IMF upgrades China’s 2023, 2024 GDP growth forecasts

2023.11.07 03:02

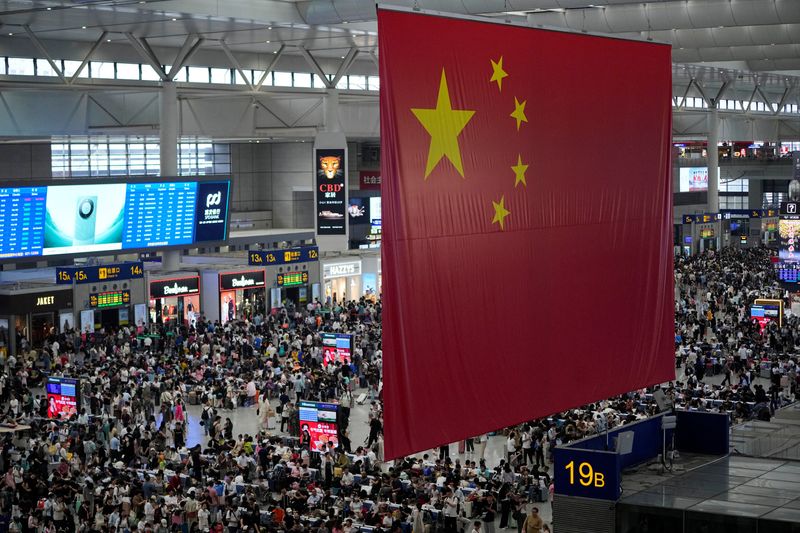

© Reuters. People wait to board trains at the Shanghai Hongqiao railway station ahead of the National Day holiday, in Shanghai, China September 28, 2023. REUTERS/Aly Song/File Photo

BEIJING (Reuters) -The International Monetary Fund on Tuesday upgraded its 2023 gross domestic product growth forecast for China to 5.4% from 5%, citing a “strong” post-COVID-19 recovery, but said the fund still expected the world’s second-biggest economy to slow next year.

GDP growth could slow to 4.6% in 2024 because of continued weakness in China’s property sector and subdued external demand, the IMF said in a press release, albeit better than its October expectation of 4.2% in the IMF’s World Economic Outlook (WEO).

The upward revision followed a decision by China to approve a 1 trillion yuan ($137 billion) sovereign bond issue and allow local governments to frontload part of their 2024 bond quotas, in a move to support the economy.

“These projections reflect upward revisions of 0.4 percentage points in both 2023 and 2024 relative to October WEO projections due to a stronger-than-expected third-quarter outturn and recent policy announcements,” said IMF’s First Deputy Managing Director Gita Gopinath in the statement.

Over the medium term, growth is projected to gradually slow to about 3.5% by 2028 amid headwinds from weak productivity and population aging, according to Gopinath.

China has introduced numerous measures to support the property market, but more is needed to secure a quicker recovery and lower economic costs during the transition, she said.

A comprehensive policy package should include measures to accelerate the exit of nonviable property developers, remove impediments to housing price adjustment, allocate additional central government funding for housing completion, and assist viable developers to repair balance sheets and adapt to a smaller property market, Gopinath said.

The combination of the downturn in the property sector and local government debt crunch could wipe out much of China’s long-term growth potential, economists say.

Local debt has reached 92 trillion yuan ($12.6 trillion), or 76% of China’s economic output in 2022, up from 62.2% in 2019. China’s Politburo, a top decision-making body of the ruling Communist Party, said in late July it would announce a basket of measures to reduce local government debt risks.

“The central government should implement coordinated fiscal framework reforms and balance-sheet restructuring to address local government debt strains, including closing local government fiscal gaps and controlling the flow of debt,” said Gopinath.

China should also develop a comprehensive restructuring strategy to reduce the debt level of local government financing vehicles (LGFVs), she said.

LGFVs were set up by local governments to fund infrastructure investment but now represent a major risk to China’s slowing economy, with their combined debt ballooning to roughly $9 trillion.

($1 = 7.2833 renminbi)