Hope Springs Eternal

2022.10.24 05:58

[ad_1]

Friday sucked for bears in , no two ways about it. I was so excited by the resistance I was seeing on a weekly chart that I even posted my “ entry before the week ended. Then the one market action which I mentioned would ruin my pattern happened on Friday, based on rumor and whispers of Fed rate slowdowns (not even a full pivot to easing) to make the market rally*. This tells me two things: 1) The bulls are so damn eager to jump on anything bullish that even a whisper will send stocks into a tizzy and 2) Shorts are weakhanded down here so we end up with this choppy no decision action.

Well, last week happened so I just need to adjust and deal with it. There are six trading days left in the month, so we’ll have to prepare for potential market movements starting with the monthly chart.

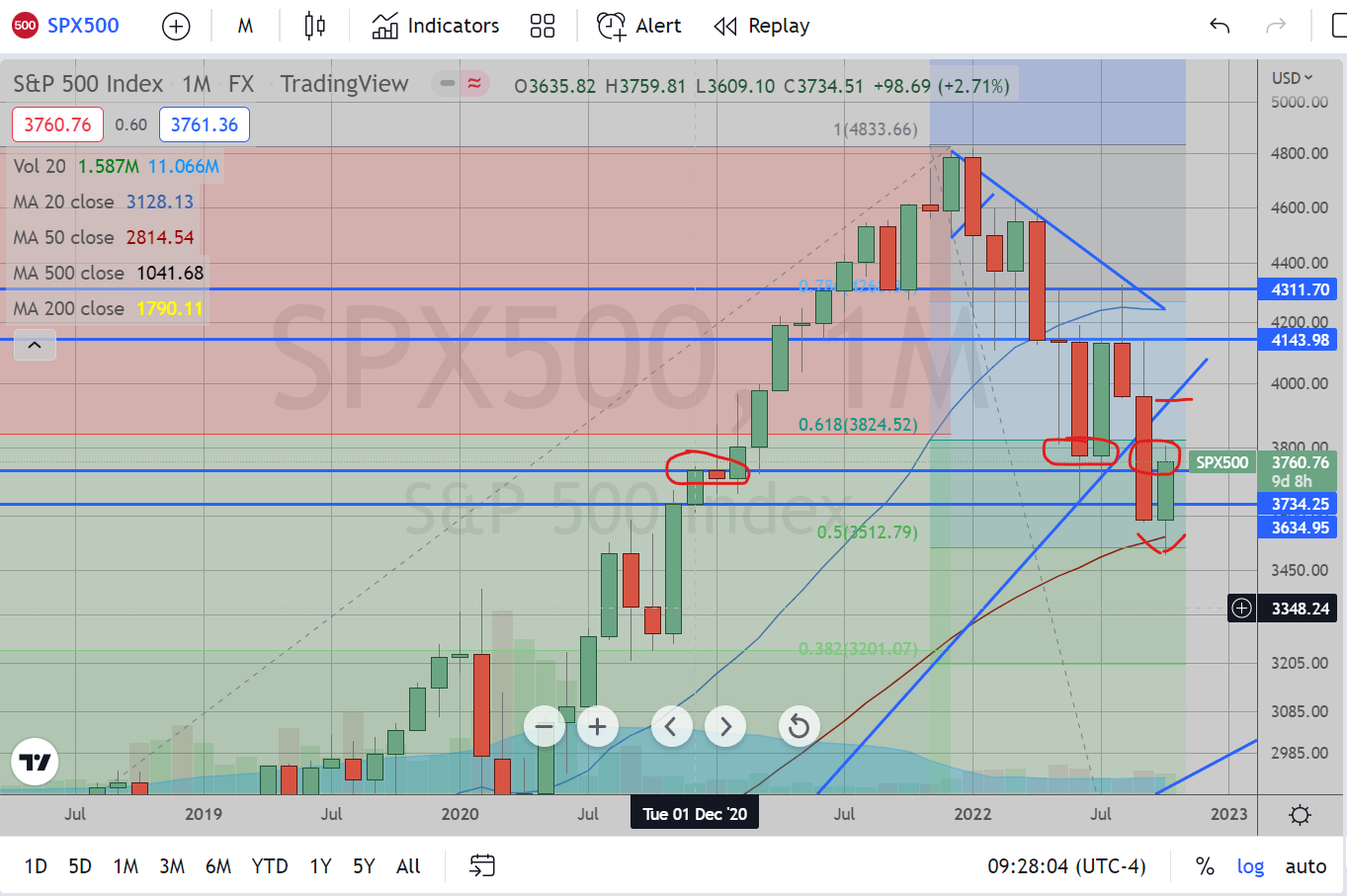

What started out as an indecisive month is starting to look potentially bullish again in the short term. There are a few things to consider about this month, however. First, December 2020 hit a high at 3760 and closed at 3735. All this chopping we have been at for the past month has been the market trying not to engulf the entirety of the yearly candlestick of 2021 and instead bounce from these levels. So, there is a lot of action occurring here that I feel like I missed before.

