Illumina expects full-year sales from core segment to decline on biotech funding crunch

2024.08.06 19:13

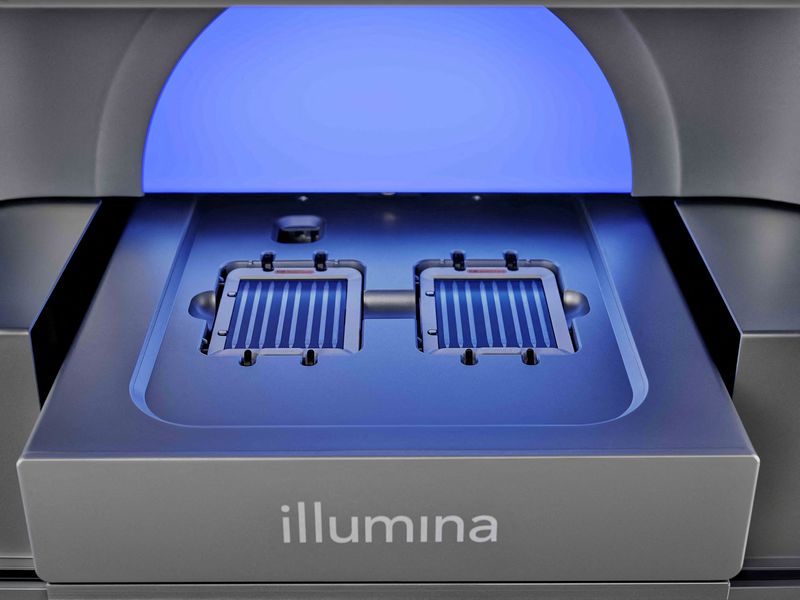

(Reuters) – Gene sequencing machine maker Illumina (NASDAQ:) on Tuesday forecast 2024 sales from its core segment to decline, a sign that subdued demand for its instruments used in genetic tests could extend further into the year.

Illumina has seen sluggish demand for its tools and services, used to develop therapies and vaccines, from key markets such as China and cautious spending from its customers such as biotechnology companies, amid high interest rates.

“Consumable sales remained solid as customers continued to increase their sequencing activity, but instrument demand has softened in a constrained funding environment,” CEO Jacob Thaysen said.

The company expects its Core Illumina revenue to decline 2% to 3%, compared to the previous year. Earlier, it had expected full-year revenue from the segment to be flat.

On an adjusted basis, it expects a per-share profit of $3.80 to $3.95 for its core segment for 2024. Analysts expect full-year adjusted profit of $3.91 per share for the whole company.

Of Illumina’s two reportable segments, Core Illumina and Grail , the latter was spun off on June 24.

It decided last December to divest cancer diagnostic tests maker Grail after the companies ran afoul of U.S. and European antitrust enforcers for more than two years and faced fierce opposition from activist investor Carl Icahn.

San Diego, California-based Illumina’s quarterly revenue was $1.11 billion in the second quarter, compared to analysts’ estimate of $1.08 billion.

On an adjusted basis, it earned 36 cents per share of profit during the quarter ended June 30, while analysts’ on average expected 90 cents per share.

The company had flagged that it would take a goodwill impairment charge of $1.47 billion in the second quarter related to the Grail spin-off.