Inflation Views Worsen in NY Fed Survey as Gas Prices Rise

2022.11.14 15:18

[ad_1]

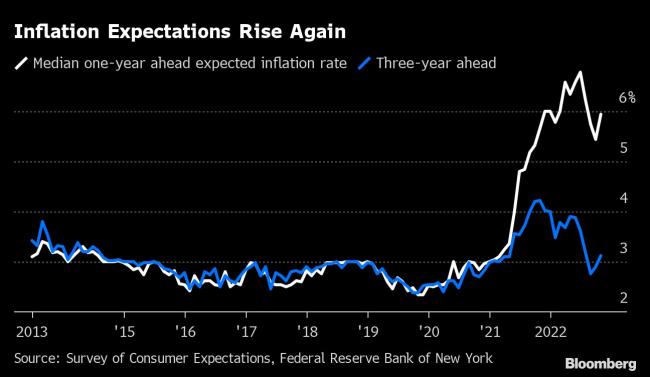

(Bloomberg) — US consumers are less optimistic than last month that inflation will cool over the next few years, and that’s partly because they anticipate higher gas prices, according the latest survey by the Federal Reserve Bank of New York.

The October consumer survey of consumer expectations released on Monday shows increases over the short, medium and longer terms. Respondents see prices rising by 5.9% in a year, up by half a percentage point from September. Three years from now, they see prices climbing 3.1%, up from 2.9% a month earlier.

The New York Fed survey also tracks household finances and perceptions of the job market. Several of those indicators deteriorated last month — including the probability of losing one’s job and perceptions of credit access.

Still, households are more optimistic about their income growth in the future, especially those who are over 60 and make less than $50,000 annually. And the probability of finding a job remains high and rising — evidence of the still-robust labor market.

Among the biggest drivers of higher inflation expectations were gas prices, which rose in October nationwide. Food and shelter also saw a jump in year-ahead changes in the New York Fed survey. Consumers anticipate that rents will rise 9.8% over the next year.

Looking at the the longer term, consumers saw inflation of 2.4% in five years in the latest survey. That’s up from 2.2% in September and still above the Federal Reserve’s general 2% long-term goal.

The consumer price index was up 7.7% in October from a year earlier, the smallest annual advance since the start of the year and down half a percentage point from 8.2% in September, according to a Labor Department report last week.

Goldman Sachs Group Inc (NYSE:). economists anticipate a significant decline in inflation next year. In a note Sunday, the economists cited three factors: the easing in supply chain constraints, a peak in shelter inflation and slower wage growth.

But the New York Fed survey Monday shows that while inflation may have cooled slightly in the country, consumers aren’t feeling it, especially with prices at the pump on the rise.

The Internet-based survey has a rotating panel of approximately 1,300 households.

©2022 Bloomberg L.P.

[ad_2]

Source link