How to Pick Winning CEFs for 387% Returns and 7%+ Dividends

2023.03.23 06:16

Once folks get a taste of closed-end funds (CEFs), they typically rave about one thing: the dividends! Yields of 7% and up are common with CEFs, and they often come your way monthly.

We also love the fact that even though CEFs are a small corner of the market (with only about 500 or so out there), we can build a diversified portfolio with them: there are CEFs that hold US and international stocks, bonds, real estate—even private equity. You name it.

This broad range gets us around a problem most income-seekers face: being forced to stake significant sums in one, or a handful of, stocks just to get big payouts. Often, this results in portfolios skewed toward certain sectors and delivering disappointing performance.

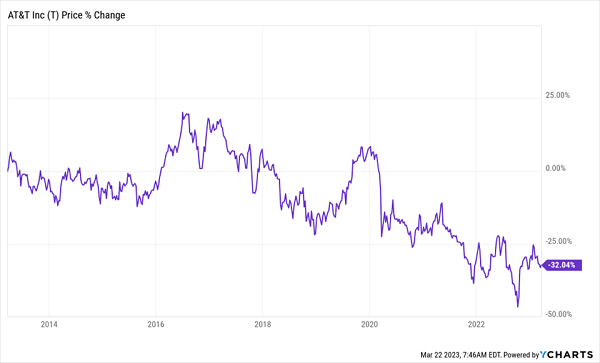

It’s a story that investors who’ve bought dividend go-to AT&T Inc (NYSE:), whose shares yield an outsized 6% right now, know well. But that high yield has everything to do with AT&T’s plunging share price (because you calculate the current yield by dividing the yearly cash payout into the current share price).

The stock has been weighed down in part by the fact that it cut its dividend as part of the spinoff of its Warner Media division, a major strike against the stock, which had come to be an income go-to for conservative dividend investors.

The Danger of Staking It on a Single High Yielder

But while we CEF buyers diversify, we must still choose our funds wisely, selecting those trading at unusually large discounts to net asset value (NAV, or the value of the investments in their portfolios) with the right mandates at the right times, as well as managers with proven histories.

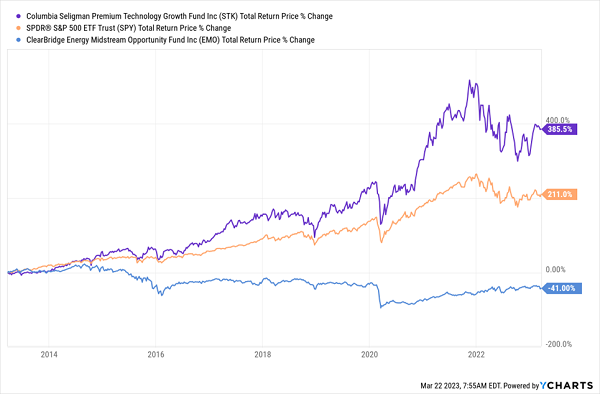

Find a fund with all those strengths and you’ll give yourself a great shot at scoring a winner like the Columbia Seligman Premium Technology Growth Closed Fund (NYSE:), a 7% yielder that’s crushed the market over the last decade, with a 387% total return.

But the story would have been much different if you’d bought, and stuck with, the oil and gas–focused (and 7.7%-yielding) ClearBridge Energy MLP Opportunity Closed Fund (NYSE:), which underperformed drastically as that sector got hammered.

Best Versus Worst: A Big Range

STK Performance Chart

There’s nothing new under the sun here: income-starved investors often ignore other flaws to get a big payout (in EMO’s case, a mandate that traps it in a volatile sector).

That’s why a fund’s yield is just one measure we evaluate at my CEF Insider service. Because we know that over time, CEFs with other strengths—like strong managers, proven histories and big discounts—will attract more investors, who will bid their prices skyward.

