How Poland snagged Intel’s multi-billion dollar investment

2023.06.22 02:23

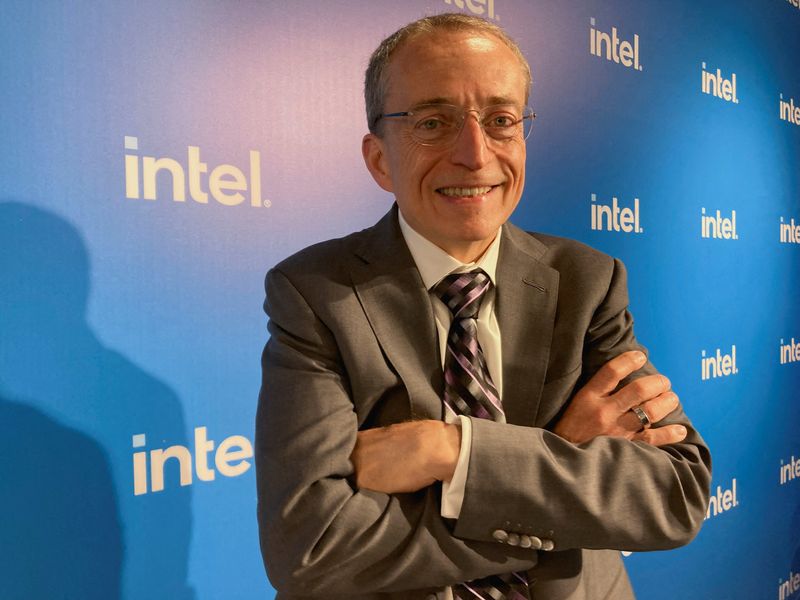

© Reuters. FILE PHOTO: Intel CEO Pat Gelsinger poses after an interview in Wroclaw, Poland, June 16, 2023. REUTERS/Karol Badohal/File Photo

By Karol Badohal and Supantha Mukherjee

WROCLAW, Poland/STOCKHOLM (Reuters) – Poland’s third-largest city Wroclaw beat rivals last week to be home to the next multi-billion dollar Intel (NASDAQ:) chip factory in Europe, with a two-year campaign promising subsidies, infrastructure, talent and a slice of American life.

In the face of an unprecedented semiconductor shortage, Europe is offering billions of euros in subsidies to reduce its dependence on Asia. In return, Intel is committing big sums and with Germany already bagging a 30 billion euro investment, Poland decided to crash the party.

Its eventual success can be seen as a lesson in perseverance.

The U.S. chipmaker said last Friday that it had decided to invest up to $4.6 billion in the new semiconductor facility near Wroclaw.

Interviews with half a dozen Polish government officials and company executives revealed previously unreported details on how a small city in southwestern Poland ticked all the boxes to get what its Prime Minister said was the largest greenfield investment in its history.

Poland initially impressed Intel executives with the speed in which it responded to queries and addressed concerns, Intel said.

“When we began the process, we hadn’t considered Poland,” Intel CEO Pat Gelsinger told Reuters.

“As you are picking a location, imagine you are going on a date. You have a sense, oh they really want this to work,” Gelsinger said. “We definitely came away with a strong belief that the local government want to make this work.”

Poland started courting Intel in July 2021. Government and municipal officials met with the company repeatedly over the next two years, according to interviews with five officials and three Intel executives.

Two government agencies – the Polish Investment and Trade Agency (PAIH) and the Industrial Development Agency (ARP) played a key role in the process, officials said.

Many meetings were conducted remotely due to COVID-19 restrictions, officials said. Marcin Fabianowicz, director of the PAIH’s investment centre later met with a representative from ARP and two senior Intel executives.

“After the first (in-person) meeting I was convinced Poland had a shot at getting the project,” he said. “The talks were warm and heading in the right direction.”

But when Intel announced its European investments in March 2022, Germany was awarded a major factory in Magdeburg while Intel told Poland it would only expand its existing facility in Gdansk.

Poland was undeterred, eventually clinching a deal in a two-day meeting last month, officials said.

“We never said something can’t be done,” Fabianowicz said.

Codenamed “Project IQ”, government and municipal officials worked confidentially on strategies to lure the chipmaker.

A team from an agency promoting the development of Wroclaw put together a presentation highlighting its quality of life, family facilities, schools, bike lanes, swimming pools and economic and demographic data.

Intel executives were also impressed by Wroclaw being home to Poland’s American football and basketball champions.

‘SNOWBALL EFFECT’

Intel’s new plant will be on a 285 hectare plot, beside another chip factory, the edible variety made by PepsiCo (NASDAQ:) and a factory which makes windows.

The global shortage of semiconductors has impacted production of everything from cellphones to electric vehicles, a shortage likely to continue throughout 2023, according to the European Parliament, as it takes two to three years to build a new chip-making factory.

The land at Wroclaw is divided between two municipalities — Miekinia and Sroda Slaska.

The region will invest in new roads to the factory, electric buses, a water treatment facility and high voltage power lines, the mayor of Sroda Slaska Adam Ruciński told Reuters.

Intel has also been allowed to construct buildings 50 metres (54.68 yards) high, more than the usual 20 metres restriction, he said.

Poland is hoping to lure other companies like Taiwan Semiconductor Manufacturing Corp (TSMC), the world’s largest contract chipmaker, to invest in the country.

Talks with TSMC started last year, several officials said.

“We are at a point where we are getting our 5 minutes (of fame), so a lot of entities are interested,” said Jakub Mazur, deputy mayor of Wrocław. “The snowball effect with Intel entering will cause talks from the Taiwan direction to come back to us.”

($1 = 0.9157 euros)