Housing Sector at a Critical Juncture: A Break Lower Doesn’t Bode Well for S&P 500

2024.06.26 02:56

It was a lopsided trading session. Yesterday, there were only 113 advancers versus 386 decliners. It’s a strange market, and I’m not sure what to make of it. There is much to take away from it because it continues to be a case of two markets: the indexes with Nvidia (NASDAQ:) and the indexes without.

The and the were lower on the day, while the and were higher. S&P 500 equal weight (NYSE:) was lower by around 70 bps, which is a good amount, considering the S&P 500 was up around 40 bps on the day.

Housing Sector Tests Support

The PHLX Housing Index was down over 2% and is back to its support level of around 665. I like to watch the housing sector because sometimes it can act as a leading indicator for where the S&P 500 is heading. It was certainly the case in 2018, but it took a long time for the SPX to finally get the message.

At this point, we are waiting to see if the will break support at 665. It would be beneficial if something could happen soon. If you want to talk about bad breath, all 19 stocks in the index were lower on the day.

Nvidia Surges Above Key Resistance Level

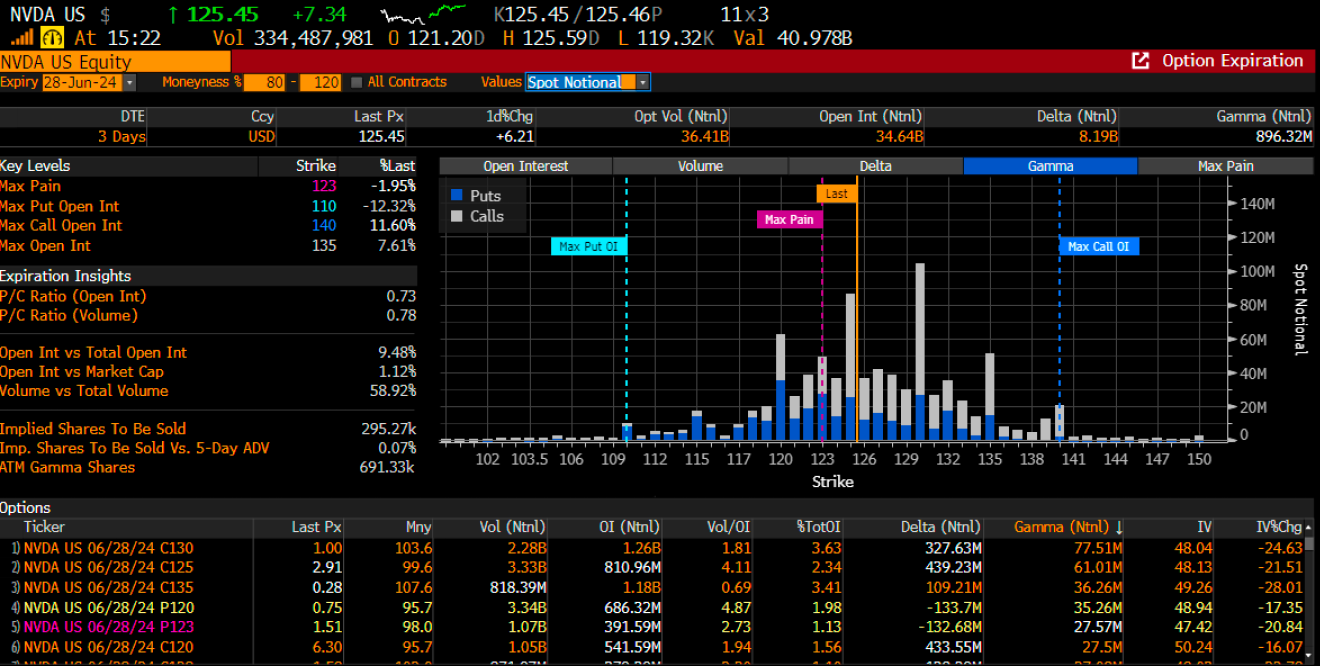

Meanwhile, it probably would have been a day more like the equal weight index had it not been for Nvidia, which rallied by 6.8% yesterday and regained much of its losses from yesterday. The $125 zone became resistance for the most part because that was level with a large amount of call gamma.