“All-in-One” Play Just Doesn’t Work With CEFs

Seeking out strong CEFs, of course, involves legwork. Some folks think they can get around that by purchasing a basket of CEFs through an algorithm-run exchange-traded fund (ETF). After all, the whole point of ETFs is to let us buy a bunch of stocks at once so we don’t have to choose winners and avoid losers ourselves. So can’t you just buy an ETF that holds CEFs and call it a day?

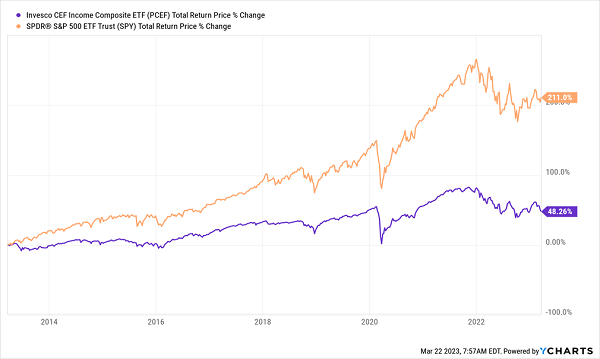

Such a move sounds great, but it just doesn’t work with CEFs. The history of the Invesco CEF Income Composite ETF (NYSE:), a collection of CEFs that pays a 9.4% dividend yield, demonstrates this.

Good Intentions, Lousy Results

PCEF Performance Chart

This is because PCEF combines a lot of underperforming CEFs, which means the fund drastically underperforms the market.

While we’re willing to accept some underperformance for a higher yield (PCEF’s 9.4% payouts are nice), having a profit dramatically smaller than that of the index while taking on a similar amount of volatility is unacceptable. Plus you’ve got the problem of high fees: PCEF’s management fee of 0.5% of assets sounds reasonable, but when you combine it with the fees on the CEFs in the fund, you get total expenses of 1.99%. (Those doubled-up fees are a particular problem for funds that devote their entire portfolios to owning other funds.)

Invesco is a great ETF company, but once you go beyond PCEF’s yield, you can see that it has little to offer.

Let’s Try That Again

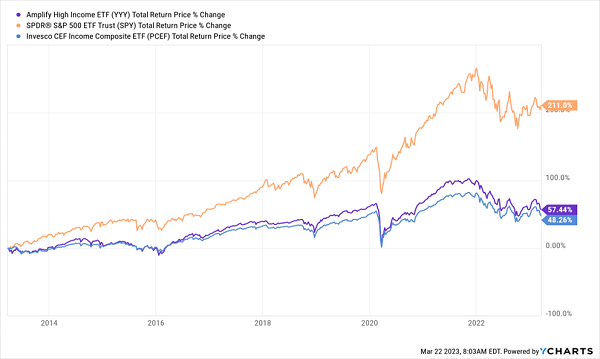

Could the problem be PCEF? Maybe the ETF-of-CEFs approach works if you try a different fund.

Nope.

Fact is, all ETFs of CEFs have underperformed the market, and big income doesn’t compensate for this. Take the Amplify High Income ETF (NYSE:), which holds 45 CEFs and pays an 11.5% dividend. Its performance is only marginally better than that of PCEF in the last decade.

Second ETF of CEFs Falls Flat

YYY Performance Chart

What’s going on here is that YYY, like most ETFs, is locked in by the specs they use to select CEFs and can’t change course with shifts in the economy (unlike a CEF run by a human manager).

YYY chooses its CEFs by focusing on the fund’s yield (so making the same mistake AT&T and CEM investors made), discount to NAV (a strong indicator, to be sure, but not good enough on its own because some funds’ discounts never narrow) and liquidity. And for that, YYY investors must pay fees of 2.72% of assets—more than most CEFs with actual managers!

In short, until there is an ETF whose algorithm can replace a human manager—and that’s not in the cards anytime soon—carefully choosing a portfolio of CEFs is a much better solution than trying to take the ETF shortcut.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”