Furthermore, that 50 month EMA is now potential support as well as the 50% Fibonacci retracement from the 2021 highs to 2020 Covid lows (which I’ll note EVERYONE was talking about, even the talking heads on CNBC, so take it with a grain of salt). There is, however, the more recent June monthly bar close at 3778 which I would expect to act as potential resistance. So, this month as of today is at a critical spot. I’d need to see the action for the next six days to see how this month wants to close out. Any close between 3735 and 3760 gives the bear case more weight in the next few weeks and could see November engulf the October candlestick. Otherwise, we may get additional chop into November (which could then lead to a December “Santa Claus Rally” scenario).

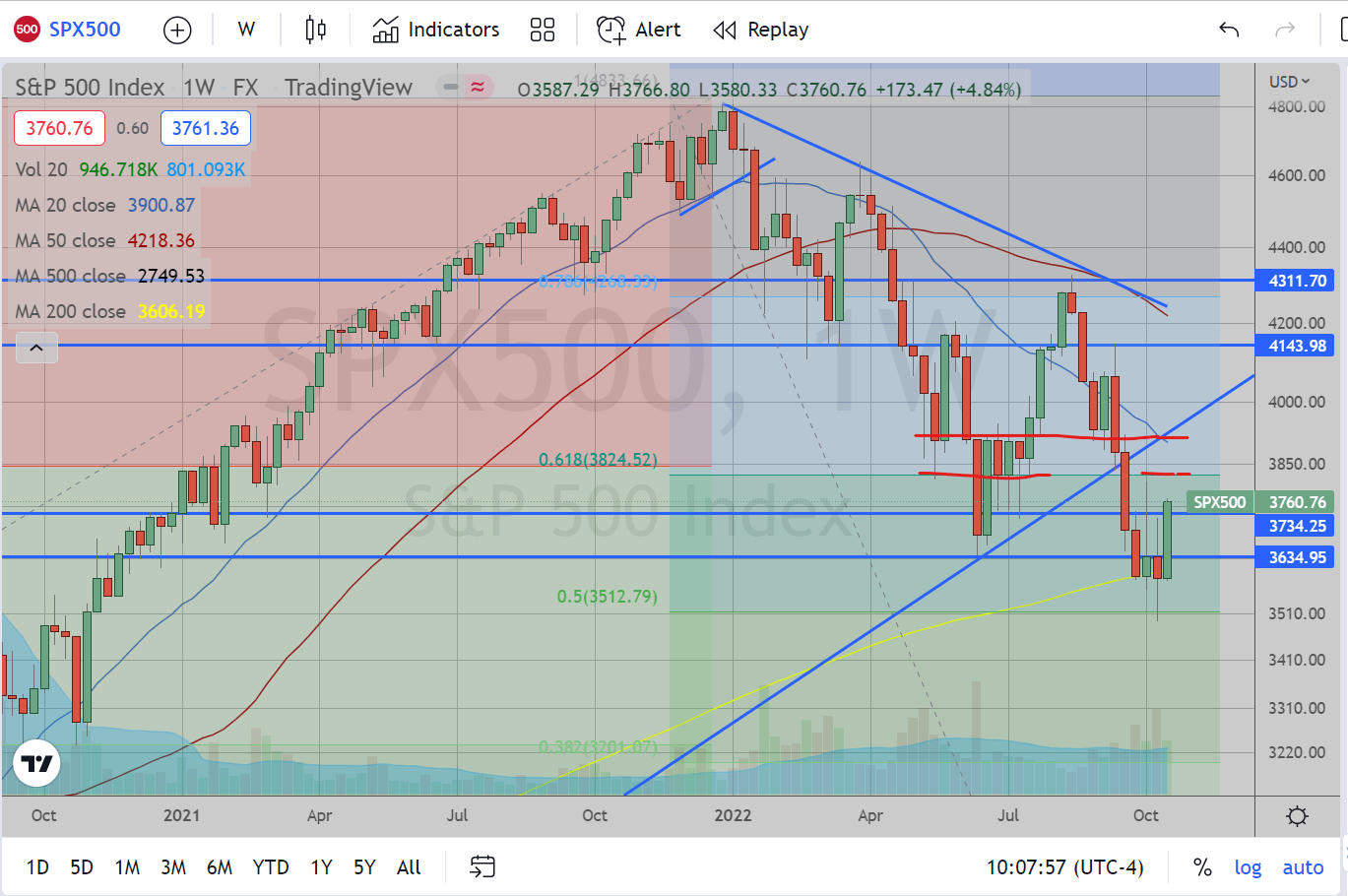

SPX Weekly

The weekly chart is a thorn in my side. What was looking so deliciously bearish on Thursday was reversed on Friday. The 200 week EMA is trying (emphasize “trying”) to bounce here. There is still a resistance level at 3806 (First week in October high). If this resistance is not broken next week then we have potential to resume our downturn in the following weeks. However, if we break up there then beyond that it looks like 3900 is in view, which is a huge spot. There is the 20 week EMA there, the underside of the broken trendline from the COVID lows, support the last week of August/first week of September, and finally, it was resistance for the entirety of June. I’d really hate to see us rally that far, but it would be a clean spot to reenter shorts if you had covered or sell out of longs if you are catching this rally.