To this point, all the stock has done is to fill the gap from yesterday morning’s drop.

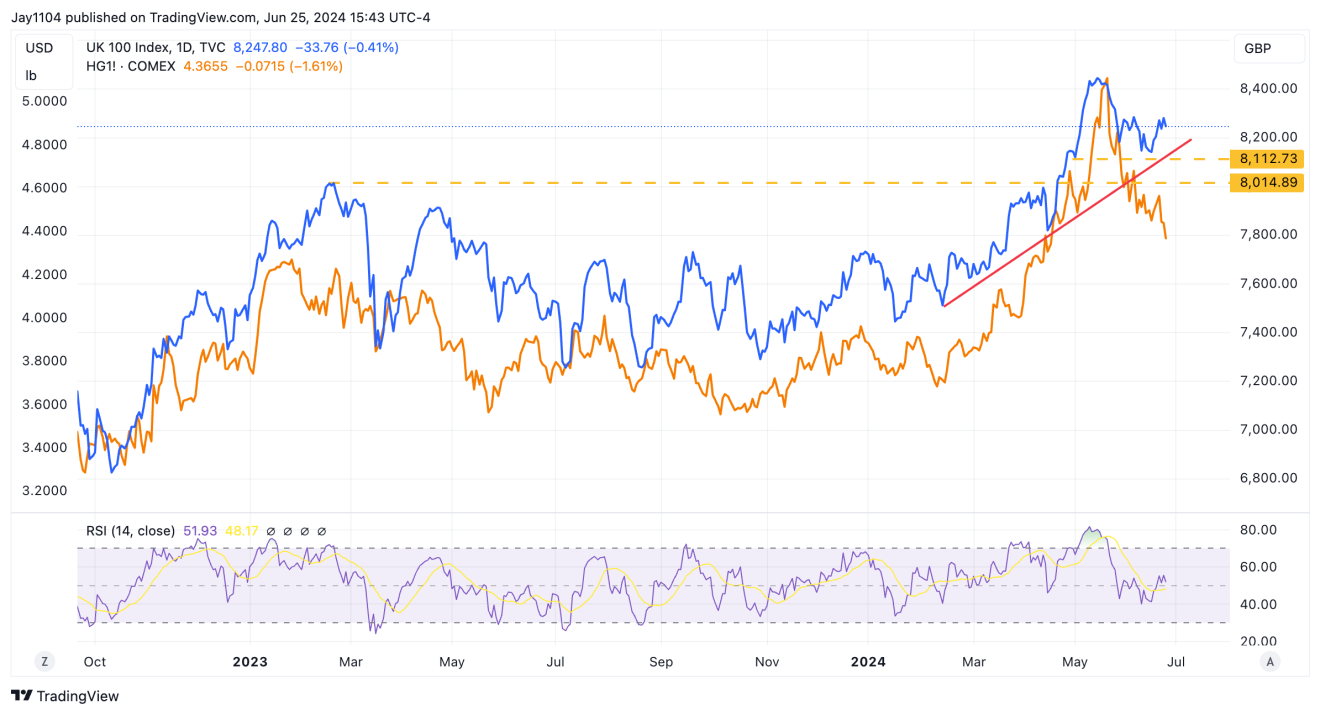

Copper finally broke support yesterday at $4.40, which probably means it could be back on its way to $4.21. This certainly won’t be good for mining stocks.

It probably won’t be good for the or an ETF like the because, for the most part, the UK indexes and ETFs seem to follow wherever they go these days.

It almost looks like the has been following copper, too. I’m unsure if that is some AI trade—more AI chips, power, and copper, who knows? But that appears to have been the case more recently.

Original Post