How to Protect Yourself From a Crash and Earn 11% Annually with Monthly Payments

2024.12.19 07:25

As I write this, the is sitting on a 28% total return for 2024. And of course, that could shoot even higher if we get the traditional Santa Claus rally.

Obviously, that’s been great for the equity funds we hold in CEF Insider, which give us price gains from their stock holdings, of course—but they also give us a huge slice of our gains in cash, thanks to their outsized yields.

But at times like this, we do need to take a step back and consider what’s going on behind a historic gain like this. While corporate earnings are rising, they’re doing so more slowly than stock prices, which is why the S&P 500’s price-to-earnings (P/E) ratio is 28, as of this writing, nearly double its long-term average of 16.1. This puts more pressure on companies to keep earnings growing at a brisk pace in 2025.

So we’re left with a situation where continued momentum means stocks are likely to keep rising, but the risks of short-term volatility are rising, too.

There is, however, a way we can offset some of that volatility: Buy CEFs holding corporate bonds. We currently hold four in our CEF Insider portfolio, and they yield around 11% on average. That’s more than nine times what your typical S&P 500 stock pays!

With corporate bonds, we can take part in the strong economy and the enthusiasm that’s boosting stocks while moderating our risk. This approach, of course, is far from revolutionary: It’s really just straight-up portfolio diversification.

But of course, we want to maintain our strong income stream, too, so we’re not going to go with an ETF for our bond exposure. Instead we’re buying closed-end funds (CEFs) that focus on corporate bonds.

This gives us two key advantages: First, a discount to net asset value (NAV), a “CEF-only” metric that means we’re buying CEFs that trade below the value of their portfolios.

Second, we get an outsized income stream, with CEFs yielding around 8% on average across the asset class, with corporate-bond CEFs, as I just mentioned, paying more.

Take, for example, the Western Asset High Income Opportunity Fund (NYSE:). With a 10.8% yield as I write this, it would deliver $100,000 in yearly income to an investor who puts in $930,000.

Even better, HIO pays dividends monthly, which breaks out to $8,333 a month.

Better still, that payout is growing.

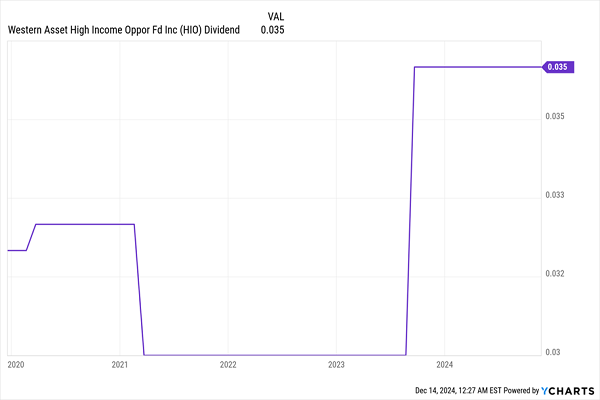

HIO’s Payout Pops

After reducing its payouts due to the ultra-low interest rates following the pandemic (more on this in a moment), HIO recently raised its distributions for a simple reason: The Fed has boosted rates at a breakneck pace in the last couple of years, meaning corporate bonds have had to pay out more interest to creditors.

Since HIO holds those bonds, that means more income for HIO’s managers to hand over to us, HIO’s shareholders.

Now wait a minute, you might be thinking: Isn’t the Federal Reserve cutting rates? And won’t that mean HIO will cut payouts like it did during the pandemic?

It’s a good question, so let’s get into it.

Source: Franklin Templeton

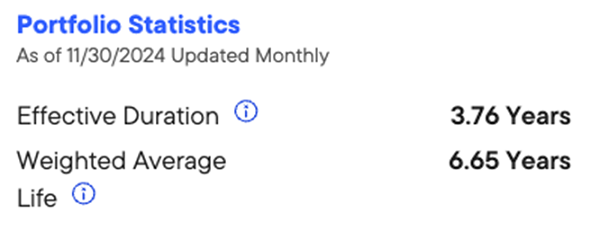

If we look at HIO’s portfolio, we see two important statistics about its holdings: One is the weighted average life of the bonds it holds. This just means these bonds will, on average, come to term in 6.7 years, at which point HIO will need to buy new bonds. If rates are lower then, the fund may have to cut distributions.

