Instant View: June US jobs growth cooled, but wages won’t comfort Fed

2023.07.07 10:04

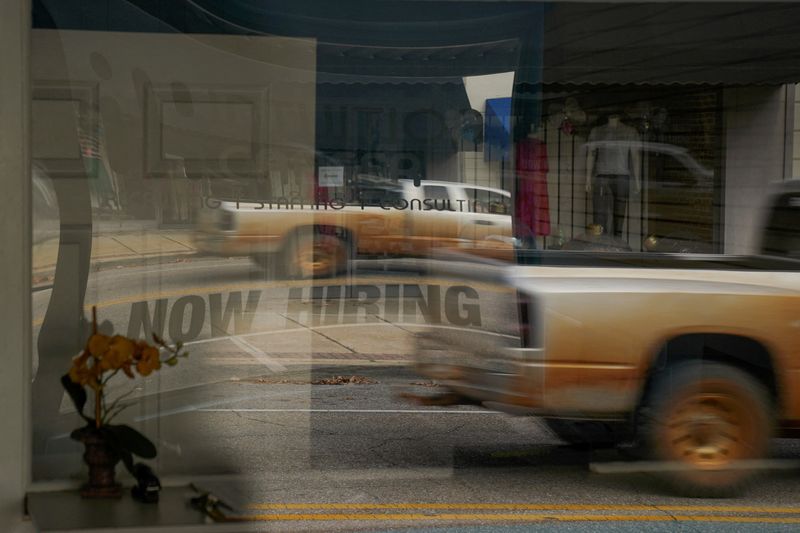

© Reuters. FILE PHOTO: A “Now Hiring” sign is reflected through the window of Intuition Career staffing agency in Greenville, Alabama, U.S., December 4, 2022. REUTERS/Cheney Orr/File Photo

NEW YORK (Reuters) – U.S. job growth slowed more than expected in June after surging in the prior month, but labor market conditions remain tight, with the unemployment rate retreating from a seven-month high and fairly strong wage gains continuing.

Nonfarm payrolls increased by 209,000 jobs last month, the Labor Department said on Friday. May payrolls were revised lower to up 306,000 from up 339,000. Economists polled by Reuters had forecast payrolls rising 225,000. The unemployment rate slipped to 3.6% from 3.7% in May.

MARKET REACTION

STOCKS: S&P e-mini futures were last down 0.3%

BONDS: The yield on 10-year Treasury note wavered after the number and was last up 4.1 basis points from late Thursday at 4.082%; The two-year U.S. Treasury yield fell and was down 1.4 basis points at 4.992%.

FOREX: The euro turned slightly higher and the was off 0.18%.

COMMENTS:

CANDICE TSE, GLOBAL HEAD OF STRATEGIC ADVISORY SOLUTIONS, GOLDMAN SACHS ASSET MANAGEMENT (emailed note)

“The below consensus number highlights a labor market that is still tight, with the strong pace of job growth driven primarily by summer hiring. The print reinforces the fact that labor rebalancing issues persist. This doesn’t change our forward expectation: our view that the Fed is poised to continue its hiking cycle this month remains intact. The US economy is still growing below potential, inflation continues to decline, but still remains above the Fed’s 2% target, keeping the Fed on track for another 25 bps hike. However, we continue to expect that that Fed will soon reach its terminal rate, bringing it closer toward the end of its most aggressive tightening campaign in generations.”

BEN JEFFERY, INTEREST RATE STRATEGIST, BMO CAPITAL MARKETS, NEW YORK

“After the data we got earlier this week the market was probably prepared for something at least consensus or stronger in terms of NFP, and obviously what we got was something a little bit on the weaker side with some fairly significant downward revisions as well.”

“This read wasn’t soft enough in its own right I think to really change the Fed’s outlook on the July meeting, but probably what it does do is leave all the weight on Wednesday’s CPI report to determine what ultimately happens at the end of this month, and then probably more likely September is the bigger wildcard at this point.”

“It’s the lowest headline NFP gain and private payrolls gain since December 2020 – so I would say evidence that the lagged impact of monetary policy is maybe starting to show up in the labor market data.”

PETER CARDILLO, CHIEF MARKET ECONOMIST, SPARTAN CAPITAL SECURITIES, NEW YORK

“It shows the labor market is still hot, but certainly not as hot as the ADP number indicated yesterday.

“Today’s numbers confirm the job market is still strong… and this report gives the green light to the Fed to raise rates. As far as the markets are concerned, the key is the Fed threat, and as you can see, we’re pulling back in futures.”

STUART COLE, CHIEF MACRO ECONOMIST, EQUITI CAPITAL

“A softer headline U.S. payrolls number is a stark contrast to yesterday’s ADP figure. It suggests that the jobs markets – as reported by the payrolls numbers at least – has been running softer over the past couple of months or so than the market and the Fed has been led to believe.” “The fly in the ointment is the rise in the earnings numbers, also accompanied by a small increase in the number of hours worked. The combination of these factors puts more money into workers’ paychecks and is a development that will not be welcomed by the Fed.””Overall, there is probably not enough in today’s report to prevent the FOMC from raising rates by another 25bps at this month’s meeting. But beyond this, further rate rises probably require further strong data to fully justify them.”

JASON PRIDE, CHIEF INVESTMENT OFFICER FOR PRIVATE WEALTH, GLENMEDE, PHILADELPHIA

“This is probably not going to be seen as a payroll report that the Fed takes a big sigh of relief and thinks that they’re done.”

“If anything, it probably confirms this idea that the Fed has had that they are making progress in the right direction.”

“It’s not like this is a sudden vast improvement in the labor market.”

MICHAEL BROWN, MARKET ANALYST, TRADERX, LONDON

“Despite the first miss versus consensus on headline NFP in 15 months, the US economy continues to create jobs at a healthy clip with 209k jobs added in June.”

“Other areas of the report also continue to point to incredible labor market tightness.”

“Of note for the Fed’s hawks, earnings growth quickened to 0.4% MoM, giving some further ammunition to the more aggressive members of the FOMC.”

“Overall, though, the jobs data shan’t prove a game-changer in terms of policy, with a 25bps hike at the end of the month remaining nailed-on, and plenty more data due before the following Fed meeting in September, at which we shall discover whether policymakers will fully deliver on the 50bps of additional tightening signaled in the recent dot plot. The rather apathetic market reaction to the data stems from this point, with traders knowing that the jobs report does little to move the macro needle too significantly.”

BRIAN JACOBSEN, CHIEF ECONOMIST AT ANNEX WEALTH MANAGEMENT, MENOMONEE FALLS, WISCONSIN

“The job gains were still strong, but the canary in the coal mine is that those employed part-time due to economic reasons surged by 452,000. A simple headcount glosses over whether those jobs are resulting in more actual hours worked. The hours worked numbers are rising slower than the payrolls numbers. The job market is still strong, but it’s becoming more superficially so.”