Intel: A Sleeping Giant Ready To Awaken

2022.12.05 21:59

[ad_1]

- Intel is a direct benefactor of the CHIPS Act of 2022

- Intel Fabrication Services will contract to produce chips in the U.S. and Europe

- Intel is trading at levels not seen since 2016

- Insiders are buying shares from $27.49 to $29.49 including the CEO

- Intel currently produces the fastest chip processor in the world

U.S. semiconductor producer Intel (NASDAQ:) stock is trading at price levels not seen since 2016. While shares rallied after a strong earnings report, the guidance was exceptionally weak, but shares have managed to grind higher despite the warnings. The markets may have finally started to believe in the value of its heavy investments in future semiconductor fabrication (fab) plants. These are extremely costly and take up to five years to become fully operational. Intel is uniquely an actual American semiconductor maker which should carry a premium compared to other semiconductor companies that rely on outsourcing the production of their chips overseas. Texas Instruments (NASDAQ:) and Globalfoundries (NASDAQ:) are the other two owners of fabs in the U.S.

CHIPS for America Act

The U.S. share of the worldwide semiconductor manufacturing capacity has fallen to 12% in 2021 from 37% in 1990. The CHIPS Act of 2022 was passed in July 2022 to strengthen domestic chip manufacturing. Intel is a key benefactor from the CHIPS Act as the largest domestic chip maker. The CHIPS act with provide $52 billion in manufacturing and research grants and provide a 25% investment tax credit (ITC) to incentivize chip production in the U.S. It’s in the nation’s best interest for its largest domestic semiconductor manufacturer does not fall behind on chip productions. Unlike its competitors like Advanced Micro Devices (NASDAQ:), Intel produces its chip in-house. Fabrication (fab) plants are extremely capital intensive and take years to construct. This is why most of the top chip companies outsource their chip production to companies like Taiwan Semiconductor Manufacturing (NYSE:) and Samsung Electronics (OTC:). China’s claim on Taiwan poses a threat to Taiwan Semi and North Korea poses a threat to South Korea and Samsung (OTC:). Intel has no geopolitical risk associated with it. It would actually be a benefactor in the event of political turmoil events.

Intel’s Fab Investments

Competitors like AMD are literally at the mercy of these foreign chip making factories. Intel stock has been beaten down due to the massive investments its made in building more fabs, but they are about to pay off as they get closed to coming online. It’s $20 billion investment in Fab 42, its Ocotillo campus in Chandler, AZ, became fully operational processing 10nm chips in 2020, thanks to government incentives that fall under the Chip Act. CEO Gelsinger commented, “We are excited to be partnering with the state of Arizona and the Biden administration on incentives to spur this type of domestic investment.”

Here’s What the Chart Says

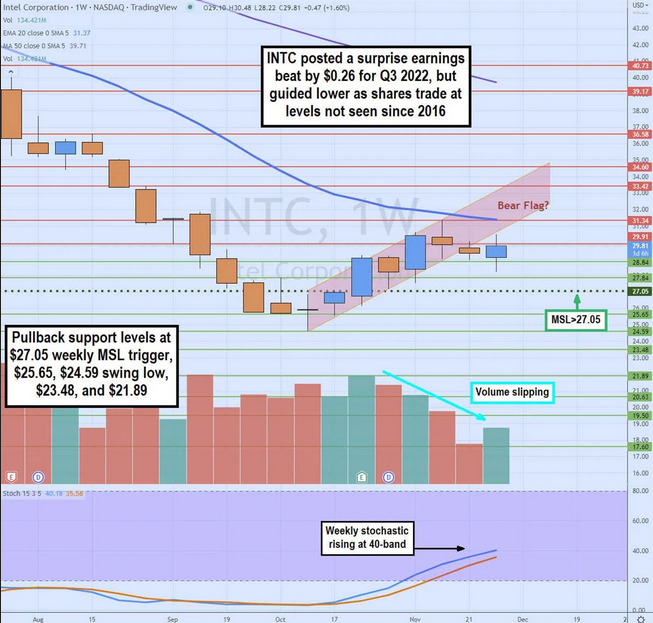

The weekly candlestick chart on INTC made a swing low and doji bottom at $24.59. This level hasn’t been seen on INTC since 2015. The reversal bounce off the doji formed a weekly market structure low (MSL) buy trigger above $27.06. It triggered as the weekly stochastic crossed back up through the 20-band. The weekly 20-period exponential moving average (EMA) continues to fall at $31.37 with a weekly 50-period MA falling at $39.71. The upside bounce peaked at $31.34 after the surprise earnings beat to form a rising channel, after a 12-week sell-off. This sets up a weekly bear flag as shares fell through the lower rising channel at $30.59. The weekly volume actually dropped while shares were floating higher but started to rise again after share attempted a weekly market structure high (MSH) under $28.91. To avoid the bear flag breakdown, shares need to breakout through the weekly 20-period EMA at $31.37. Pullback supports sits at the $27.05 weekly MSL trigger, $25.65, $24.59 swing low, $23.48, and the $21.89 levels.

Earnings Upside Surprise

On Oct. 27, 2022, Intel released its third-quarter fiscal 2022 results for the quarter ending October 2022. The Company earnings-per-share (EPS) of $0.59 excluding non-recurring items versus consensus analyst estimates for a profit of $0.33, a $0.26 per share beat. Revenues fell (-15.4%) year-over-year (YoY) to $15.4 billion, beating consensus analyst estimates for $15.31 billion. CEO Gelsinger commented:

“In June, we were one of the first companies to highlight an abrupt and pronounced slowdown in demand, which has brought and beyond our initial expectations and is now having an industry-wide impact across the electronic supply chain. We are adjusting our Q4 outlook, and we are planning for the economic uncertainty to persist into 2023.” He went on to explain that they are further accelerating cost reduction and efficiency efforts as they move into IDM 2.0 to unlock “the full potential of the IDM advantage.”

Ugly Guidance

Intel provided downside guidance for Q4 2022 with EPS of $0.20 versus $0.68 consensus analyst estimates. Revenues are expected between $14 billion to $15 billion versus $16.43 billion consensus analyst estimates. If they were going to lowball guidance,

Intel Foundry Services

Intel is constructing more fabs at the Ocotillo campus. It also has two new fabrication plants (fabs) in Ohio, which are planned to go into production by 2025 at a cost of $20 billion. Intel is set to start construction on two new plants in Magdeburg, Germany, in 2023 to be operation by 2027 at a cost of 17 billion euros. It is expanding its fabs in Ireland at a cost of 12 billion euros. These investments have taken a hit on Intel’s free cash flow. Pain now for profit later is the theme here. Intel’s fabs will not only produce their own chips but will also produce chips for other companies under its integrated device manufacturing (IDM) 2.0 model. It’s already created a division called Intel Foundry Services headed by semiconductor veteran Dr. Randhir Thakur. In its Q3 2022 conference call, CEO Gelsinger detailed IFS opportunities ahead, “Since Q2, IFS has expanded engagements to seven out of the 10 largest foundry customers, coupled with consistent pipeline growth to include 35 customer test chips. In addition, IFS increased qualified opportunities by $1 billion to over $7 billion in deal value, all before we welcome the Tower team with the expected completion of the merger in Q1 ’23.”

Original Post

[ad_2]

Source link