IBM Q3 Earnings Preview: Sales Momentum In Focus Amid Macro Headwinds

2022.10.18 14:09

[ad_1]

- Reports Q3 2022 results on Wednesday, Oct. 19, after the market close

- Revenue Expectation: $13.54 billion; EPS Expectation: $1.79

- IBM stock is outperforming technology giants on signs that its turnaround is gaining momentum

When International Business Machines (NYSE:) reports third-quarter earnings tomorrow, investors will look for signs that the company has been able to maintain sales momentum in the face of the widespread economic slowdown that’s hurting other technology giants.

IBM has comfortably outperformed its tech peers this year, losing around 8% year to date, compared with a more than 31% plunge for the broader .

IBM Vs. Nasdaq 100 (Purple) Daily Chart (YTD)

IBM Vs. Nasdaq 100 (Purple) Daily Chart (YTD)

The key reason behind the company’s better-than-average performance is a complete business turnaround in the hands of Chief Executive Officer Arvind Krishna, aimed at reviving growth after decades of underperformance.

IBM is now a learner and better-focused company. Last year, the giant completed the spinoff of its $19 billion information technology services business, Kyndryl Holdings (NYSE:).

Moreover, 9% to $15.5 billion in the three months ending June 30, the highest growth in almost ten years. Hybrid cloud revenue jumped 18% to $5.9 billion in the quarter.

Despite the positive figures, IBM is not immune to macroeconomic headwinds. In July, the Armonk, New York-based giant lowered its forecasts for free cash flow due to the impact of a strong dollar and the loss of business in Russia.

IBM, which gets about half of its sales outside the Americas, expects to make a free cash flow of $10 billion this year, at the low end of a previous range.

Despite this slippage, there are strong signs that CEO Krishna remains on track to transform Big Blue from its traditional business of infrastructure and information-technology services to the fast-growing cloud-computing market.

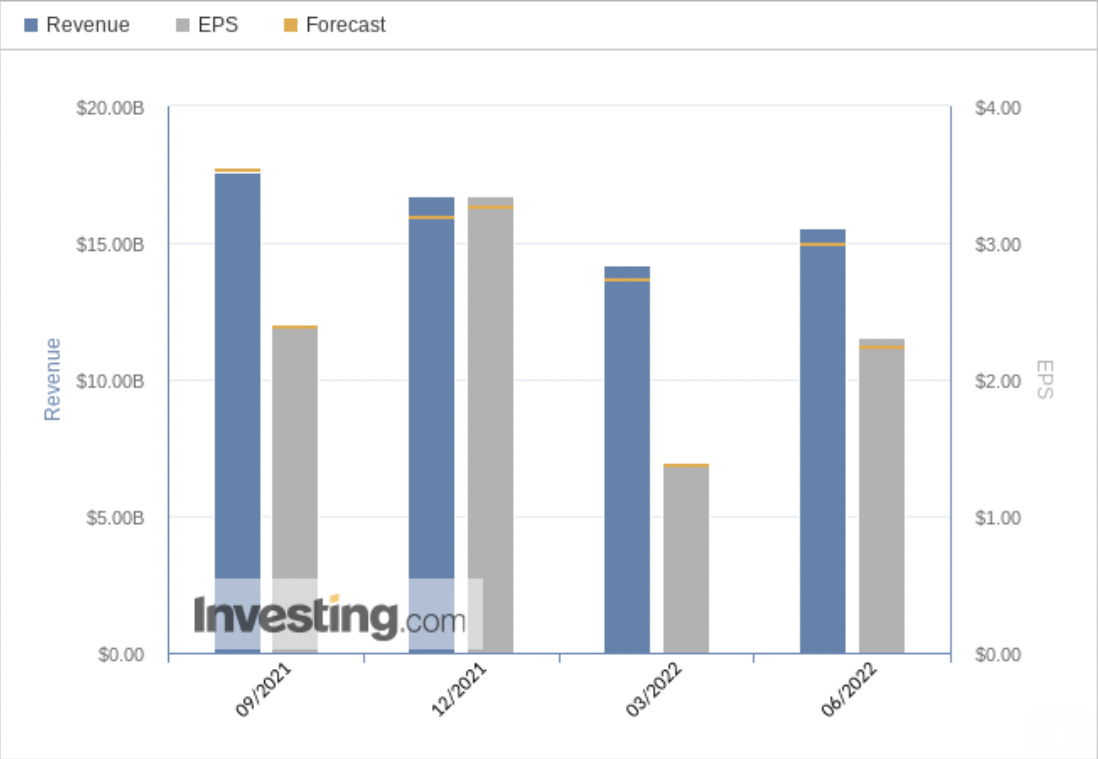

IBM Past Quarter’s Revenue, EPS And Forecasts

IBM Past Quarter’s Revenue, EPS And Forecasts

Defensive Nature

IBM’s defensive nature and solid momentum have kept its stock well insulated from the current market turmoil.

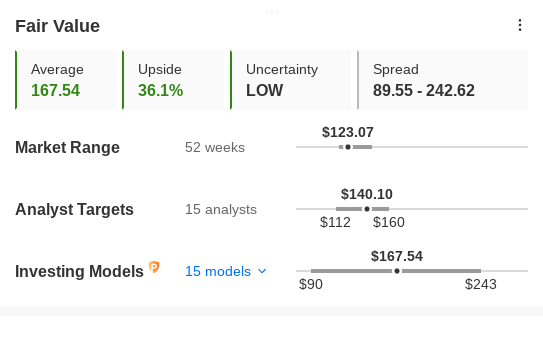

The company also has substantial upside potential, according to InvestingPro’s models, which value companies based on P/E or P/S multiples or terminal values. The average fair value for IBM on InvestingPro stands at $167.54, implying more than 30% upside potential.

IBM Fair Value

Source: InvestingPro

Since taking over as the CEO in April 2020, Krishna has reorganized the company’s business around a hybrid-cloud strategy, which allows customers to store data in private servers and on multiple public clouds. IBM completed its purchase of Red Hat for $33 billion in 2019, the first step in a shift to what it calls a hybrid cloud.

According to a recent note by Morgan Stanley, IBM is proving to be a good place to hide in the current market turmoil, mainly due to its revenue diversification. Even as IT hardware budgets and tech valuations take a hit in an environment overwhelmed by inflation, companies are increasingly investing in areas like cybersecurity and analytics, which make up about half of IBM’s revenue. In addition, only 20% of the company’s revenue stems from hardware and operating system software.

Bottom Line

IBM’s earnings tomorrow may show some weakness, given the current uncertain macroeconomic environment. However, the company’s more defensive portfolio—with a 50%+ recurring revenue mix and 75% software and services mix—positions it to continue outperforming its peers.

Disclosure: At the time of writing, the author doesn’t own any shares mentioned in this report. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.

[ad_2]

Source link