SPX Daily

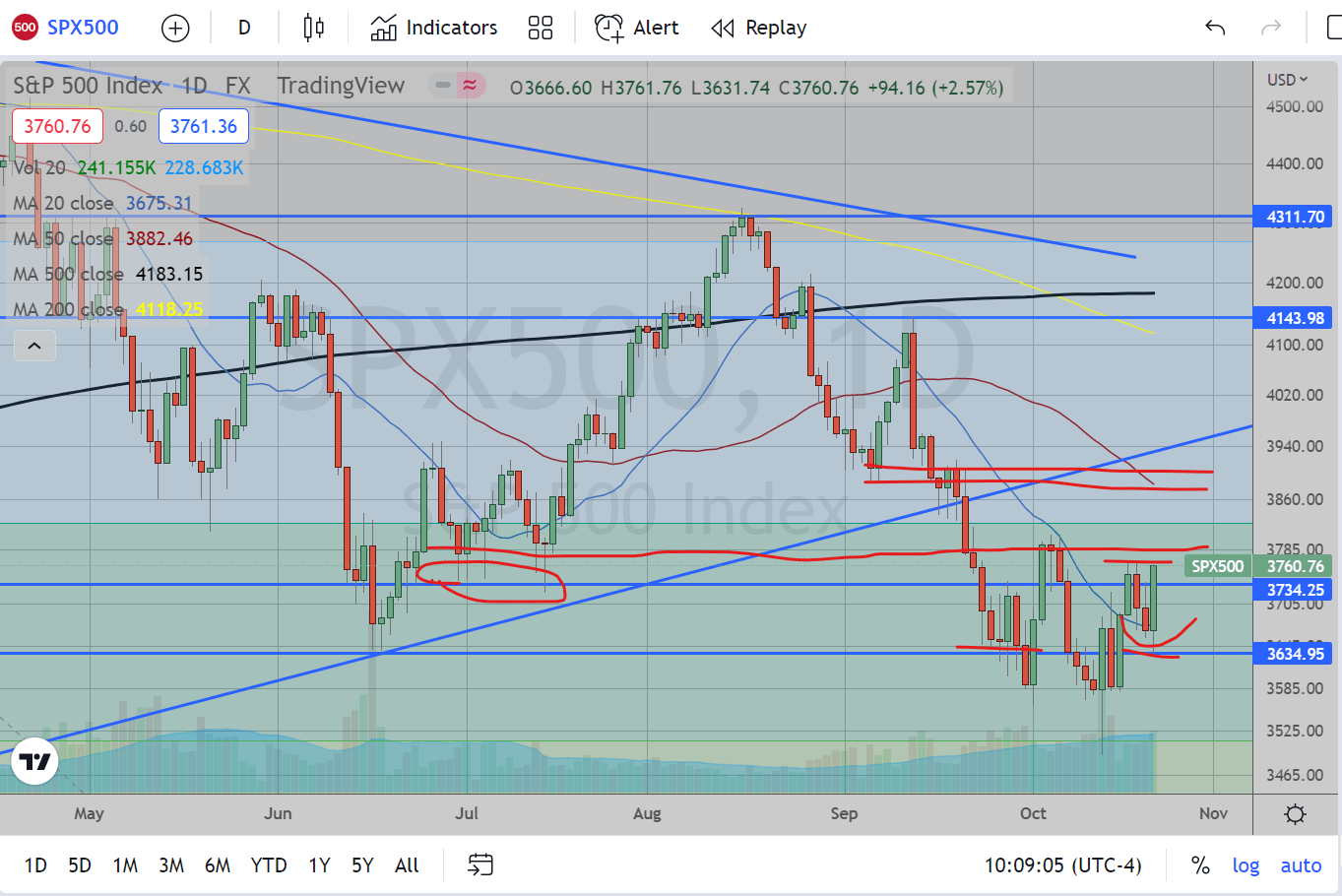

What a jumbled mess. From the bullish perspective, we supported at the 20 day EMA, looking like it wants to reverse higher. We closed Friday at the highs after finding support at the June lows at 3635. It always feels like it can continue the next trading session when it closes at highs or at lows in the previous session. From a bearish perspective, we are still beneath the choppy June support zone as well as the October highs at 3806. My interpretation of all this is that until resistance is broken, I’m not convinced. I’m still giving stock to that June trading zone as resistance. While we closed at the highs Friday, who’s to say it MUST continue? I’m no expert on OPEX either, but I think some of the volatility we saw was certainly attributable to that. Who knows? I’ll need to wait until Monday to see what happens.

As I said in my Thursday post, my stops are in place. While the bullishness on Friday was certainly a kick to the bears’ balls, we didn’t actually break any levels yet. I’ll be watching Monday. If we break up higher, I’ll throw on some hedges. If not, then I’ll be adding in a bit up here with stops above 3800 zone. Good Luck to All this week!

Side note: My post on Thursday versus action on Friday is the type of stuff that makes me develop superstitions. Like if I kept my mouth shut then Friday would have been a nice red day. Shame on me!

[ad_2]

Source link