chart) but also holds its 50-DMA (blue on the daily chart)

Our proprietary indicator which lets you see hidden strengths or weaknesses during market trends, shows momentum still above its 50 and 200-DMAs.

It also remains, despite the price drop, in a bullish diversion meaning momentum is ok.

Yet, with today’s sell-off, and considering we might have hit the top of this year’s trading range in , Granny remains a concern.

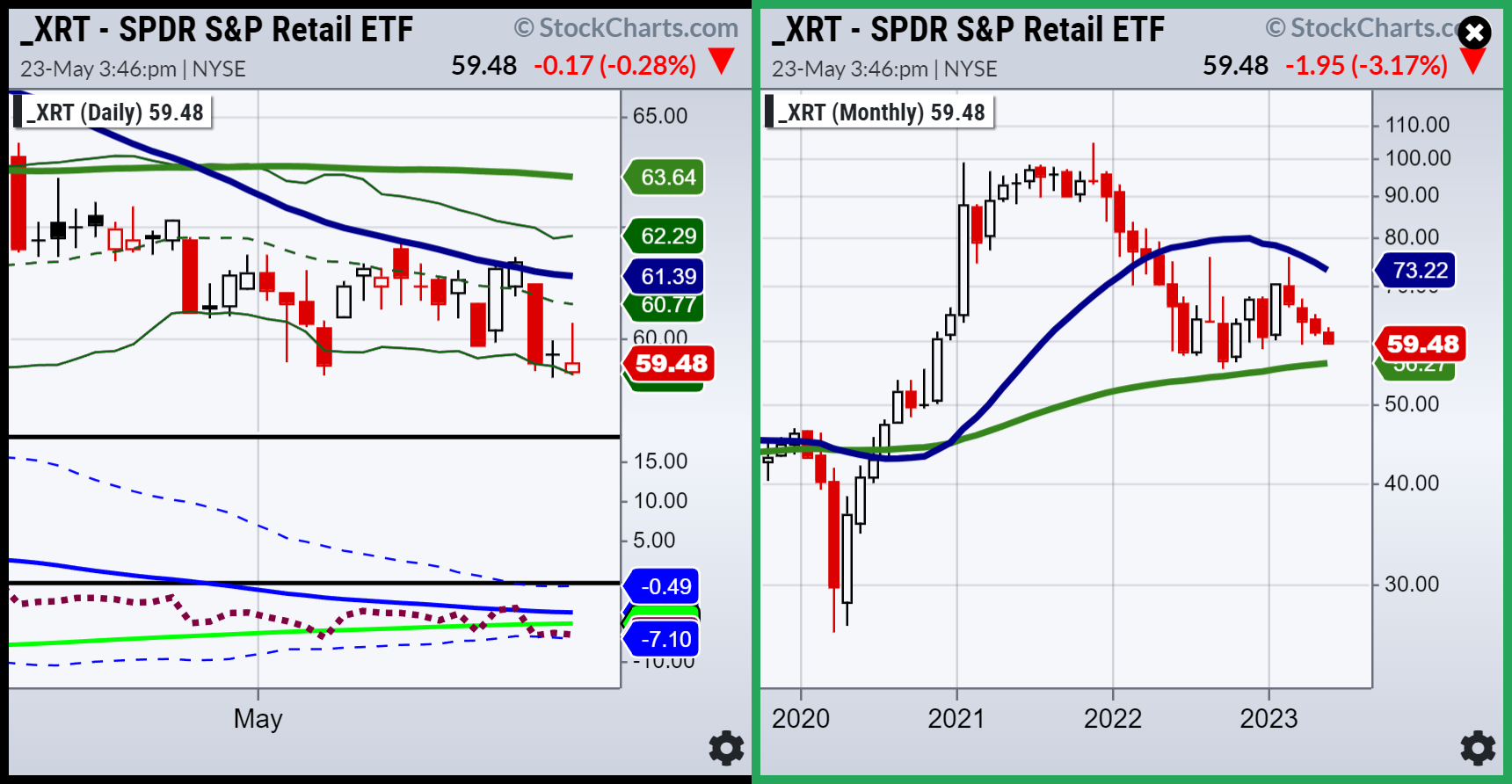

XRT-Daily & Monthly Chart

XRT-Daily & Monthly Chart

Granny XRT fell in price closer to the March low.

Momentum though is now going sideways, sitting on the Bollinger band, perhaps getting ready for a mean reversion.

That would be a better sign for everyone if XRT holds here and turns higher.

These two key Family members in the Economic Modern Family are not only telling a story-they are the story.

That story reflects a thin veil of optimism but with enough doubt that unless both move higher from here, the market could return to risk-off.

That is until SPY tests the lower regions of its persistent trading range.

ETF Summary

- S&P 500 (SPY) 23-month MA 420 Support 415

- Russell 2000 (IWM) 170 support – 180 resistance

- Dow (DIA) 336 the 23-month MA

- Nasdaq (QQQ) 336 cleared or the 23-month MA-now its all about staying above

- Regional banks (KRE) 42 now pivotal resistance-37 support

- Semiconductors (SMH) 23-month MA at 124 now more in the rear-view mirror

- Transportation (IYT) 202-240 biggest range to watch

- Biotechnology (IBB) 121-135 range to watch from monthly charts

- Retail (XRT) This could be the new harbinger like KRE was in March. Poor Granny.