However, we also need to consider “effective duration,” which accounts for things like callability and optionality—these are just different ways that a bond issuer can redeem their bonds earlier through covenants in the issue. With that in mind, HIO’s portfolio of bonds will actually come to term in a little less than four years.

In other words, if interest rates are lower at the end of 2027, HIO’s payouts will likely go down. And if rates are higher, the payouts will go up. But stick with me for a sec here, because there’s more to the story.

Of course, no one knows where interest rates will be in 2027. Rates may go down or they may go up. But in the meantime, an investment in HIO will get you a 10.8% income stream. That’s eight times the payout on the typical S&P 500 stock.

And if rates do go down? Well, consider this.

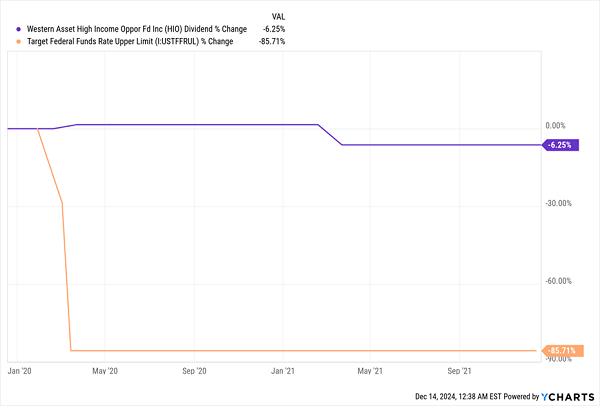

Big Interest Rate Drop = Small HIO Dividend Cut

During the pandemic, which was an extreme event to say the least, rates plummeted over 85% in a matter of days. In the following two years, HIO cut its payouts by a measly 6.25%. In other words, if the Fed cuts rates as dramatically again, HIO’s payouts would decline from 10.8% to 10.1%, based on the share price at the time of writing.

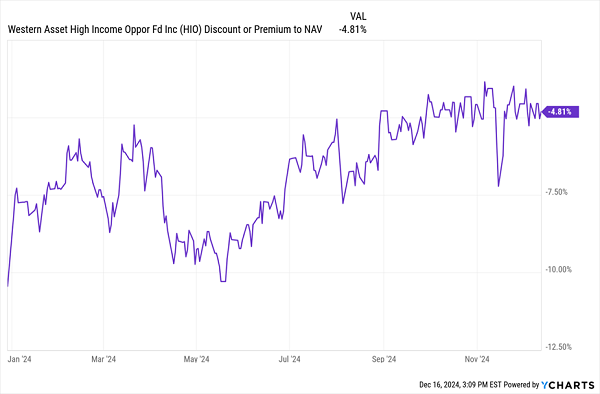

Here’s the kicker: Any dividend cut is priced in, which is why HIO trades at a 5% discount to NAV, although that discount is shrinking as investors realize they have overpriced the risks of a Fed rate hike in recent months.

HIO’s Vanishing Discount

To be sure, first-level investors worried about what the Fed might do are likely to avoid HIO. But those who look deeper stand to benefit from a double-digit yield that is on solid footing, and looks to be for several more years.

Urgent: Buy These 4 Dividends Now (Inauguration Day Will Be Too Late)

I’m pounding the table on 4 other CEFs that are perfectly tuned to the times we’re living in now: The yield 9.8% today and are bargains—so much so that I see them soaring 20% in the first year of the new Trump administration.

They hold the cash-rich tech stocks that directly benefit from the new administration’s AI- and crypto-friendly policies. And the best real estate investment trusts (REITs) to profit as manufacturing continues to “reshore” to the USA.

And, of course, the best bonds to kick us huge income streams as rates move lower.

Now is the time to buy them—and we don’t have long, since I expect the bulk of their gains to come in the first half of the year. Don’t miss out.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”