Industry and shippers brace for Canada rail stoppage, fear ‘catastrophe’

2024.08.14 17:29

By David Ljunggren and Promit Mukherjee

OTTAWA (Reuters) -North American industry groups and shippers are bracing for an unprecedented simultaneous stoppage at both of Canada’s main railway companies that could inflict billions of dollars’ worth of economic damage.

Canada is the world’s second-largest country by area and relies heavily on trains to transport grain, beans, automobiles, potash, coal and other goods.

“It’s a catastrophe. Literally nothing would move,” said Greg Northey, vice president of public affairs at Pulse Canada.

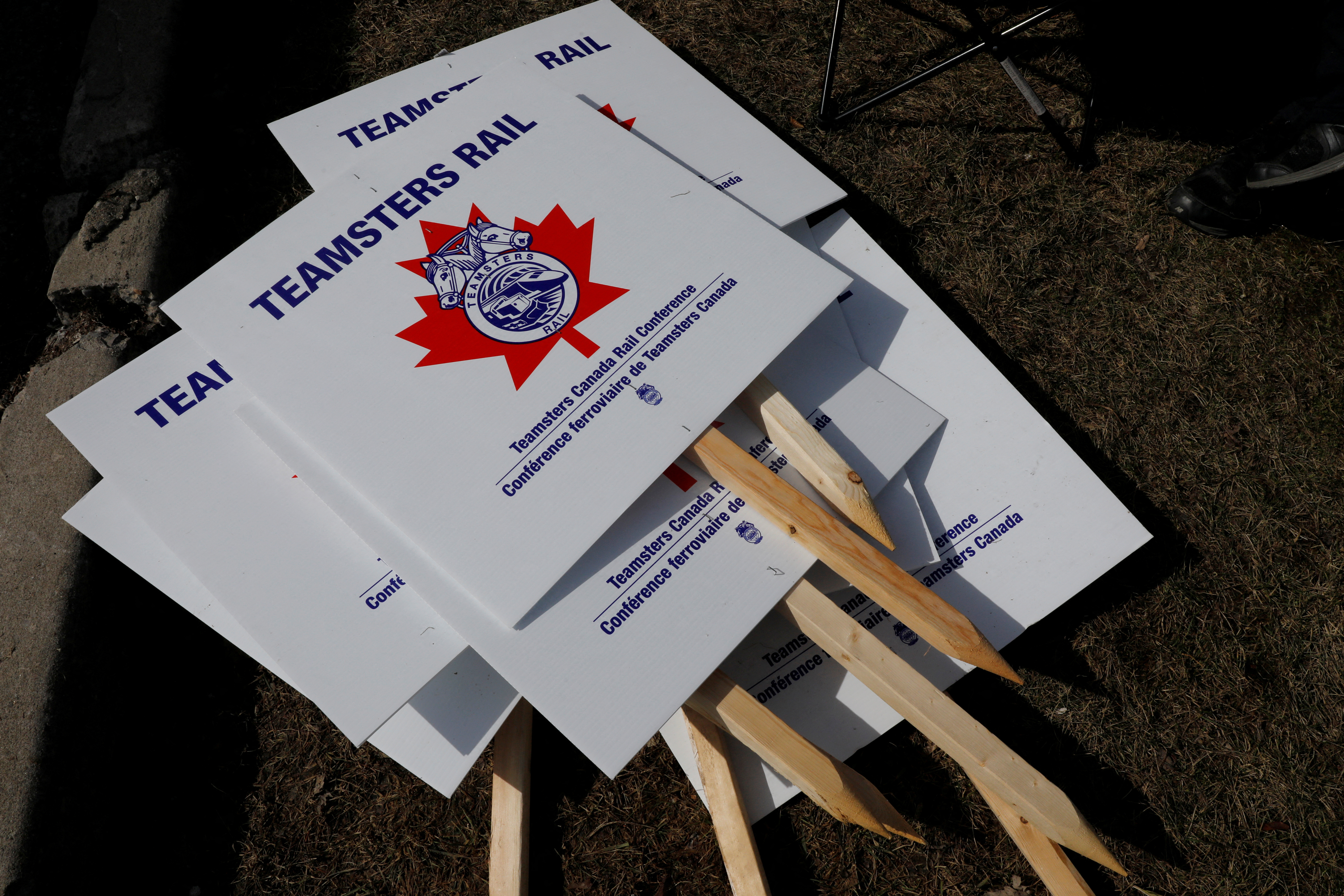

Talks between Canadian National Railway (TSX:) and Canadian Pacific (NYSE:) Kansas City on one hand and the Teamsters union on the other have deadlocked, with each side accusing the other of bad faith.

The rail companies say they will start locking out workers on Aug. 22 if they cannot reach a labor deal, while the union says it is ready to call a strike for that date.

Industry groups want the Liberal government of Prime Minister Justin Trudeau to prevent a stoppage, noting Canada’s railways transport around C$380 billion ($277 billion) worth of goods annually.

“Factoring in the millions of Canadian jobs that would be impacted, the magnitude of the disruption is daunting,” the Business Council of Canada lobby organization said in an open letter to Trudeau and Labour Minister Steven MacKinnon.

U.S. FREIGHT TRAFFIC IMPACTED

A stoppage would also hit the United States, given the degree of integration between the two economies. Canada sends around 75% of all goods exports south of the border.

The networks of the two Canadian rail operators, CN and CPKC, connect with several key U.S. rail and shipping hubs such as Chicago, New Orleans, Minneapolis and Memphis. CPKC’s network also extends further south connecting with ports on both the east and west coast of Mexico.

CN said on Tuesday it was putting in place an embargo on any new reservations for movement of hazardous materials, security-sensitive cargoes or refrigerated containers originating in Canada, starting on Thursday.

It also announced it was embargoing all intermodal traffic originating from over half a dozen U.S. hubs with which its network connects, starting on Friday.

Separately, U.S. rail operator Norfolk Southern (NYSE:) on Tuesday advised customers that it was embargoing all hazardous and security-sensitive cargoes to or from CN and CPKC’s networks effective immediately. It said additional embargoes may come in case of any work stoppages at the Canadian rail operators.

Some U.S. companies find it more efficient to use Montreal or Vancouver for imports and exports.

U.S. logistics firm C.H. Robinson, which manages more than 650,000 loads across the border a year, said it was lining up extra trucking capacity on both sides of the border.

“When all trains serving the entire country could literally be stopped on their tracks, that’s another whole level of disruption,” said Scott Shannon, a senior executive at C.H. Robinson.

PRESSURE MOUNTS

Industry groups say MacKinnon has the power to refer the dispute to the country’s labor relations board and thereby head off a stoppage.

MacKinnon has so far said he wants the two sides to strike a deal at the negotiating table.

Pressure on Ottawa looks set to mount in the coming days as industry groups hammer home the potential costs of a stoppage.

Earlier this week, Morgan Stanley in a note to clients said that each week of shipment disruptions could dent the earnings before taxes of mining giant Glencore (OTC:) by an estimated $100 million, or more, as a rail shutdown would disrupt coal shipments from its majority-owned unit, Elk Valley Resources.

The Chemistry Industry Association of Canada said chlorine shipments would soon become unavailable, hitting the quality of drinking water within two weeks.

“There are very large municipalities that – if the strike goes on – are going to be under boil water advisories,” CEO Bob Masterson said by phone, noting that the industry moved more than 500 rail cars a day.

“There is no plan B … to transport this kind of volume you will need 2,000 trucks, roughly. There aren’t 2,000 trucks, and there aren’t 2,000 drivers,” he said.

($1 = 1.3721 Canadian dollars)